USD/JPY soars as BoJ keeps dovish stance, US bond yields climb

- USD/JPY marks a 0.38% gain, as the Bank of Japan (BoJ) holds rates and maintains its accommodative monetary policy, questioning the sustainability of rising inflation.

- Soaring US Treasury bond yields, reaching levels unseen since 2007, bolster the US Dollar, pushing it above the 106.00 figure.

- Potential US government shutdown looms as budget talks stall, with lawmakers utilizing the budget as a political tool, potentially leading to a strengthened Japanese Yen and a subsequent downside for USD/JPY.

the US Dollar (USD) rises sharply against the Japanese Yen (JPY) following last week’s Bank of Japan’s (BoJ) decision to hold rates unchanged while delivering a dovish statement. That, alongside a risk-off impulse and soaring US bond yields, is a tailwind for the major. The USD/JPY is trading at 148.91, gaining 0.38%.

American Dollar gains momentum against the Yen, on BoJ’s maintaining it’s monetary policy, despite high inflation lurking

Last Friday, the BoJ kept rates in negative territory and pledged to support its ultra-loose monetary policy despite the latest inflation reports, which suggest inflation is above the bank’s goal of 2%. Still, BoJ policymakers question if it would be sustainable for a more extended period.

The BoJ Governor Kazuo Ueda said there’s “very high uncertainty” on companies to continue to lift prices and wages as the bank continues to stick to its accommodative posture. Ueda said the BoJ is not “fully convinced” that wages would continue to accelerate, seen as a reason for the BoJ, to stay pat on its posture.

In the meantime, threats of intervention continue, as the Japanese Prime Minister said that excessive forex moves are undesirable and that authorities would continue to monitor Forex moves closely with a sense of urgency.

Meanwhile, the higher for longer mantra is felt in the financial markets. With the US Federal Reserve set to hike once more in the year, US Treasury bond yields are soaring while Wall Street dives. The US 10-year Treasury bond yield touched a high of 4.533%, a level last seen in 2007, underpins the Greenback above the 106.00 figure for the first time since November of last year.

The USD/JPY continues to trend up as Federal Reserve officials stressed the need for more rate hikes, particularly Governor Michelle Bowman. Contrarily, Boston and San Francisco Fed Presidents Susan Collins and Mary Daly said patience is required but didn’t talk about disregarding another hike. Recently, the Chicago Fed President Austan Goolsbee said that a soft landing is possible, but inflation risks remain tilted to the upside.

Another reason market sentiment is shifting sour is that US lawmakers are warning that the US is headed for a shutdown, as budget talks stalled. Once again, US policymakers use the budget as a political tool to push their agenda. Usually, lawmakers fix this until the last moment, so traders must be aware of this. In the event of a shutdown, look for Japanese Yen (JPY) strength, so the USD/JPY could be headed to the downside.

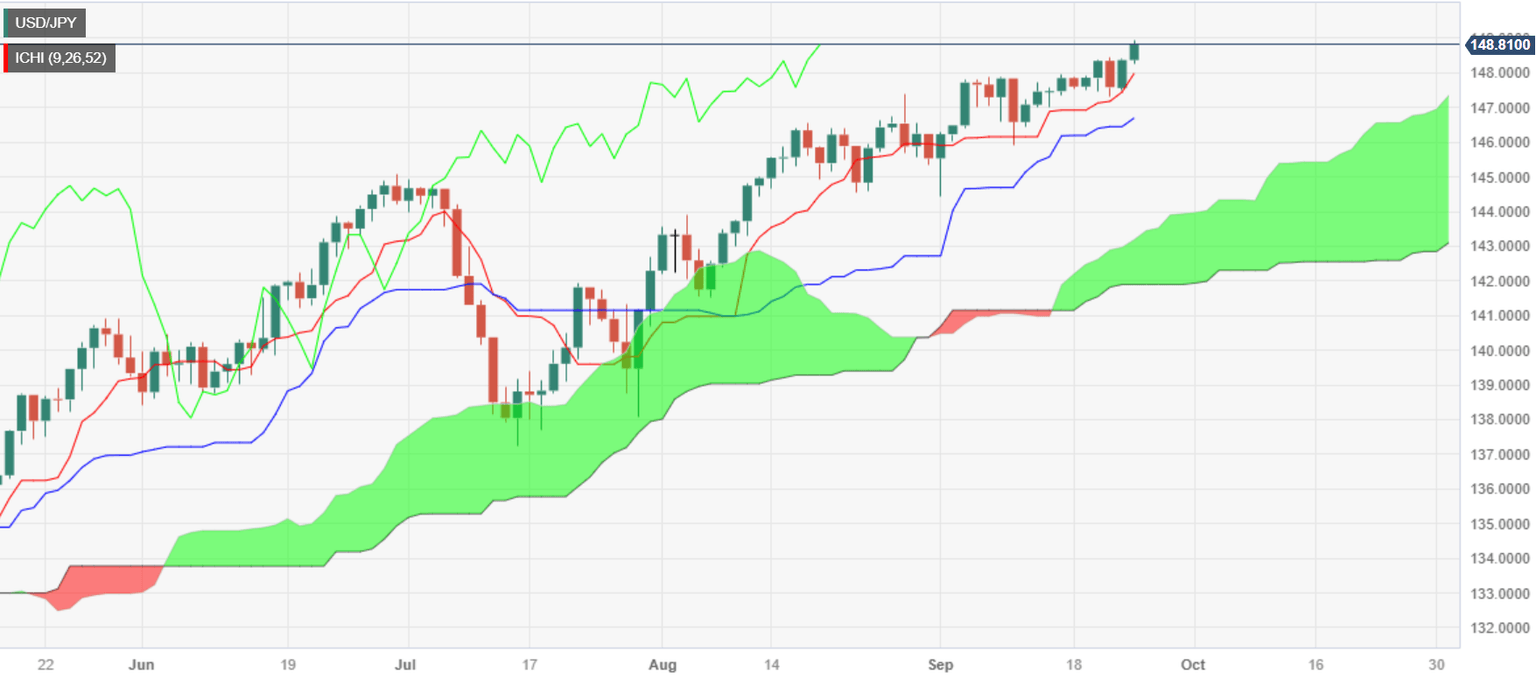

USD/JPY Price Analysis: Technical outlook

After breaking the 148.00 figure, the USD/JPY is set to test the 149.00 figure, followed by the 150.00 handle. However, traders should be nimble as the threat of intervention looms. Based on October of last year’s Japanese authorities stepping in, the pair printed a 560-pip daily candle on October 21, followed by another 500 pip on November 10. On the flip side, the USD/JPY first support would be the Tenkan-Sen at 147.99, followed by the 47.00 mark, and the Kijun-Sen at 146.70

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.