USD/JPY Price Analysis: Stumbles below 145.00 amid falling US bond yields as the pair turns bearish

- USD/JPY down 0.72%, trading at 144.79, as falling US bond yields and soft economic data put pressure on the pair.

- Technicals indicate a neutral to upward bias, but recent slip below key levels opens the door for further downside.

- First support at August 23 swing low of 144.54; a decisive break could target the 143.00 mark.

USD/JPY retraced its earlier weekly gains, as the pair printed losses of 0.72% on Wednesday, courtesy of falling US bond yields, as US economic data was soft. As Thursday’s Asian session begins, the USD/JPY is trading at 144.79, down by a minimal 0.03%.

USD/JPY Price Analysis: Technical outlook

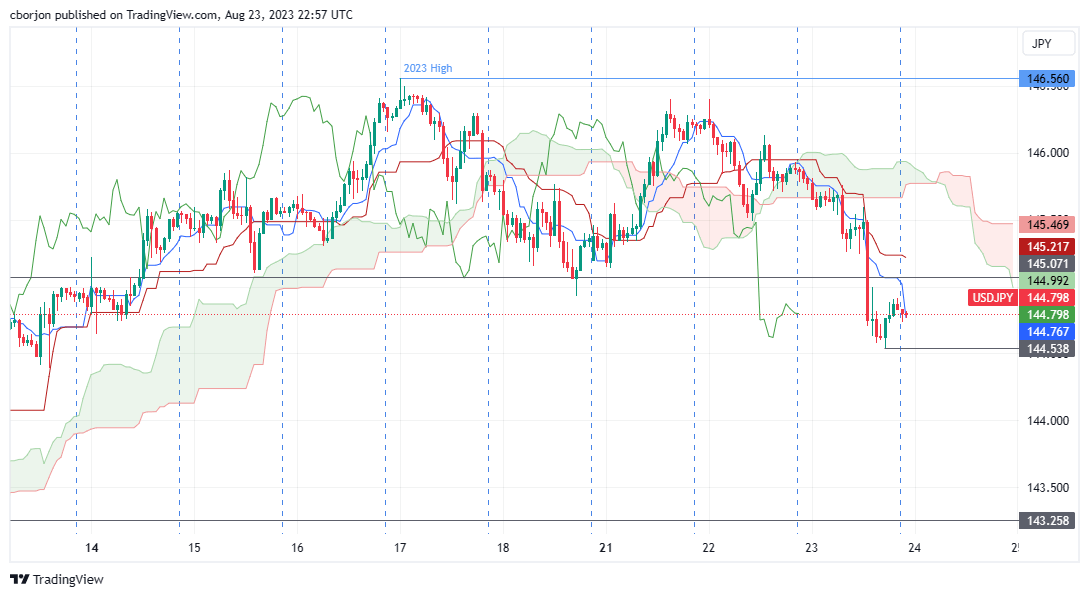

The USD/JPY is neutral to upward biased, but its fall below the Tenkan-Sen line at 145.54 opened the door for further losses. Price action is closing its distance from the Ichimoku Cloud (Kumo), which is still below the exchange rate, maintaining the bullish stance in the pair. But, given the USD/JPY slipped below the June 30 daily high and turned support at 145.07, it suggests the pair could extend its losses.

Short term, the USD/JPY hourly chart depicts the pair as bearish biased due to several technical indications: the Kijun-Sen is above the Tenkan-Sen line, usually the first sign of a change in the trend, followed by the Chikou Span breach below the price action, two days ago. That warrants further downside, alongside USD/JPY sliding below the Kumo.

First support would be the August 23 swing low of 144.54, followed by the August 10 daily low of 143.26. A decisive break and the USD/JPY could aim towards the 143.00 mark.

USD/JPY Price Action – Hourly chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.