USD/JPY Price Analysis: Sees subtle retreat after hitting YTD high shy of 141.00

- Technical indicators suggest potential exhaustion in the pair's rally, as the failure to cross the 141.00 mark triggers a downward correction toward 140.00, hinting at an ongoing correction.

- Despite the short-term pullback, market bulls remain prepared for a potential rally, setting sights on the November 22 daily high of 142.24 and further up at the 143.00 mark.

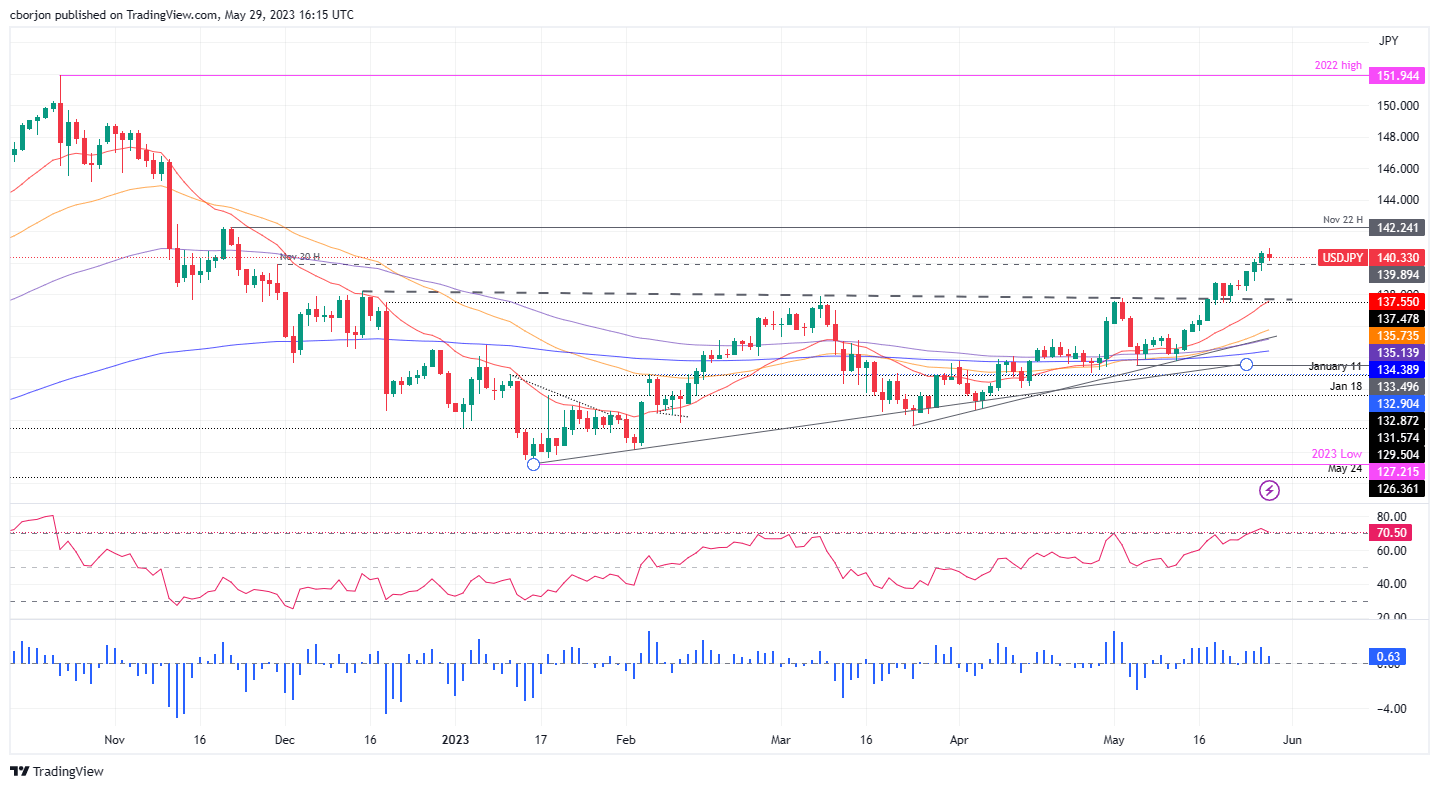

USD/JPY retraces after hitting a new year-to-date (YTD) high of 140.92, trades below its opening price by 0.19% amidst thin volume during the North American session. Memorial Day in the United States (US), and holidays across Europe, keep the Forex markets depressed. At the time of writing, the USD/JPY is trading at 140.34.

USD/JPY Price Analysis: Technical outlook

The USD/JPY is still upward biased, but the rally is fading as the pair shows signs of exhaustion. Failure to decisively crack the 141.00 figure exacerbated a downward correction toward the 140.00 figure, ahead of reaching for May 26 daily low of 139.50. It should be said the Relative Strength Index (RSI) indicator, at 70, begins to aim downwards, while the 3-day Rate of Change (RoC) points toward the neutral area, suggesting an ongoing correction.

That could trigger a short-term correction before USD/JPY bulls jump into action and lift the exchange rates past the 141.00 mark, on its way toward the November 22 daily high f 142.24, before reaching 143.00.

USD/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.