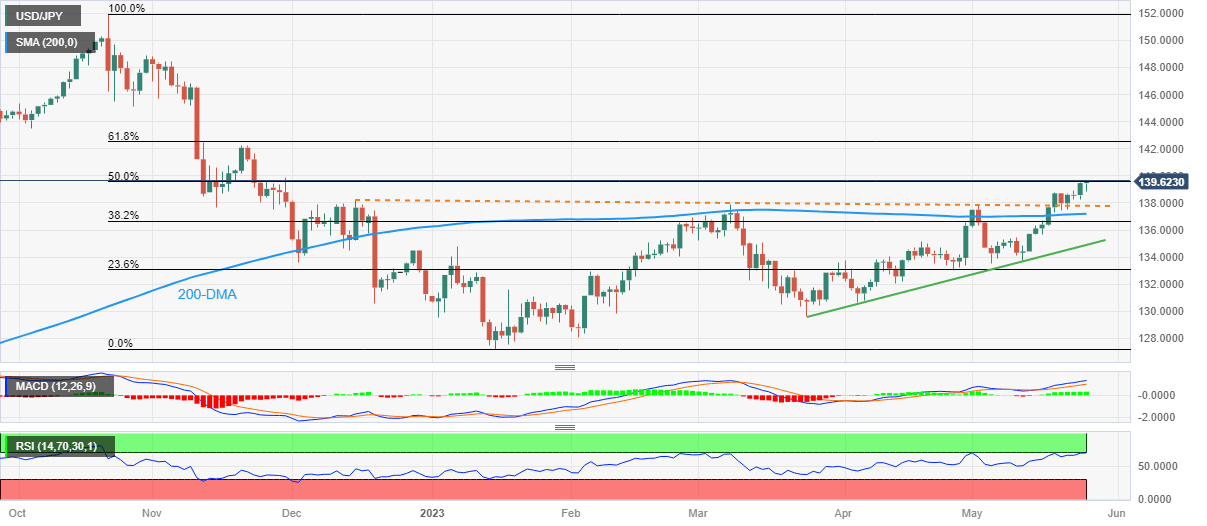

USD/JPY Price Analysis: Overbought RSI caps Yen pair’s upside below 140.00

- USD/JPY buyers struggle to extend latest run-up at the highest levels in six months.

- Key Fibonacci retracement level, late November 2022 peak prod Yen pair buyers.

- Multi-day-old previous resistance line, 200-DMA challenges USD/JPY bears amid bullish MACD signals.

USD/JPY edges higher as it renews the yearly top around 139.65-70 during early Thursday. In doing so, the Yen pair prods the 50% Fibonacci retracement level of its October 2022 to January 2023 downside amid overbought conditions of the RSI (14) line.

Apart from the 50% Fibonacci retracement level surrounding 139.60, the late November 2022 peak of around 139.90, quickly followed by the 140.00 round figure, also challenge the USD/JPY bulls.

In a case where the USD/JPY pair remains firmer past 140.00, the quote’s run-up towards the late November swing high of around 142.25 can’t be ruled out.

Though, the 61.8% Fibonacci retracement level near 142.50, also known as the golden Fibonacci ratio, could challenge the Yen pair buyers afterward.

Meanwhile, USD/JPY pair’s retreat remains elusive unless it breaks the previous resistance line stretched from December 2022, close to 137.80 at the latest.

Following that, the 200-DMA of around 137.20 can challenge the Yen pair sellers before giving them control.

Even so, a two-month-old ascending support line at 134.90 can prod the USD/JPY bears afterward.

Overall, USD/JPY remains on the bull’s radar even if the price is likely to witness a pullback.

USD/JPY: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.