USD/JPY Price Forecast: Surges to two-week peak, shy of 147.00

- USD/JPY closed August above Kijun-Sen and Ichimoku Cloud, showing buyer strength; break above 152.00 needed to target YTD high of 161.95.

- Pair consolidates within 140.78-147.30 range inside Ichimoku Cloud, indicating potential for sideways trading. Break above 149.39 required for uptrend continuation; a dip to 141.69 could test Kumo bottom at 140.78.

- Buyer momentum picking up, targeting Kijun-Sen at 148.46. Watch resistance at 147.00 and 148.00; a fall below Senkou Span A at 146.90 may lead to levels at 146.00 and Tenkan-Sen at 145.31, nearing the 145.00 support.

The USD/JPY rises for the fourth straight day on Monday as September commences, up by 0.49% amid thin liquidity conditions during the North American session. At the time of writing, the pair trades at 146.87 after bouncing off a daily low of 145.78.

USD/JPY Price Forecast: Technical outlook

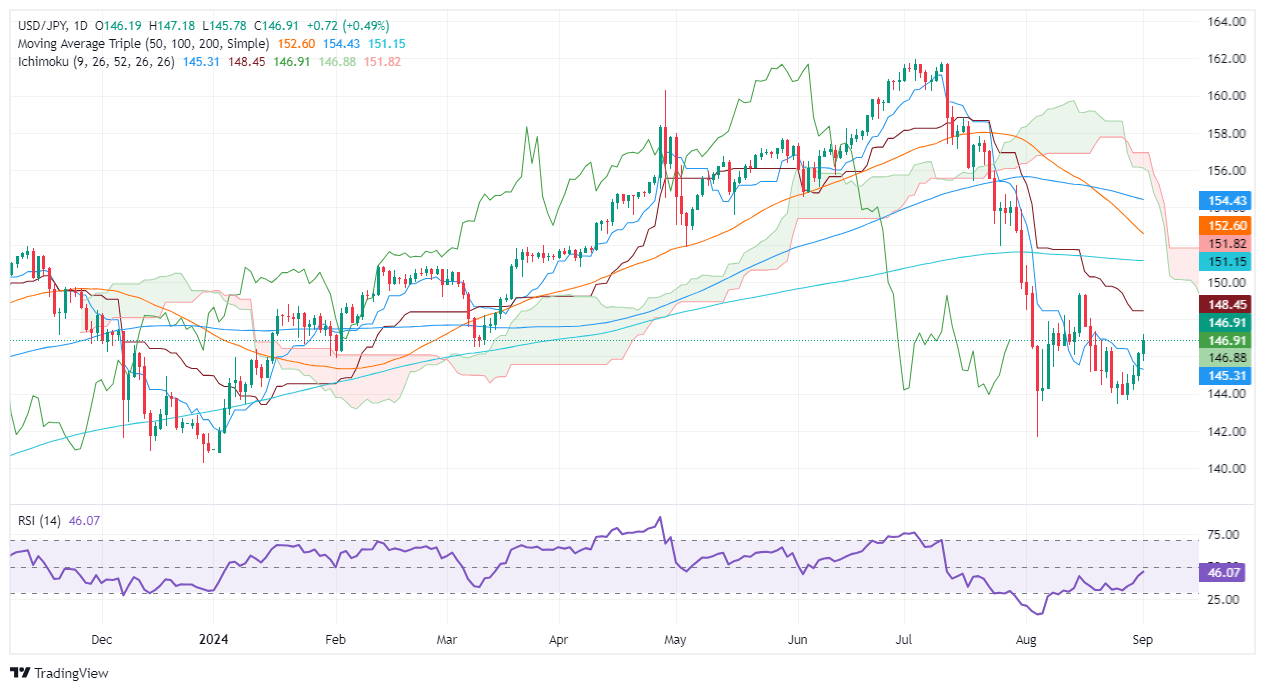

The USD/JPY monthly chart shows the pair dipping toward 141.69 but recovering late and closing at 146.17, above the Kijun-Sen and the Ichimoku Cloud (Kumo). Even though this hints that buyers are in charge, the pair should clear 152.00 to re-test the year-to-date (YTD) high at 161.95.

From a weekly standpoint, the USD/JPY consolidates at around the top of the 140.78-147.30 range inside the Kumo, an indication of sideways trading. For buyers to resume the uptrend, they need to push prices above the latest cycle high of 149.39. On the other hand, sellers need to clear 141.69 before testing the Kumo's bottom at 140.78.

Meanwhile, the USD/JPY daily chart shows that buyers are regaining control. They could push prices toward the Kijun-Sen at 148.46, but first, they need to clear key resistance levels. The first would be the 147.00 figure, followed by the 148.00 threshold.

Conversely, if sellers move in and drag the price below the Senkou Span A at 146.90, that can pave the way for further downside. The next support would be the 146.00 mark, followed by the Tenkan-Sen at 145.31, before challenging 145.00.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | 0.00% | -0.03% | -0.02% | -0.02% | 0.18% | 0.00% | |

| EUR | 0.00% | -0.01% | -0.02% | -0.03% | -0.03% | 0.08% | 0.00% | |

| GBP | -0.01% | 0.00% | 0.00% | -0.02% | -0.02% | 0.09% | 0.00% | |

| JPY | 0.03% | 0.02% | 0.00% | -0.01% | -0.00% | 0.00% | 0.00% | |

| CAD | 0.02% | 0.03% | 0.02% | 0.01% | -0.02% | 0.01% | 0.03% | |

| AUD | 0.02% | 0.03% | 0.02% | 0.00% | 0.02% | -0.01% | 0.03% | |

| NZD | -0.18% | -0.08% | -0.09% | -0.01% | -0.01% | 0.00% | 0.03% | |

| CHF | -0.00% | 0.00% | -0.01% | -0.01% | -0.03% | -0.03% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.