USD/JPY Price Analysis: Tumbles on Japanese authorities language intervention, falling US bond yields

- USD/JPY declined for two consecutive days following remarks from Japanese authorities indicating increased scrutiny of currency market movements.

- Japanese Yen strengthens in response to the news, putting downward pressure on the USD/JPY pair.

- USD/JPY maintains an upward bias as long as it holds above the key level of 138.74, representing the May 18 daily high.

USD/JPY dropped for two consecutive days after Japanese authorities expressed that currency market moves would be watched, following a meeting between the Bank of Japan (BoJ) and Masato Kanda, vice finance minister for international affairs. After those remarks, the Japanese Yen (JPY) strengthened. At the time of writing, the USD/JPY is trading at 139.87, losing 0.40%.

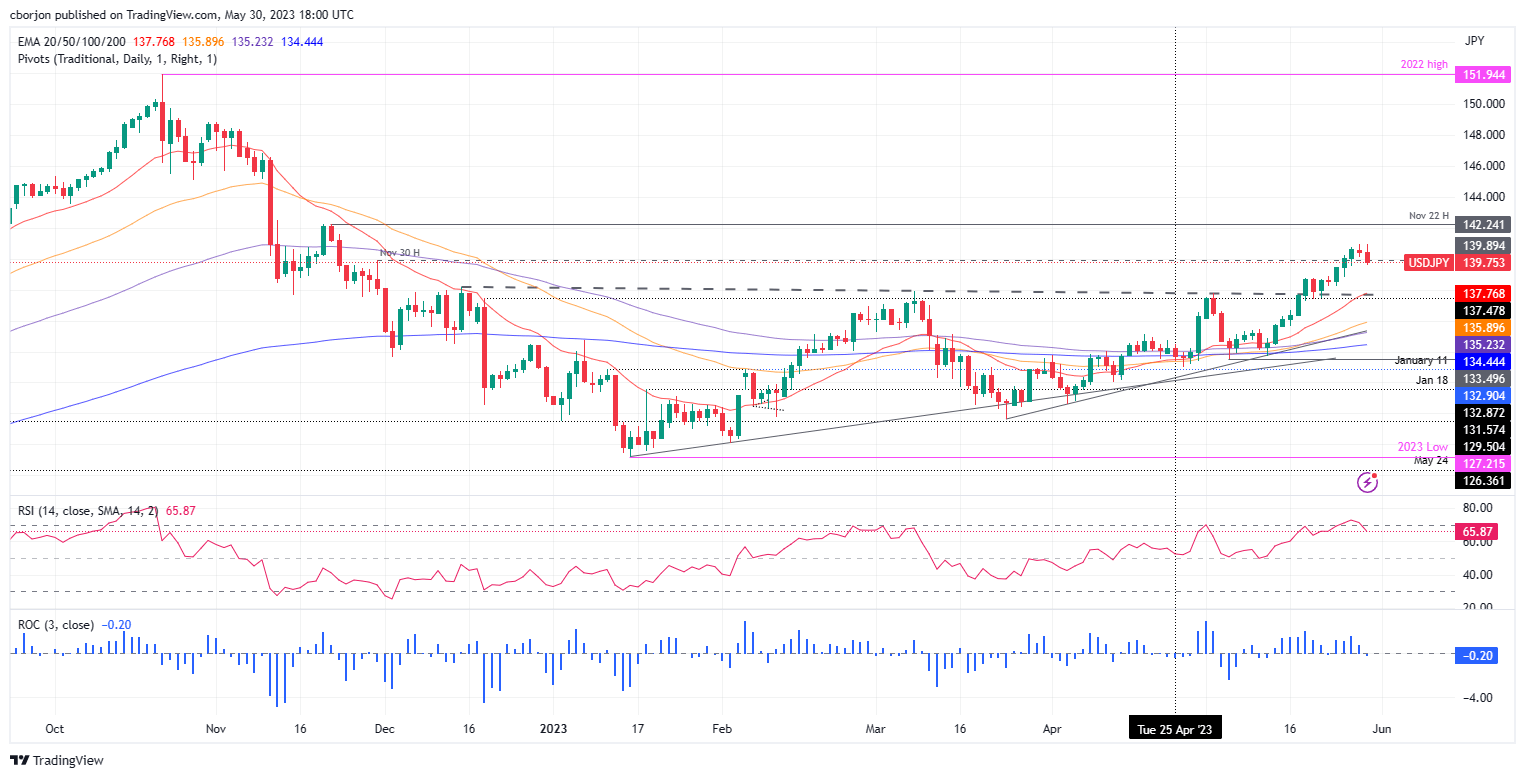

USD/JPY Price Analysis: Technical outlook

USD/JPY remains upward biased as long as the pair remains above the May 18 daily high of 138.74, though the recent pullback could be attributed to market sentiment deterioration. Additionally, the Relative Strength Index (RSI) indicator, exiting from overbought conditions, could be one of the reasons, alongside plunging US Treasury bond yields.

That said, USD/JPY first support would be the 139.00 figure. A breach of the latter will expose the May 18 high, followed by the 138.00 figure. Next would be the confluence of a previous resistance trendline turned support and the 20-day EMA at 137.76.

Conversely, if buyers reclaim 140.00, that could open the door for further upside, like the year-to-date (YTD) high of 140.93, before challenging the 141.00 mark.

USD/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.