USD/JPY Price Prediction: Breaks out of price pattern and declines

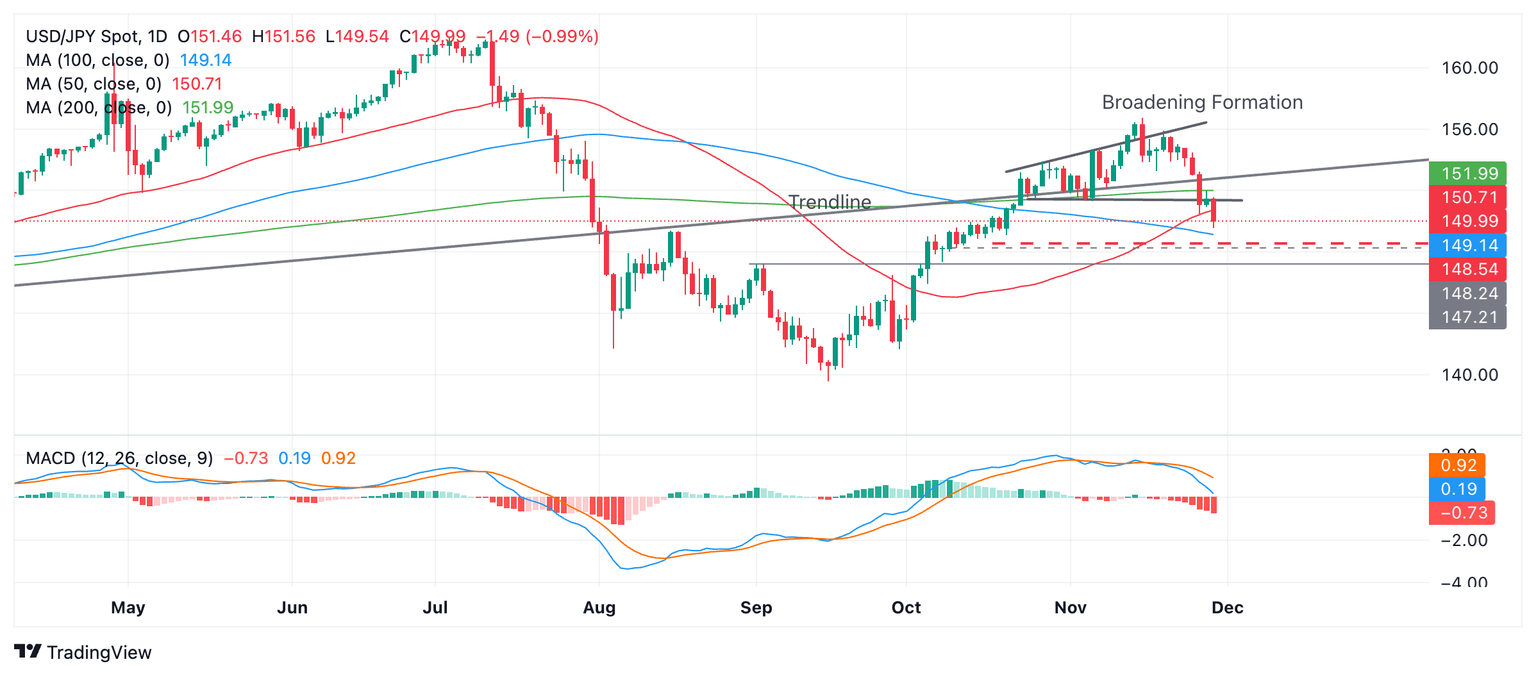

- USD/JPY has broken out of a Broadening Formation pattern and is falling towards its target.

- The pair has probably reversed its short-term trend and risks now lie to the downside, in line with the bearish bias.

USD/JPY has breached the bottom of a bearish Broadening Formation price pattern and is falling toward the first downside target at 148.54, the 61.8% Fibonacci extrapolation of the height of the pattern extrapolated down.

USD/JPY Daily Chart

Further bearishness could carry USD/JPY to the next target at 148.24, the September 2, key swing high.

The (blue) Moving Average Convergence Divergence (MACD) momentum indicator is diverging away from its red signal line – a further bearish sign.

The short-term trend has probably reversed from bullish to bearish after the breakdown. Given it is a principle of technical analysis that trends have a tendency to extend, the odds now favor more weakness in the short-term.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.