- USD/JPY recovered some ground but remained in danger of losing its early gains due to the slowing pace of inflation in the United States.

- The pair saw a brief uplift as a report from the University of Michigan indicated improved Consumer Sentiment, posting a two-year high.

- Rising household inflation expectations and speculation on adjustments to Yield Curve Control put pressure on the Bank of Japan.

USD/JPY recovers some ground but remains at the brisk of erasing most of its earlier gains after data from the United States (US) continued to show inflation is decelerating. At the same time, an improvement in US consumer sentiment lifted the pair towards its daily high of 139.15 before reversing its curse. The USD/JPY is trading at 138.47 after hitting a daily low of 137.21, up 0.31%.

USD/JPY trims losses on upbeat US data but inflation data on the US warrants less Fed tightening needed

The USD/JPY jumped during the latest hour after a report from the University of Michigan (UoM) saw an improvement in Consumer Sentiment, which was expected to print 65.5 but came at 72.6m at a two-year high. Joanne Jsu, the UoM Surveys of Consumers Director, said, “The sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets.” Additional data showed that inflation expectations for one year were upward revised to 3.4% from 3.3% in June, while for a five-year period, they were 3.1%, up from 3%.

Other data the US Department of Labor revealed showed US Import and Export prices slowed down, falling below the estimates in annual and yearly figures for June. The report aligned with the recent inflation data on the consumer and producer side, with numbers justifying the case for the US Federal Reserve (Fed) to keep rates unchanged if they want to, as prices are accelerating towards the Fed’s 2% goal. Nevertheless, Fed policymakers stressed that the battle against inflation has not been won, suggesting further tightening is needed.

US Treasury bond yields are recovering some ground, as the 10-year Treasury note rate sits at 3.793%, up two basis points, a tailwind for the greenback. The US Dollar Index, a measure of the dollar’s performance against a basket of peers, stopped its drop at 99.809, gaining 0.03%.

On the Japanese front, a Bank of Japan (BoJ) survey showed that households’ inflation expectations had risen, keeping the BoJ pressured. Also, expectations of the BoJ tweaking its Yield Curve Control (YCC) have been the main driver behind the Japanese Yen (JPY) strong week against most G8 FX currencies.

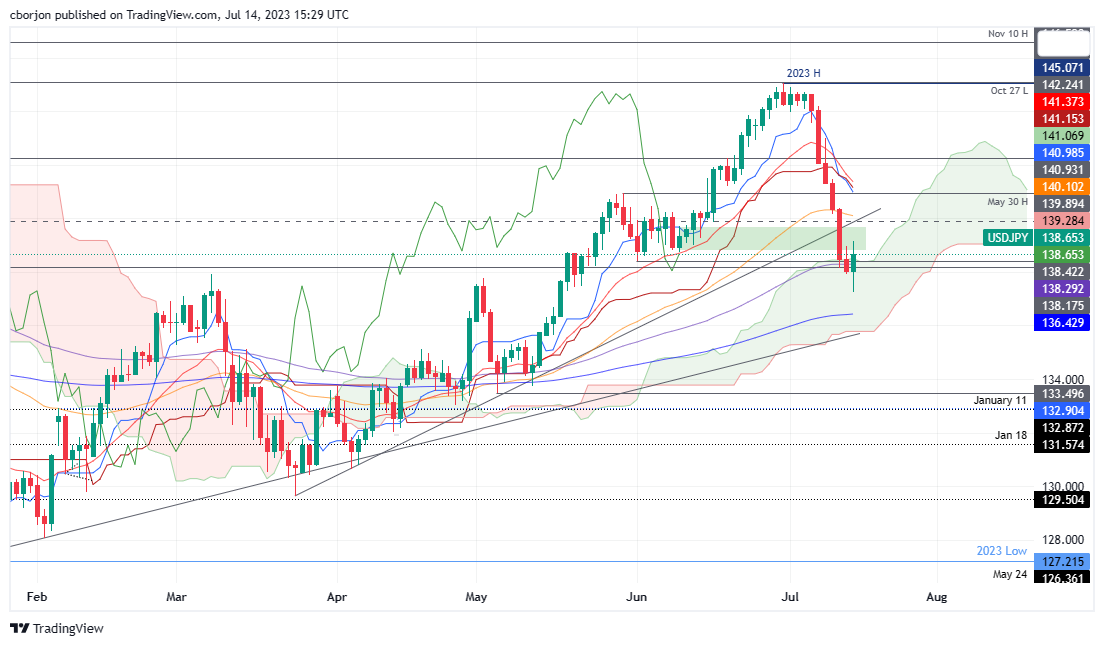

USD/JPY Price Analysis: Technical outlook

As of writing, the USD/JPY is struggling to decisively break the top of the Ichimoku Cloud (Kumo), which could pave the way for consolidation. USD/JPY’s sellers are eyeing the bottom of the Kumo at around 135.80/90, but the 200-day Exponential Moving Average (EMA) at 136.43 is expected to cushion the USD/JPY fall. On the upside, if USD/JPY buyers lift the pair past the top of the Kumo at around 138.50/60, it would exacerbate a challenge of the 139.00 psychological level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.