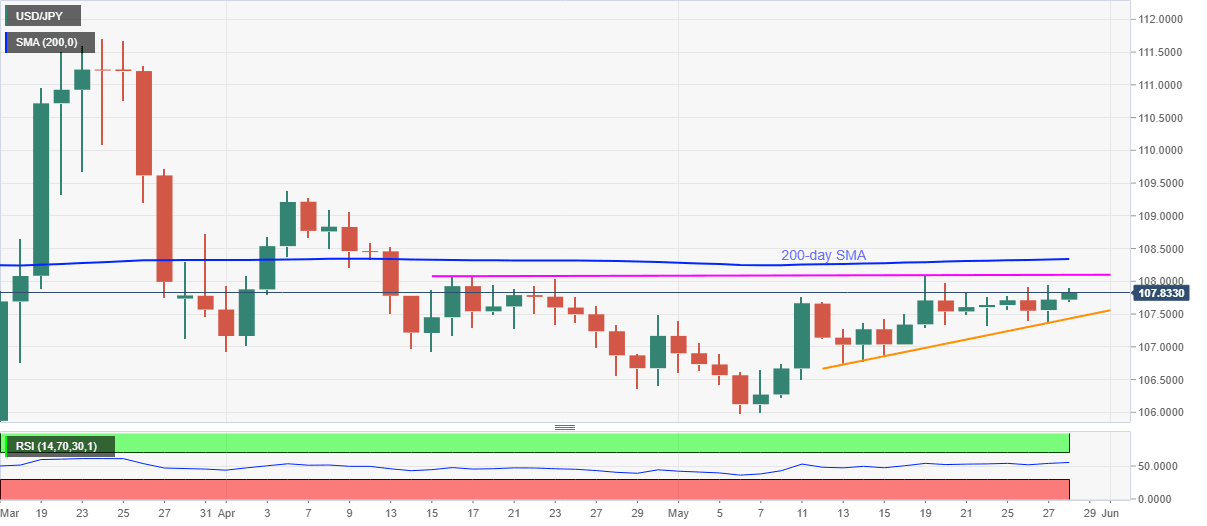

USD/JPY Price Analysis: Mildly bid above 107.50 amid risk-on sentiment

- USD/JPY prints a two-day winning streak above the 11-day-old rising support line.

- A horizontal area comprising mid-April high, 200-day SMA on the bulls’ radars.

- May 13 low could please sellers below the short-term ascending trend line.

- US Treasury yields, Japan’s NIKKEI portrays an upbeat market mood despite US-China tussle.

USD/JPY softens to 107.83, up 0.11% on a day, during the pre-European session on Thursday. Even so, the yen pair stays above an immediate support line.

As a result, buyers keep targeting the 108.05/10 area comprising multiple highs marked since April-19. However, a 200-day SMA level of 108.34 could keep the bulls checked then after.

In a case where the bulls manage to cross 108.34 on a daily chart, 109.00 and April month’s top nearing 109.40 will becomes their favorites.

If at all the US-China tussle weigh on risk-tone and drags the quote down, sellers will wait for a sustained break below 107.43, comprising an ascending trend line from May 13, for fresh entries.

Should that happen, the mid-month low near 106.75 and the monthly bottom around 106.00 will be on the bears’ radars.

USD/JPY daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.