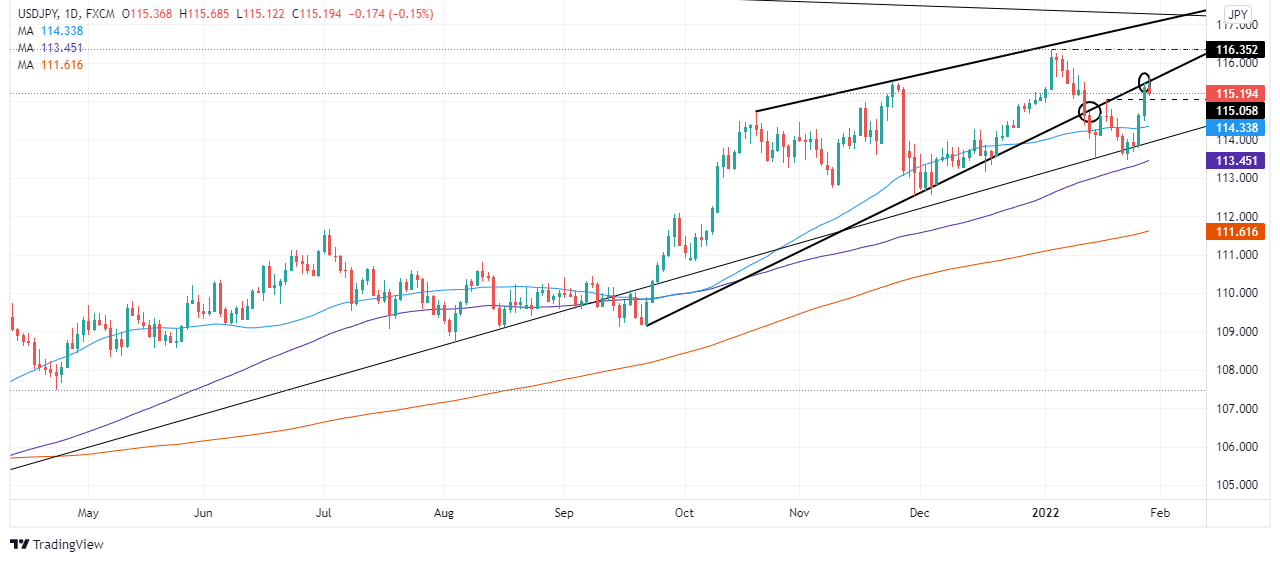

USD/JPY Price Analysis: Failure at 115.70 opens the door for a leg-down before resuming uptrend

- The USD/JPY slides 0.15% as investors prepare for the weekend.

- The greenback finished the week above 97.00 for the first time since June 2020.

- USD/JPY is upward biased, but the pair could print a leg-down before resuming the uptrend.

As Wall Street closes, the USD/JPY slides ahead of the weekend, spurred by the US 10-year Treasury yield fall, which drops eight basis points, from 1.85% to 1.777%. At the time of writing, the USD/JPY is trading at 115.22.

The New York session witnessed a slight improvement in the market mood as US stocks rebounded near the close of Wall Street, finishing with gains.

The USD has been on the defensive in the FX market, undermined by falling US T-bond yields versus the Japanese yen, failing to break above an upslope trendline, drawn from October 2021 lows to December ones passing around the 115.40-60 range.

On Friday, during the overnight session for North American traders, the USD/JPY peaked at around 115.68, above the abovementioned trendline. However, as American traders got to their desks, the pair fell 40-pips to current levels.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, as depicted by the daily chart. Failure to break above 115.70 might open the door for a leg-down before resuming the uptrend. However, as long as the retracement remains above the 50-day moving average (DMA) at 114.34, it would keep the uptrend intact.

The USD/JPY to the upside, the first resistance would be January 4, YTD high at 116.35. A breach of the latter would expose a downslope trendline drawn since August 1998 swing highs, a 24-year old trendline around 117.00-20, followed by a test of January 3, 2017, swing high at 118.61.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.