USD/JPY stabilizes as markets await US inflation data

- USD/JPY stable at 149.33 as markets await crucial US inflation data, affecting Fed policy outlook.

- US January CPI expected to decline, fueling discussions on Fed's easing timeline amid calls for patience

- Fed unlikely to alter rates in March, but May divided on potential for rate cuts.

- BoJ's cautious normalization stance influenced by wage growth, despite US monetary policy adjustments.

The USD/JPY is virtually unchanged late in the North American session, hovering at around the 149.20s area, as traders await the latest release of inflation data in the United States (US). At the time of writing, the major trades at 149.33, up 0.03%.

USD/JPY at the mercy of US inflation data, US Treasury yields

Traders turned cautious as Wall Street erased the previous gains, with the Nasdaq and the S&P 500 edging lower. The US Department of Labor is expected to release January’s Consumer Price Index (CPI) expected to dip from 3.4% to 2.9% YoY, while Core CPI is foreseen at 3.7%, down from 3.9%. If the data comes as expected, that will open the door to ease policy in the near term.

Meanwhile, Federal Reserve officials pushed back against slashing rates sooner than expected; Fed Governor Michelle Bowman said, “It’s too soon to project when, how much the Fed will cut rates.” Lately, Richmond Fed President Thomas Barkin stressed, “We (Fed) are closing in on the inflation target, but we’re not yet there.”

The CME FedWatch Tool predicts the Fed will keep rates unchanged at 5.25%-5.50% on the March meeting, but in May, there’s a 52% chance for a 25 basis points cut.

On the Japanese front, the Japanese economic calendar will feature the 2023 Q4 Gross Domestic Product (GDP) on Thursday. The economy is foreseen to recover from -0.7% Q3 contraction to 0.3%. Additional data suggests private consumption would stay put while business spending is expected to increase. Aside from this, further data will be revealed, with January PPI and Machine Tool Orders revealed on Tuesday.

Regardless of the data, the Bank of Japan (BoJ) has expressed is in no rush to normalize policy until wages sustainably pick up. Therefore, further USD/JPY upside is seen, and traders would look to test the 150.00 figure.

USD/JPY Price Analysis: Technical outlook

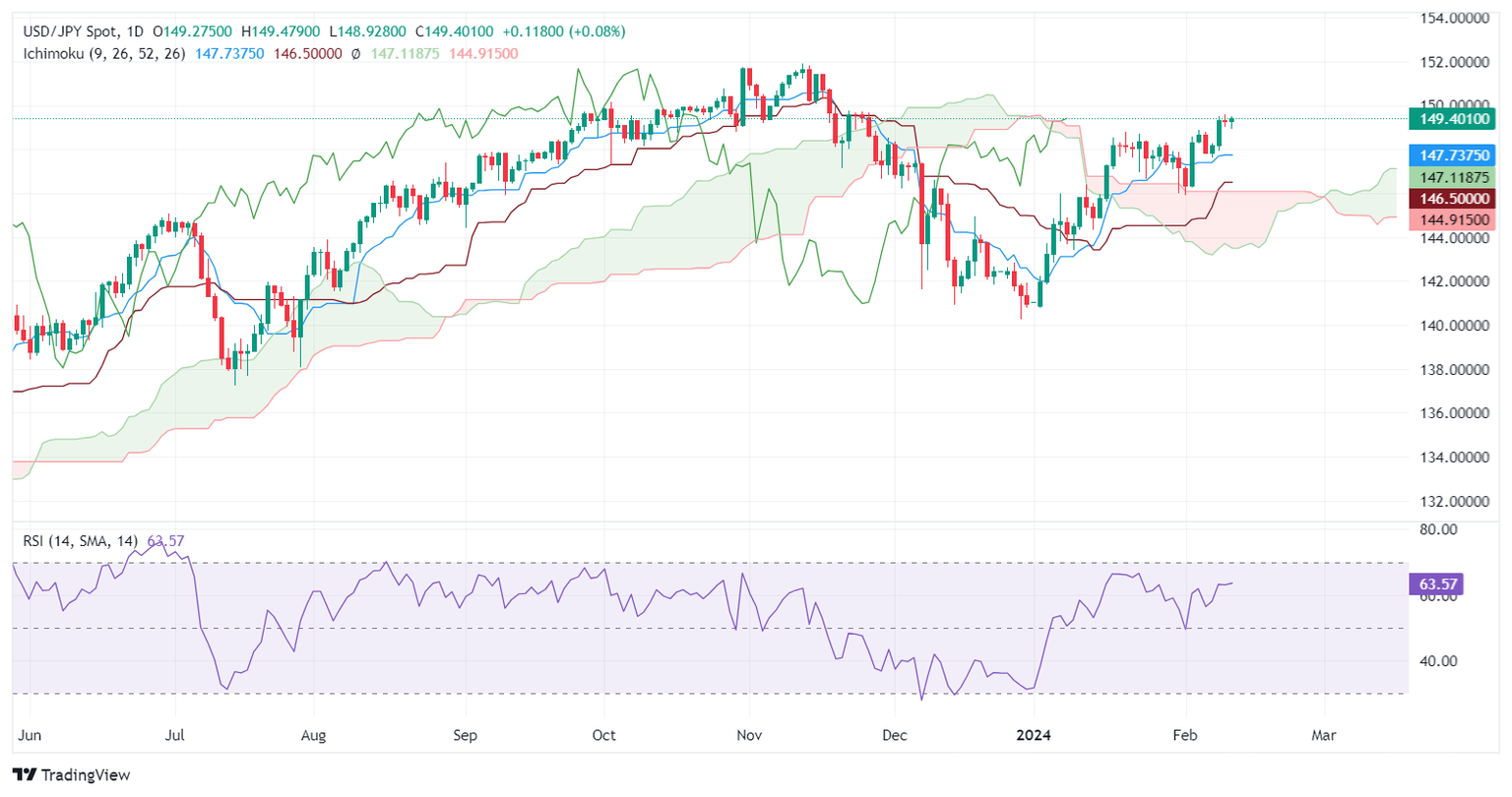

The USD/JPY daily chart suggests the pair is consolidating after posting back-to-back doji’s. Although Japanese officials have remained muted on the Japanese Yen (JPY) levels, buyers are being cautious ahead of testing the 150.00 figure. Further upside is seen at 151.38, the November 16 high, followed by the November 13 high at 151.91. On the flip side, if the pair edges below the 149.00 figure, that could pave the way to test the 148.00 figure, followed by the Tenkan-Sen at 147.74.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.