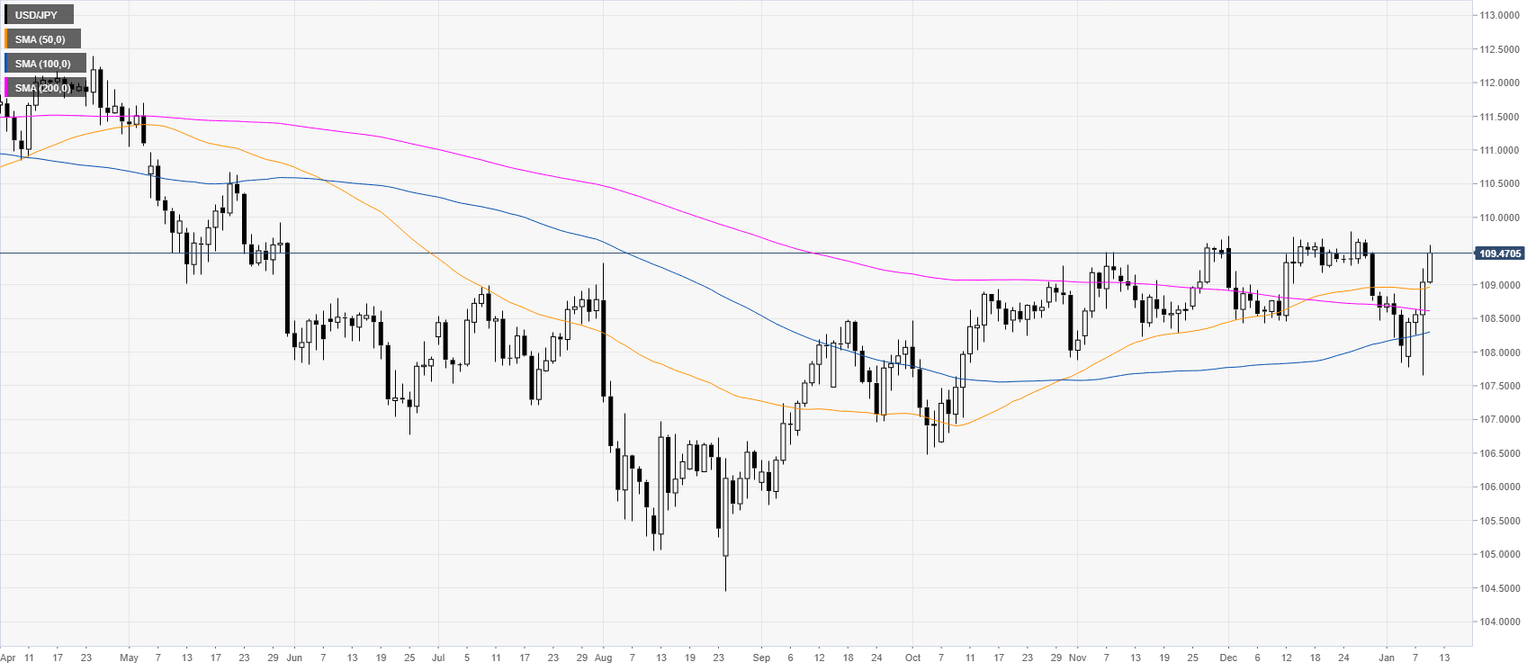

USD/JPY Price Analysis: Greenback climbs to 109.50 nearing multi-month highs

- USD/JPY is bouncing up strongly trading at its highest since the start of January.

- Resistances are seen at 109.50 and 109.90 levels.

USD/JPY daily chart

USD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst