USD/JPY Price Analysis: Peaks below 145.00 amid Japanese intervention, choppy trading

- USD/JPY experienced minor losses due to threats of Japanese Forex intervention and US Independence Day trading lull.

- Technical indicators suggest the potential for a pullback, with the RSI nearing the overbought threshold and a negative RoC.

- If USD/JPY retraces, key supports stand at 144.00 and 143.11, while a rally could target the November highs and beyond.

USD/JPY trades with minuscule losses amidst verbal intervention by Japanese authorities, as week as choppy trading, with traders in the United States (US) out for the US Independence Day holiday. The USD/JPY is exchanging hands at 144.48 after hitting a daily high of 144.70.

USD/JPY Price Analysis: Technical outlook

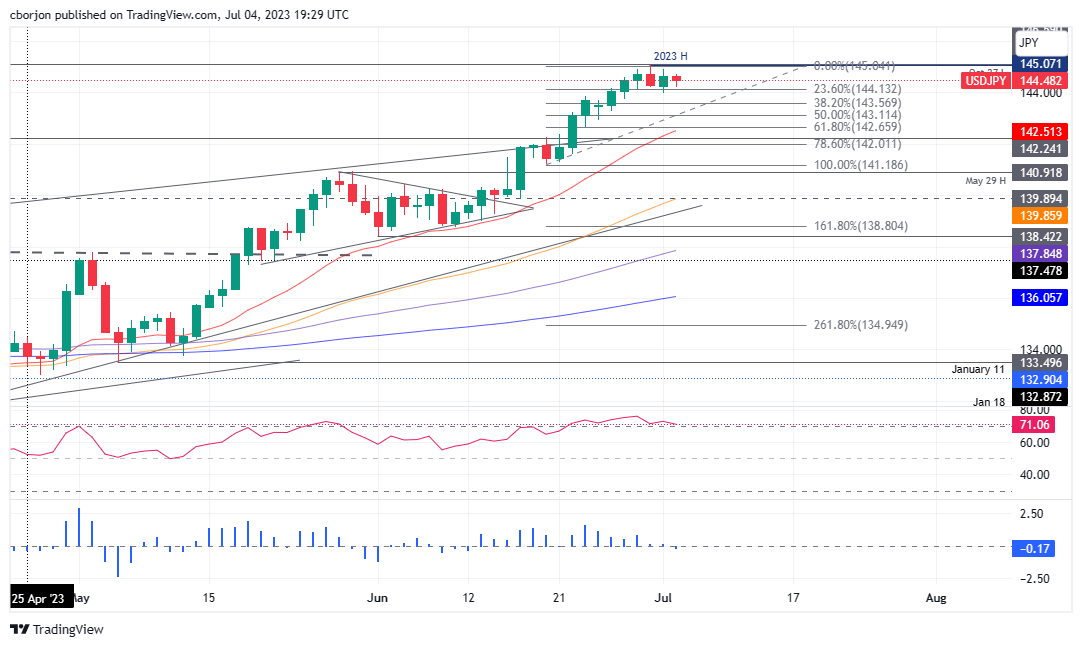

The USD/JPY remains upward biased even though it cannot edge towards a new year-to-date (YTD) high of 145.07 amidst threats from Japanese authorities of steepening into the Forex markets. It should be said the Relative Strength Index (RSI) remains at overbought conditions, about to cross below the 70 levels, which could open the door for a deeper pullback.

Furthermore, the three-day Rate of Change (RoC) portrays that selling pressure is fading as it turned negative, suggesting that further downside is possible.

If USD/JPY retraces, the first support will be the 144.00 figure. A breach of the latter will expose the 38.2% Fibonacci retracement at 146.57, drawn from the lows of June 28 toward the YTD high. Once cleared, the 50% Fibo retracement will be up next at 143.11, followed by the confluence of the 20-day Exponential Moving Average (EMA) and the 61.8% golden ratio at 142.51/65.

Conversely, if USD/JPY rallies to new YTD highs above 145.00, the next resistance would be the November 10 high at 146.59, followed by the November 1 daily high at 148.82 and 2022 high at 151.94.

USD/JPY Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.