USD/JPY Price Analysis: Drops below 150.00 as US yields weigh on US Dollar

- USD/JPY hovers at 149.96, influenced by a dip in US Treasury yields and a subdued Dollar.

- Market's tight range near 150.00 may shift, watching for Japanese authority interventions.

- A move below 150.00 might steer USD/JPY towards 149.00, as an uptrend seeks to top 150.00 again.

The USD/JPY is almost flat as Wednesday’s Asian session begins after posting minuscule losses of 0.09% on Tuesday, at the time of writing trades at 149.96. The drop in US Treasury bond yields and a subdued US Dollar (USD) were the two reasons that favored the Japanese Yen (JPY).

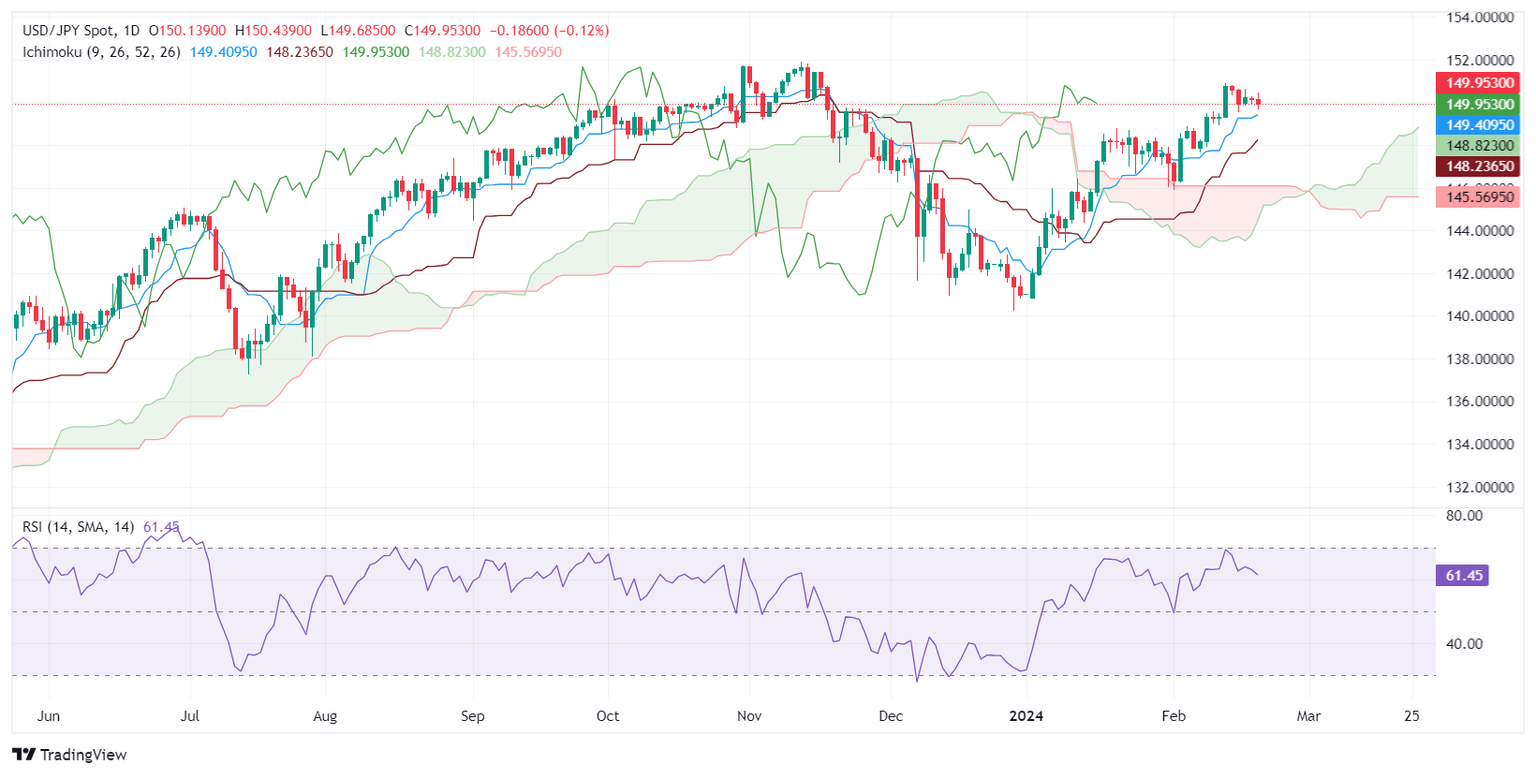

The pair has consolidated at around the 149.90-150.00 area for the last three trading sessions, capped on the upside by fears that Japanese authorities might intervene. However, if bulls push prices decisively above 150.00, that will pave the way toward the February 13 high at 150.88, followed by the 151.00 mark.

Conversely, if the USD/JPY tumbles below the Tenkan-Sen at 149.91, that would exacerbate the pair’s fall toward the Senkou Span A area at 149.15 before testing the 149.00 area. A breach of the latter will expose the Kijun-Sen at 148.39, ahead of the 148.00 mark.

USD/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.