USD/JPY seeking 150.00 as US Dollar rises across the board

- USD/JPY is floating just shy of the 150.00 major level heading into Tuesday's Asia market session.

- The US Dollar is extending a broad-market bid that scooped up markets on Friday, driving the USD/JPY into year-long highs.

- Economic calendar lacks Japan data heading into another NFP week.

The USD/JPY is pushing into its highest prices in eleven months, driving towards the 150.00 major handle as the US Dollar (USD) catches a broad-market ride up the charts on souring investor appetite and risk-off flows piling into the safe haven USD. The Japanese Yen (JPY) has lost almost 3% since September's opening bids near 145.55.

The Bank of Japan (BoJ) continues to chase its hyper-easy monetary policy framework, announcing an unscheduled bond purchasing exercise on Monday attempting to clamp down on spiraling Japanese government bond yields.

BoJ announces unscheduled bond-buying operation to stem surge in yields

Despite the operation, the BoJ's bond buying saw little market absorption, with investors broadly focusing on how much USD they can scoop up, and the JPY continues to tumble towards the USD/JPY's highest bids in a year.

September's US Manufacturing Purchasing Manager Index (PMI) figures on Monday came in better than expected, printing at 49.0 against the forecast uptick into 47.7 from the previous reading of 47.6.

ISM Manufacturing PMI improves to 49.0 vs. 47.7 forecast

With little of note on the economic calendar for Japan, market focus will be squarely on the US data docket heading into another Non-Farm Payrolls (NFP) Friday, with the US NFP for September expected to slip from 187K to 163K.

Next up will be Tuesday's JOLTS job openings for August, forecast to tick upwards slightly from 8.827M to 8.83M.

Read More:

Forex Today: US Dollar shows its strength, RBA to keep rates unchanged

USD/JPY technical outlook

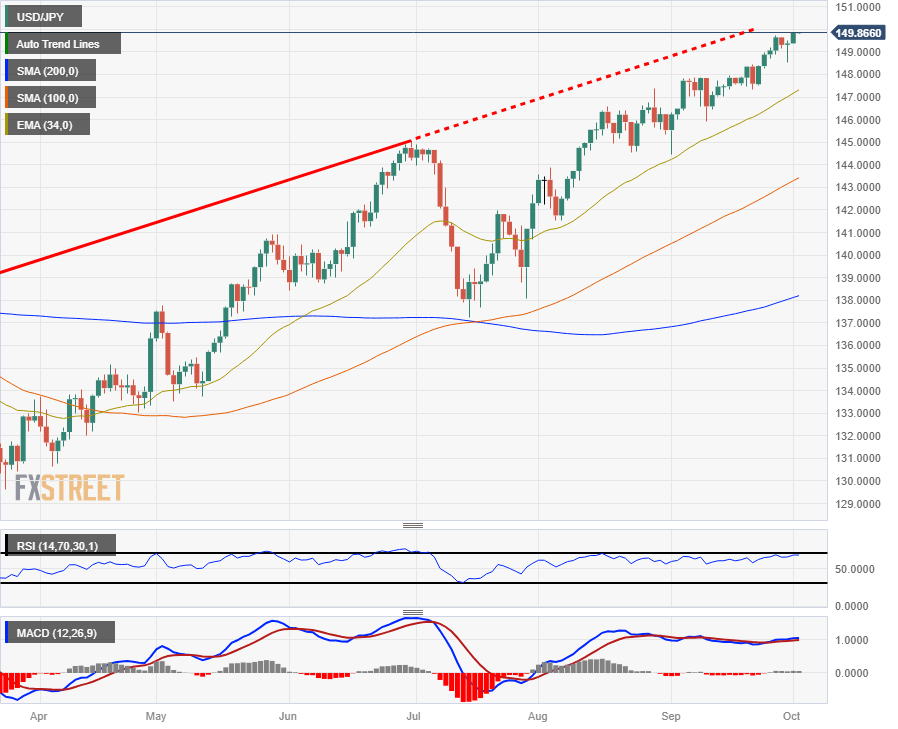

The USD/JPY is pinning into eleven-month highs just beneath the 150.00 major psychological handle, and Tuesday markets are rolling out of bed with the pair bidding near 149.85.

Hourly candles see the USD/JPY trading well above the 200-hour Simple Moving Average (SMA) near 148.90 as the major moving average sees itself pinned in place to a rising near-term trendline from last week's swing low into 147.32.

On the daily candlesticks, the US Dollar has closed bullish against the Japanese Yen for six of the last eight straight trading months, and current price action is well-bid after rebounding from the 34-day Exponential Moving Average (EMA) just above 147.00, with the 200-day SMA far below current prices, turning bullish from 138.00.

USD/JPY hourly chart

USD/JPY daily chart

USD/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.