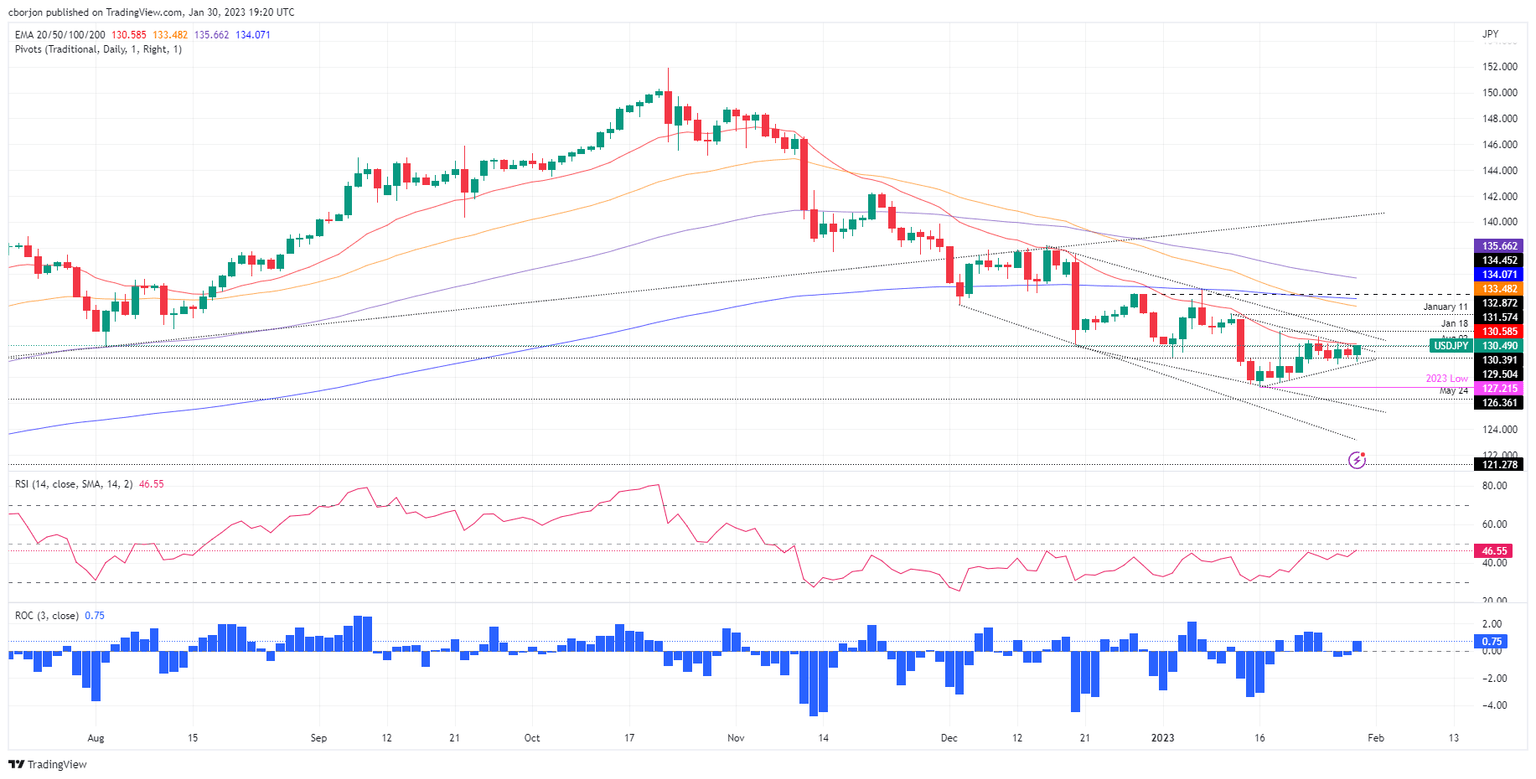

USD/JPY Price Analysis: To test the 20-day EMA after hitting a new session high around 130.50

- USD/JPY recovers some ground as traders brace for a busy US economic calendar.

- Buyers are eyeing a test of the 20-day EMA, as the RSI and RoC suggest the USD/JPY could print a leg-up in the near term.

- SUD/JPY Price Analysis: Remains downward biased, but it could aim higher.

USD/JPY erases last Friday’s losses and reaches a new session high at 130.49, though slightly beneath the 20-day Exponential Moving Average (EMA), used as a barometer for short-term bias, which remains above the exchange rate. Therefore, the USD/JPY remains bearish despite trading at 130.49, above its opening price by 0.56%.

USD/JPY Price Analysis: Technical outlook

From a price action point of view, the USD/JPY remains bearish biased, even though it printed new daily highs. However, USD/JPY buyers need to clear the 20-day EMA at 130.57, to open the door for further gains. Traders should be aware the Rate of Change (RoC) depicts the buyer gaining momentum, while the Relative Strength Index (RSI) is about to turn bullish, suggesting that upward pressure is building.

Therefore, the USD/JPY first resistance would be the 131.00 figure. A breach of the latter will expose a one-month-old downslope trendline at around 131.330-40, followed by the January 18 daily high at 131.57, and then January’s 11 swing high

As an alternate scenario, if the USD/JPY tumbles below 130.00. the next support would be the January 30 daily low of 129.19. A breach of the latter will expose the psychological 128.00, followed by the YTD low at 127.21.

USD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.