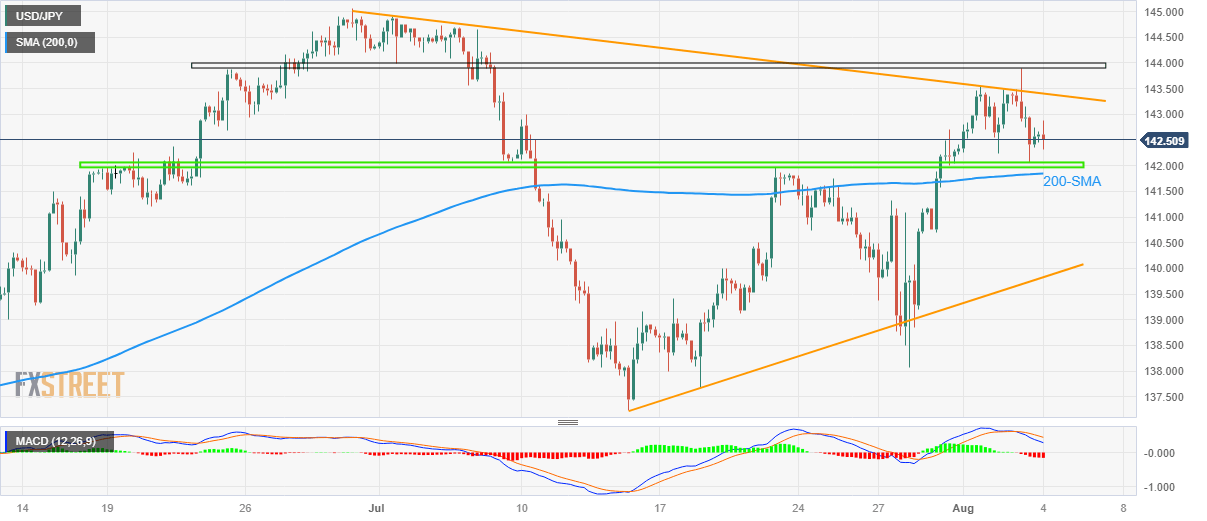

USD/JPY Price Analysis: Fades bounce off key support zone surrounding 142.00 as US NFP looms

- USD/JPY extends the previous day’s pullback from one-month high as bears attack multi-day-old horizontal support.

- Bearish MACD signals, sustained trading below short-term key resistance line keeps Yen pair sellers hopeful.

- 200-SMA, 140.00 act as additional downside filters before three-week-long support line prod bears.

- US employment numbers need strong numbers to defy latest pullback moves.

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day.

The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day.

Furthermore, bearish MACD signals and the Yen pair’s clear observance of the descending resistance line from June 30, at 143.40 by the press time, also keep the USD/JPY bears hopeful.

However, a horizontal area comprising multiple levels marked since June 18, around 142.00, quickly followed by the 200-SMA level of 141.85, restricts the Yen pair’s further downside.

In a case where the USD/JPY pair remains bearish past 141.85, a quick fall toward the 140.00 round figure can be expected while an ascending support line from July 14, close to 139.80, might challenge the sellers afterward.

Meanwhile, USD/JPY recovery remains elusive below the five-week-old descending resistance line of near 143.40.

Following that, a 1.5-month-long horizontal resistance area of around 143.90–144.00 will act as the final defense of the USD/JPY bears before challenging the yearly top marked in June around 145.00.

USD/JPY: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.