USD/JPY Price Analysis: Grinds near 144.50 within weekly triangle, depicts cautious mood

- USD/JPY struggles within weekly trading range near YTD high amid sluggish sentiment.

- Cautious mood ahead of Fed Minutes, Japan intervention fears and recession woes prod sentiment.

- Downbeat RSI suggests Yen pair’s gradual grinding towards the south but 200-HMA appears the key support.

- Bulls have a bumpy road towards the north to travel even if they cross 144.65 immediate hurdle.

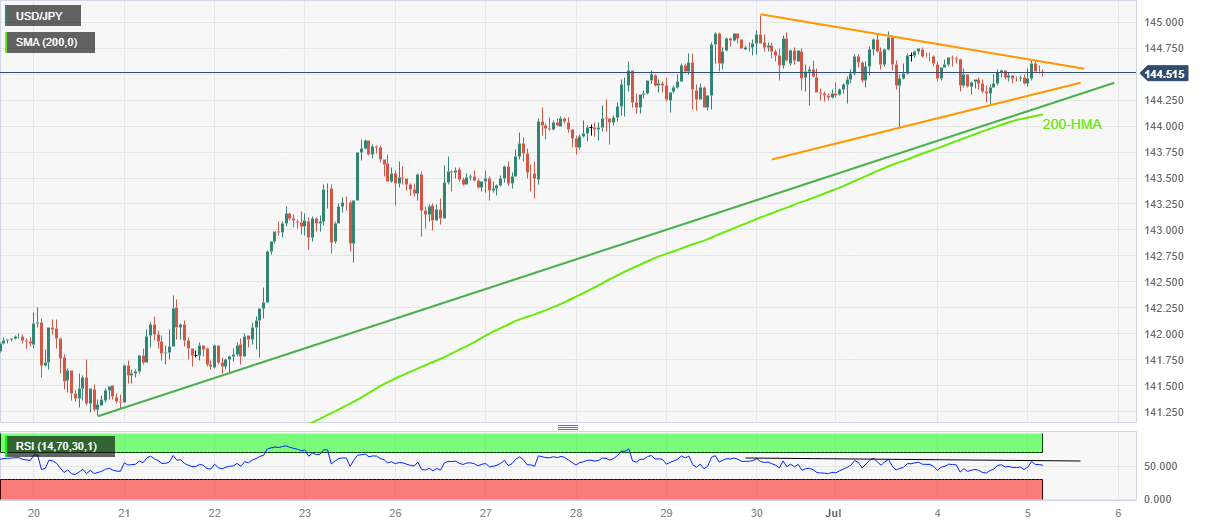

USD/JPY aptly portrays the market’s indecision around mid-144.00s as traders await the week’s key catalysts amid early Wednesday in Europe. In doing so, the Yen pair seesaws within a symmetrical triangle comprising multiple levels marked since June 30.

Among the headline catalysts, the US-China tussles, recession woes and Japan’s market intervention gain major attention. Additionally, amplifying the cautious mood is the wait for the Federal Open Market Committee (FOMC) Minutes for the June meeting.

Also read: USD/JPY consolidates in a range around mid-144.00s, just below YTD peak

With this, the USD/JPY pair remains sidelined within the weekly triangle, currently between 144.65 and 144.30.

However, the downward-sloping RSI (14) line suggests that the buyers are running out of steam as they repeatedly failed to refresh the Year-To-Date (YTD) high in the last one week.

As a result, the Yen pair is likely to break the 144.30 support and can please the bears.

Though, an upward-sloping trend line from June 20 and the 200-Hour Moving Average (HMA), respectively near 144.20 and 144.10, quickly followed by the 144.00 round figure, can challenge the USD/JPY bears before giving them control.

On the contrary, an upside break of the 144.65 hurdle will need validation from a horizontal area comprising the recent multi-month peak and October 2022 low of near 145.10.

Following that, September 2022 high of near 145.95 and the late October top surrounding 148.85 can challenge the USD/JPY bulls.

USD/JPY: Hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.