USD/JPY reached a YTD high but retreated as Fed minutes confirmed a possible pause

- Some Fed officials suggest the May meeting’s 25 bps rate hike may be the last, stressing the need for flexibility in the face of economic changes.

- Federal Reserve staff project a mild recession late in the year, with tightening monetary policy beginning to impact the economy and heightened risks to growth.

- Despite the uncertainty, most participants deem rate cuts unlikely, maintaining the possibility of further rate increases if necessary.

USD/JPY extended its gains of more than 0.39%, as the latest Federal Reserve May meeting minutes showed that a scenario of more rate hikes was “less certain.” At the time of writing, the USD/JPY is trading at 139.05, pointing a new year-to-date (YTD) high of 139.38.

Minutes reveal a split among policymakers, stress the importance of flexibility in upcoming meetings

Fed’s May meeting minutes showed uncertainty amongst policymakers, with some approving the 25 bps rate hike, stressing that it could be the last, while others cautioned that some flexibility is needed at upcoming meetings. Officials stated that if the economy evolves “along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.”

The staff of the Federal Reserve projects a mild recession late in the year, with officials “seeing evidence” that the cumulative tightening has begun to impact the economy, as “almost all participants” see risks to growth as bank credit tightens.

Most participants commented that no rate cuts are likely while keeping rate increases on the table if needed. “Participants emphasized the importance of communicating to the public the data-dependent approach.” Therefore, this confirms the meeting-by-meeting approach after the May meeting, and the US central bank will update its projections after the June 13-14 meeting,

USD/JPY’s reaction to the FOMC’s minutes

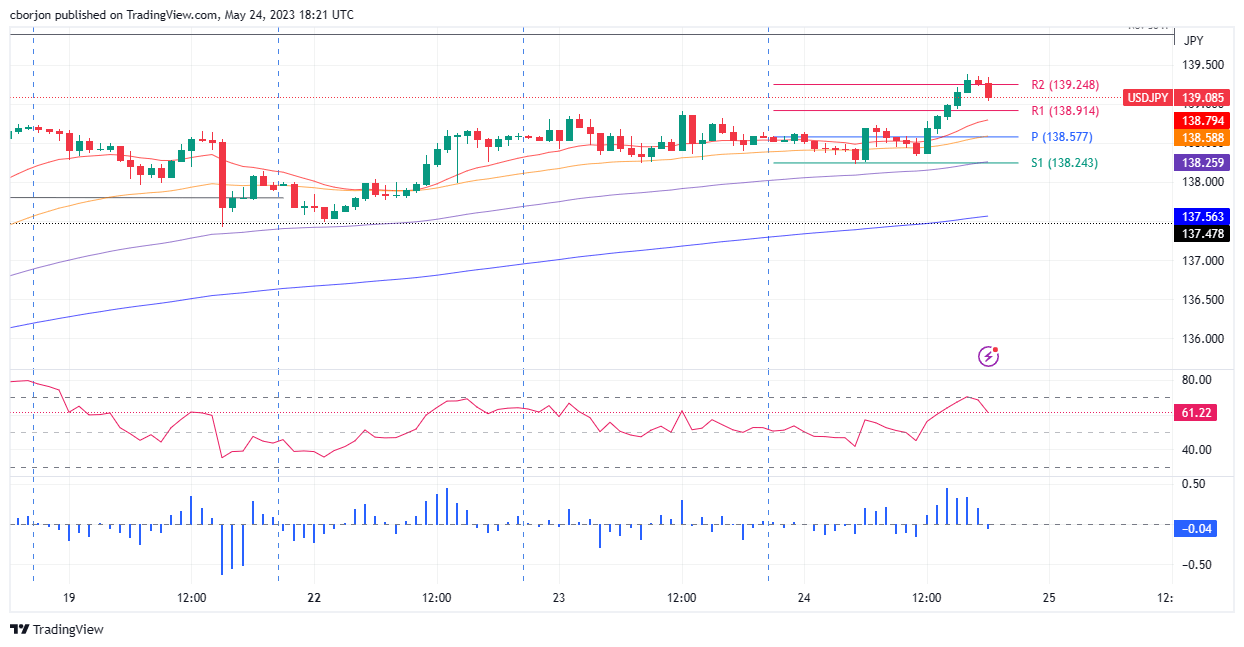

The USD/JPY reacted upwards and hit a new YTD high, above the R2 daily pivot, before pairing some of those gains, with the USD/JPY eyeing a test of the 139.00 figure. The Relative Strength Index (RSI) made a U-turn around the overbought area and heads downwards, while the 3-period Rate of Change (RoC) has dropped below the neutral area, suggesting that sellers may be gathering strength.

Upside risks lie at 139.38, which, once cleared, could pave the way toward 140.00. A bearish continuation is possible if USD/JPY dips below 139.00, exposing the R1 pivot at 138.91, followed by the central daily pivot point at 138.57, ahead of the 100-EMA at 138.25.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.