- USD/JPY trades down 0.13% at 145.68, pressured by disappointing US labor market data and lower-than-expected Q2 GDP growth.

- US 10-year Treasury Note yield dips to 4.102%, further weakening the dollar, as the DXY index slumps 0.43% to 103.041.

- BoJ board member Naoki Tamura signals inflation is "clearly in sight," hinting at a potential end to negative rates next year, which could bolster the Yen further.

The Japanese Yen (JPY) registers back-to-back positive sessions against the US Dollar (USD), which remains downward pressured after last Tuesday’s data depicted the US labor market is cooling. Today’s data reinforced the latter, easing pressure on the US central bank to increase borrowing costs. The USD/JPY is trading at 145.68, down 0.13%, after reaching a daily high of 146.84.

Yen gains momentum vs. a battered US Dollar amid soft labor and GDP data

The Greenback extended its losses courtesy of weaker-than-expected growth data. The US Commerce Department Q2’s Gross Domestic Product (GDP) was 2.1% below the government’s previous estimates of 2.4%, an uptick from Q1’s 2%. That, alongside the ADP National Employment report missing estimates of 195K at 177K, revealed the labor market is losing steam.

On Tuesday, the US Department of Labor revealed 1.51 job openings for every unemployed person, the lowest ratio since September 2021, compared with 1.54 in June.

Given the worse-than-expected economic data, US Treasury bond yields fell. The US 10-year Treasury Note yield slides two basis points down to 4.102%, a headwind for the USD/JPY pair due to its close positive correlation. That undermined the US Dollar (USD), which, according to its index, the US Dollar Index (DXY) slumps 0.43%, down at 103.041.

On the Japanese front, the Bank of Japan (BoJ) board member Naoki Tamura said that inflation is “clearly in sight,” indicating that negative rates could end next year. Market participants are eyeing the BoJ’s next move, as it’s the only global central bank easing monetary policy. Once the BoJ normalizes its monetary policy, broad Japanese Yen (JPY) strength is expected. It could trim its 11.22% YTD losses against the Greenback, suggesting further USD/JPY downside is expected.

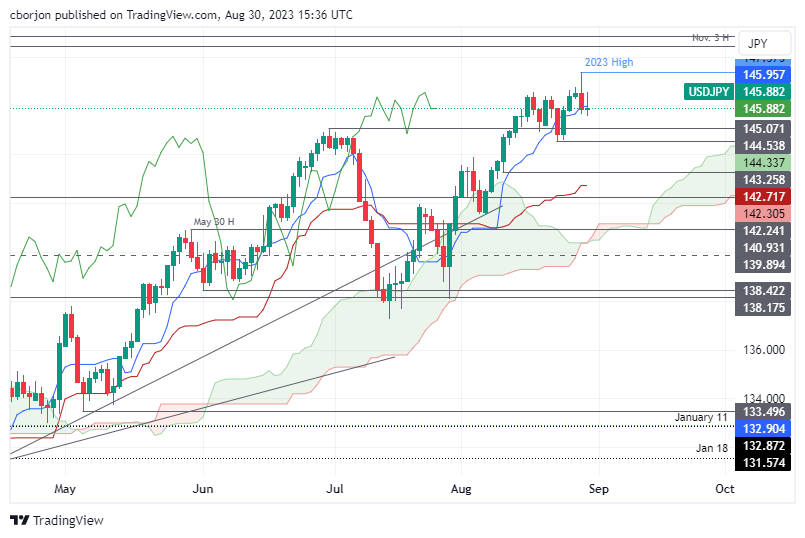

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY remains upward biased, though the pair slide below the Tenkan-Sen line at 145.95 could open the door for a pullback, with support emerging at the June 30 daily high turned support at 145.07. Otherwise, if buyers reclaim the Tenkan-Sen line, the next stop would be 146.00. A breach of the latter could pave the way for a test of the year-to-date (YTD) high of 147.37.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD oscillates in a range below 0.6300 amid mixed cues

AUD/USD struggles to build on the previous day's positive move and remains below the 0.6300 mark ahead of Trump's tariffs announcement later this Wednesday. In the meantime, the cautious market mood lends some support to the safe-haven USD and caps the upside for the pair.

USD/JPY remains below 150.00 as traders await Trump's tariffs

USD/JPY regains positive traction on Wednesday as receding bets that the BoJ would raise the policy rate at a faster pace undermine the JPY. Spot prices, however, remain confined in the weekly range as traders wait on the sidelines ahead of Trump's reciprocal tariffs announcement.

Gold price holds comfortably above $3,100 amid trade jitters

Gold price attracts some dip-buyers following the previous day's retracement slide from the record high amid persistent safe-haven demand, bolstered by worries about a tariff-driven global economic slowdown. Furthermore, Fed rate cut expectations and the lack of USD buying interest offer additional support to the XAU/USD.

US Government to conclude BTC, ETH, XRP, SOL, and ADA reserves audit next Saturday

Bitcoin price rose 3% on Tuesday, as MicroStrategy, Metaplanet and Tether all announced fresh BTC purchase. However, BTC price is likely to remain volatile ahead of the anticipated disclosure of U.S. government crypto holdings, which could fuel speculation in the coming days.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.