USD/JPY Price Analysis: Failure at 135.00 to pave the way for a pullback towards 131.00

- On Friday, the USD/JPY climbs 0.11%, and in the week, 2.80%.

- Risk-aversion initially weighed on the USD, but late in the North American session, higher US Treasury yields lifted the USD/JPY.

- USD/JPY Price Analysis: The USD/JPY might retrace as intervention looms, towards 131.00s.

The USD/JPY is registering gains close to 2.80% during the week, and on Friday is edging up after reaching a daily low at 133.36, following the statement’s release by Japanese authorities, which acknowledged the yen weakness. The pair fell, though late as the New York session wanes, recovered, and the USD/JPY is trading at 134.43, up 0.11%.

Wall Street finished the last trading day of the week with losses between 2.53% and 3.56%, portraying the dismal market mood. Meanwhile, US Treasuries rose, with the 10-year benchmark note up at 3.163%, gaining 11 basis points. The greenback followed suit, with the US Dollar Index rallying towards 104.185, up by 0.85%.

USD/JPY Price Analysis: Technical outlook

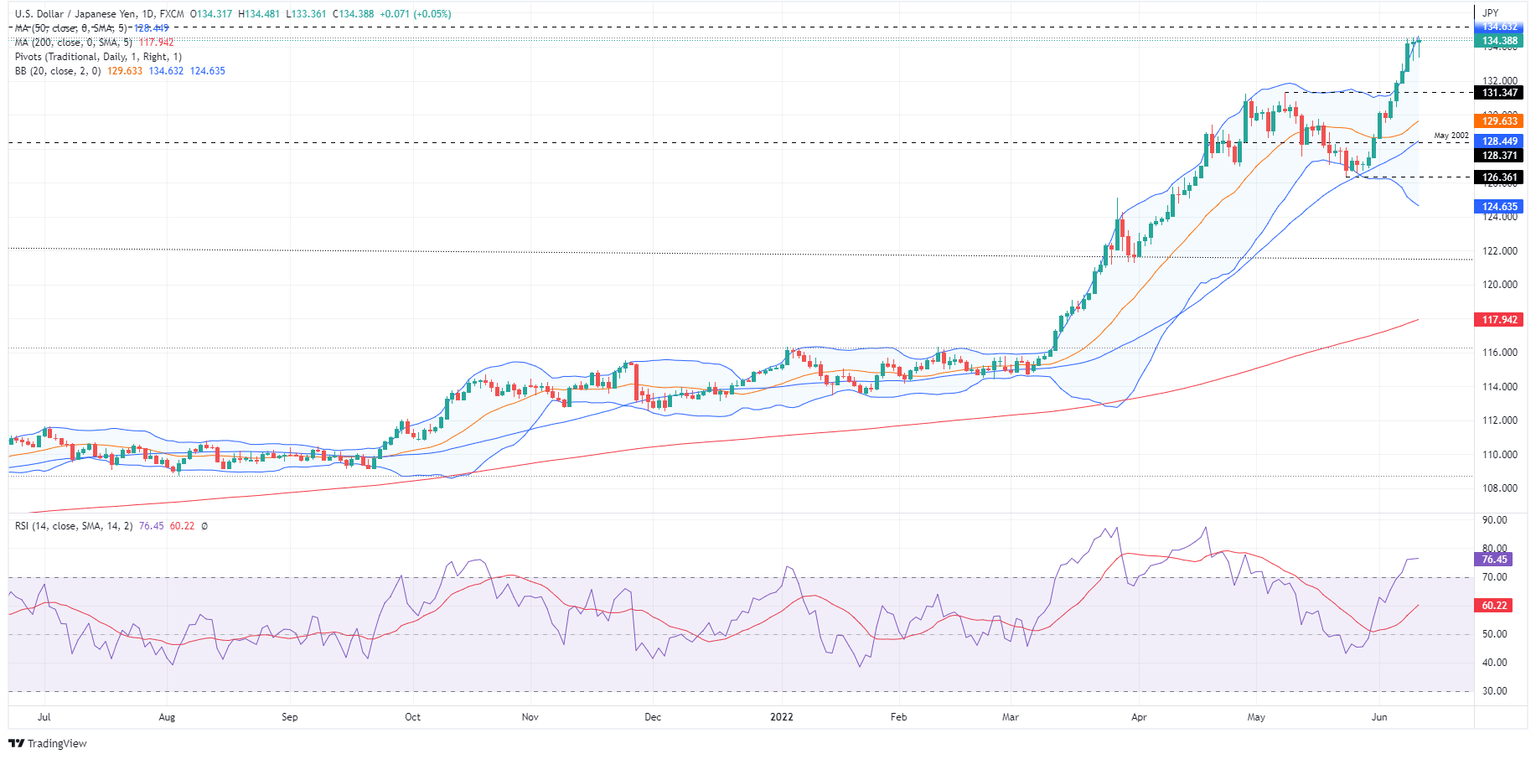

The major’s daily chart illustrates that the uptrend remains intact, though the rally appears overextended. The top Bollinger band, at 134.62, would be a challenging resistance level to overcome. The Relative Strength Index (RSI) making lower higher-highs, contrary to the USD/JPY’s price action, might create a negative divergence. That said, the USD/JPY might pull back towards the 131.00 area as JPY’s weakness begins to gather Japanese authorities’ attention near the 135.00 mark.

Therefore, the USD/JPY’s first support would be June’s 9 daily low at 133.18. A breach of the latter would expose June’s 8 low at 132.54. Once cleared, the USD/JPY’s next demand zone would be May 9 high-turned-support at 131.34.

Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.