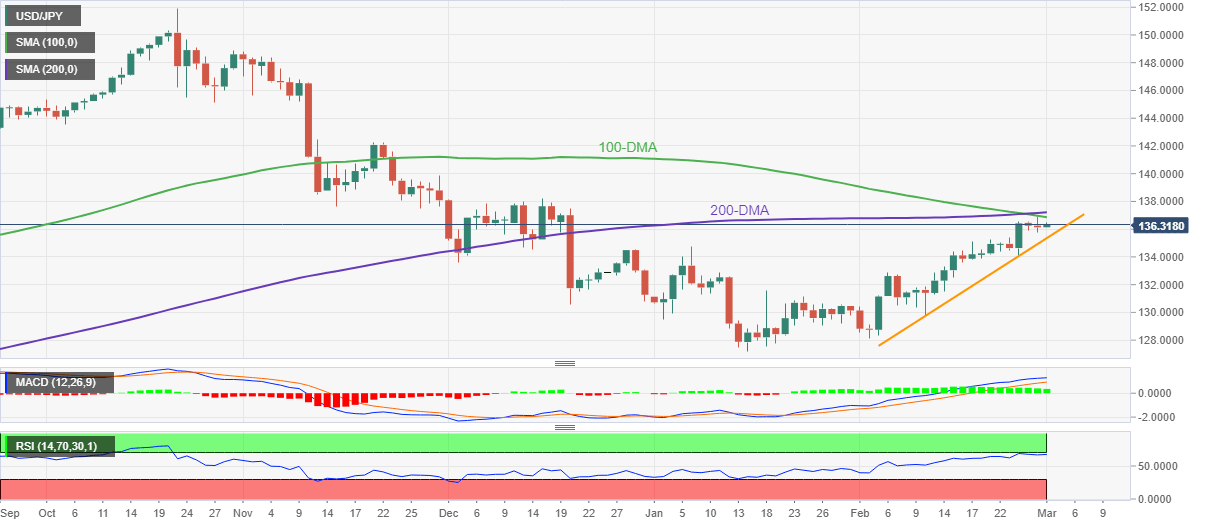

USD/JPY Price Analysis: Eyes another battle with the key DMAs above 136.00

- USD/JPY picks up bids to snap two-day downtrend around 10-week high.

- Bullish MACD signals, sustained trading beyond two-week-old support line keep buyers hopeful.

- 100-DMA, 200-DMA challenges Yen pair buyers amid overbought RSI (14).

USD/JPY prints mild gains around 136.30-40 during early Wednesday morning in Europe. In doing so, the Yen pair snaps the previous two-day losing streak around the lowest levels since late December 2022. The recovery moves, however, gain little acceptance amid overbought RSI (14), as well as due to the presence of the key 100-DMA and 200-DMA.

Hence, the quote’s latest rebound needs validation from the 100-DMA and 200-DMA, respectively near 136.85 and 137.20, to convince buyers. Adding to the upside filter is the last December’s peak near 138.20.

Following that, the 140.00 round figure and late November 2022 high of 142.25 could lure the USD/JPY buyers.

On the flip side, a 13-day-long ascending support line, close to 135.35 at the latest, restricts the short-term pullback of the USD/JPY pair.

In a case where the USD/JPY price drops below the 135.35 support, the January 2022 peak near 134.75 can act as the additional check for the pair bears before aiming for the multiple support levels surrounding 131.00.

Overall, USD/JPY may trace bullish MACD signals to extend the run-up beyond the nearby support line but the room towards the north appears limited due to the existence of the key moving averages and overbought RSI conditions.

USD/JPY: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.