- USD/JPY could meet the immediate barrier around March’s high of 151.97 and the psychological level of 152.00.

- The lagging indicators suggest a confirmation of the bullish trend for the pair.

- The pair could test the support region around the major level of 151.50 and the nine-day EMA at 151.39.

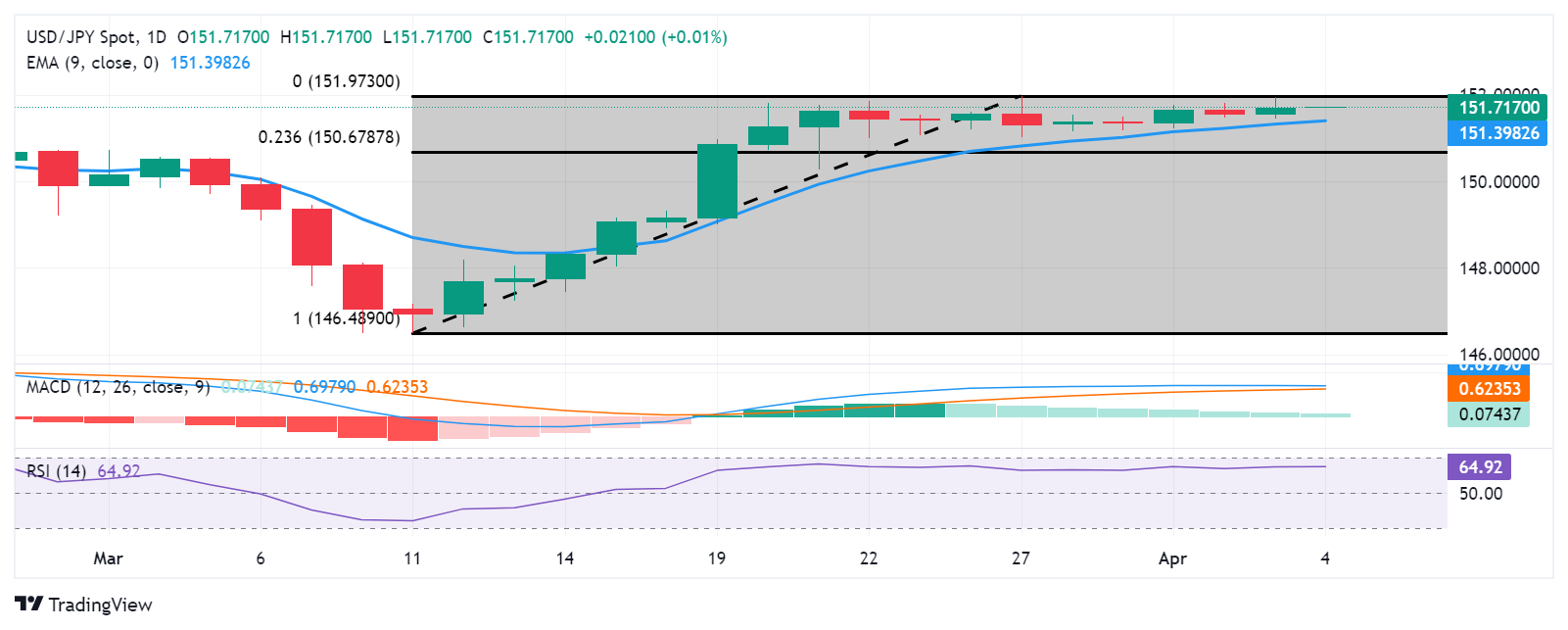

USD/JPY exhibits sideways trading on Thursday, hovering around 151.70 during the European trading hours. The pair may encounter immediate resistance around the recent high of 151.95 marked on Wednesday, which aligns with March’s high of 151.97 and the psychological level of 152.00.

A breakthrough above this level could support further upward movement, potentially allowing the USD/JPY pair to explore the region around the major level of 152.50.

The technical analysis for the USD/JPY pair indicates a bullish momentum, with the 14-day Relative Strength Index (RSI) positioned above the 50 level.

Additionally, the Moving Average Convergence Divergence (MACD) indicator confirms the bullish trend, with the MACD line above the centerline and showing divergence above the signal line.

On the downside, the USD/JPY could find immediate support at the significant level of 151.50, followed by the nine-day Exponential Moving Average (EMA) at 151.39.

A breach below the latter level might exert downward pressure on the USD/JPY pair, potentially leading to a test of the psychological mark of 151.00 before reaching the Fibonacci 23.6% retracement level of 150.67.

USD/JPY: Daily Chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD moves little due to thin trading ahead of New Year holiday

The Australian Dollar remains tepid against the US Dollar following the release of mixed NBS Manufacturing Purchasing Managers' Index data from China on Tuesday. As close trade partners, any fluctuations in China's economy tend to impact Australian markets.

USD/JPY pulls back, knocks back below 157.00

USD/JPY corkscrewed on Monday, backsliding seven-tenths of one percent and getting knocked back below the 157.00 handle as markets push back into the midrange ahead of the midweek New Year’s holiday closures. The year-end holiday session is in full swing, and broad-market volumes remain low.

Gold price set to finish the year with gains, driven by bank purchases, geopolitical tensions

Gold price holds ground after two days of losses amid thin trading volume on Monday. Gold prices are set to finish the year with an impressive 27% gain, representing their strongest annual performance since 2010.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.