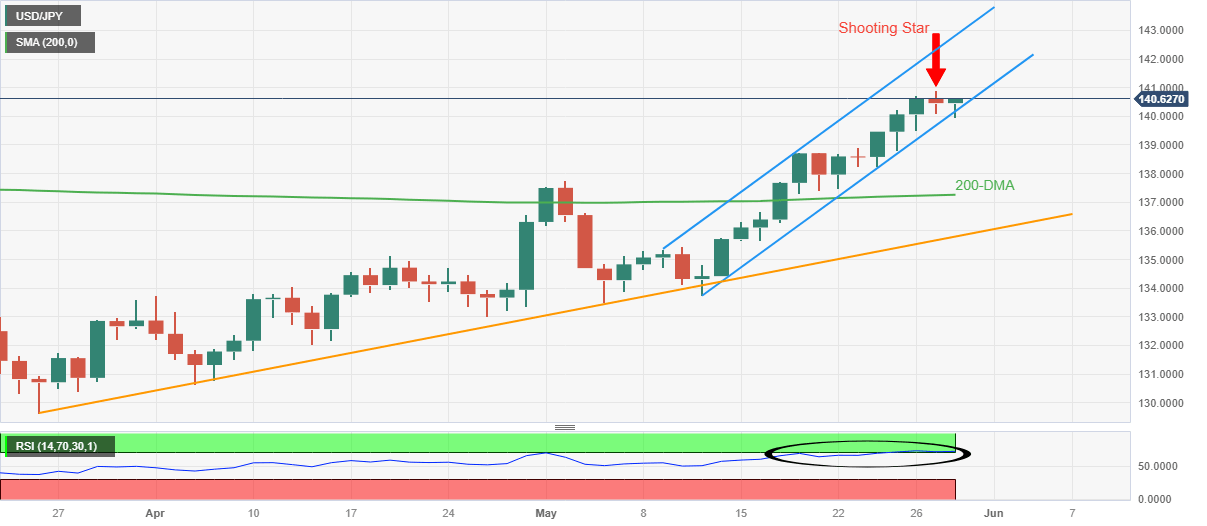

USD/JPY Price Analysis: Grinds higher around mid-140.00s within rising channel despite overbought RSI

- USD/JPY recovers from intraday low within three-week-old bullish chart formation.

- Monday’s bearish candlestick formation, overbought RSI (14) line lure bears.

- Clear downside break of 140.00 needed to lure the Yen buyers.

- Bulls need 141.00 breakout to aim for late November peak.

USD/JPY makes rounds to 140.50 as bulls and bears jostle amid mixed technical signals heading into Tuesday’s European session.

That said, the Yen pair portrays a three-week-old bullish channel, currently between 140.20 and 141.85, to keep the buyers hopeful.

However, the overbought conditions of the RSI (14) line join Monday’s “Shooting Star” candlestick to suggest that the bulls are running out of steam.

As a result, the USD/JPY traders should remain cautious before taking any fresh positions, especially on the short side considering the US Dollar’s broad strength, unless the quote remains within the stated channel.

Even if the quote breaks the 140.20 support, the 140.00 psychological magnet will act as an extra filter toward the south before directing the bears toward the 200-SMA level of 137.25.

Following that, an upward-sloping support line from March 24, close to 135.80 at the latest, will be the key to defending the buyers.

On the flip side, the USD/JPY pair’s successful trading above the previous day’s peak of 140.92 defies the bearish candlestick. However, the buyers will need to cross the 141.00 round figure for conviction.

In that case, the late November 2022 peak of 142.25 may act as an intermediate halt ahead of directing the bulls to the stated channel’s top line of around 142.85.

USD/JPY: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.