USD/JPY Price Analysis: Trades nearby six-week highs, above 136.20s

- USD/JPY skyrocketed after BoJ’s dovish decision and high US core PCE data.

- USD/JPY Price Analysis: Rallied more than 200 pips, set for a pullback, before challenging YTD high,

The USD/JPY rose sharply after the first monetary policy decision by the Bank of Japan (BoJ) new Governor Kazuo Ueda struck a dovish tone, a greenlight for US Dollar (USD) buyers, against the Japanese Yen. (JPY). Therefore, the USD/JPY extended its gains of more than 1.73%, trading at 136.27.

USD/JPY Price Action

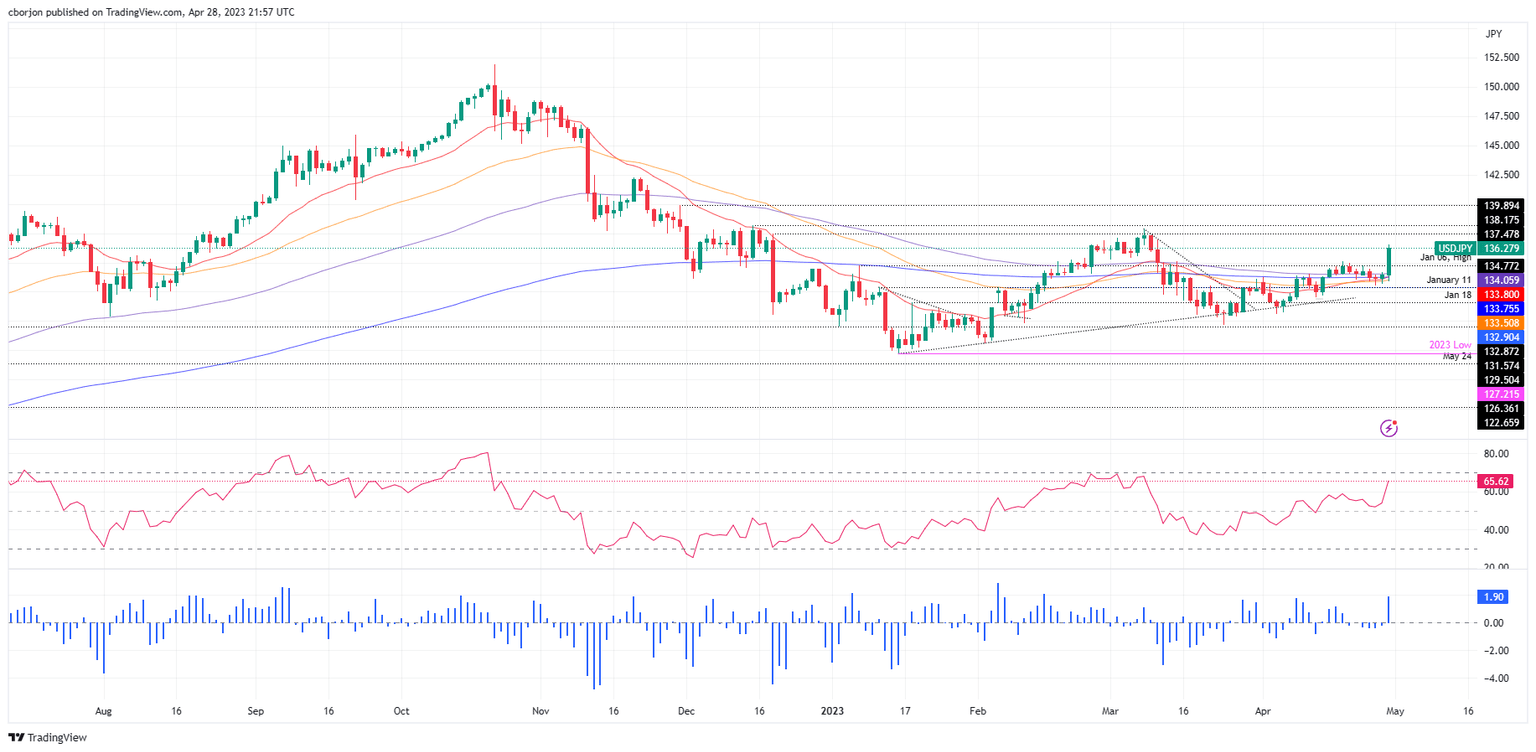

After the US inflation data release, the USD/JPY skyrocketed, past the last week’s high of 135.13, and extended its gains toward the 136.56 area, a six-week high at 136.56.

The USD/JPY resumed its uptrend after the release of inflation data in the US. On its way north, the price jumped more than 200 pips in the day, and it had opened the door to test the YTD high at 137.91. Nevertheless, buyers must reclaim some resistance levels before challenging the YTD high.

The first resistance would be the March 10 high at 136.99, which, once cleared, the USD/JPY will continue towards the March 9 high at 137.35. Up next would be the YTD high before testing 138.00.

On the other hand, the aggressive rally lifted the Relative Strength Index (RSI) indicator shy of reaching the overbought level; while the Rate of Change (RoC) hit levels last seen on February 15. Given the backdrop, the USD/JPY might be headed for a pullback after Friday’s rally.

The USD/JPY first support would be 136.00, followed by the 135.50 area. A breach of the latter, the USD/JPY could dip toward April 19 daily high, turned support at 135.13, ahead of challenging the 135.00 figure.

USD/JPY Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.