USD/JPY Price Analysis: Bulls on course for a 129.50 target

- USD/JPY is gathering momentum after a test of the structure around 128.80.

- The 38.2% Fibonacci is a first target near 129.50 with 131.20's eyed thereafter.

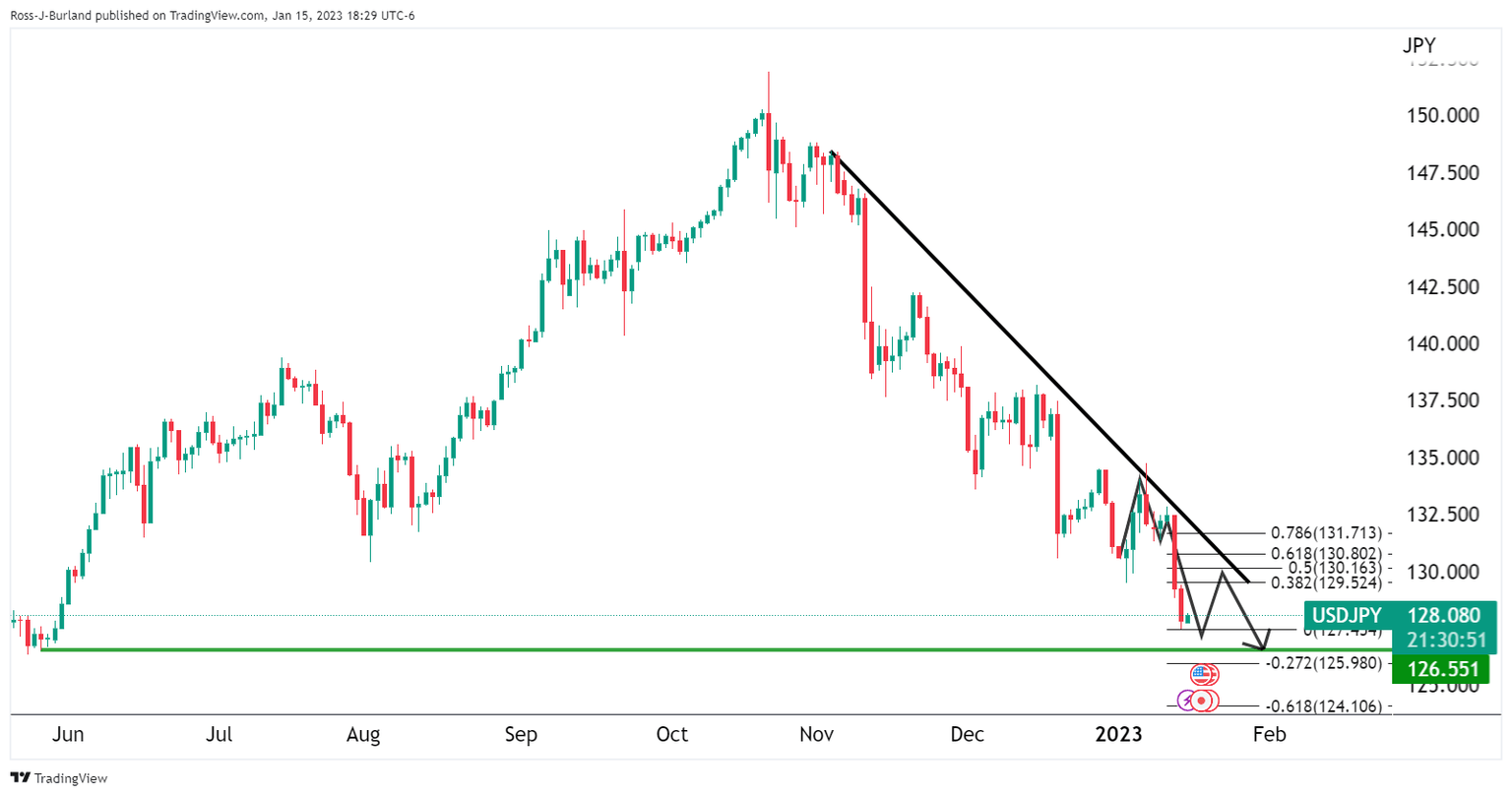

As per the prior analysis, USD/JPY bulls move in and eye a correction towards 129.50, USD/JPY has indeed corrected higher and remains in the hands of the bulls as we enter the rollover and early hours of the Asian session.

As previously explained, there were prospects of a reversion into the M-formation\s bearish impulse on the prior leg:

USD/JPY update

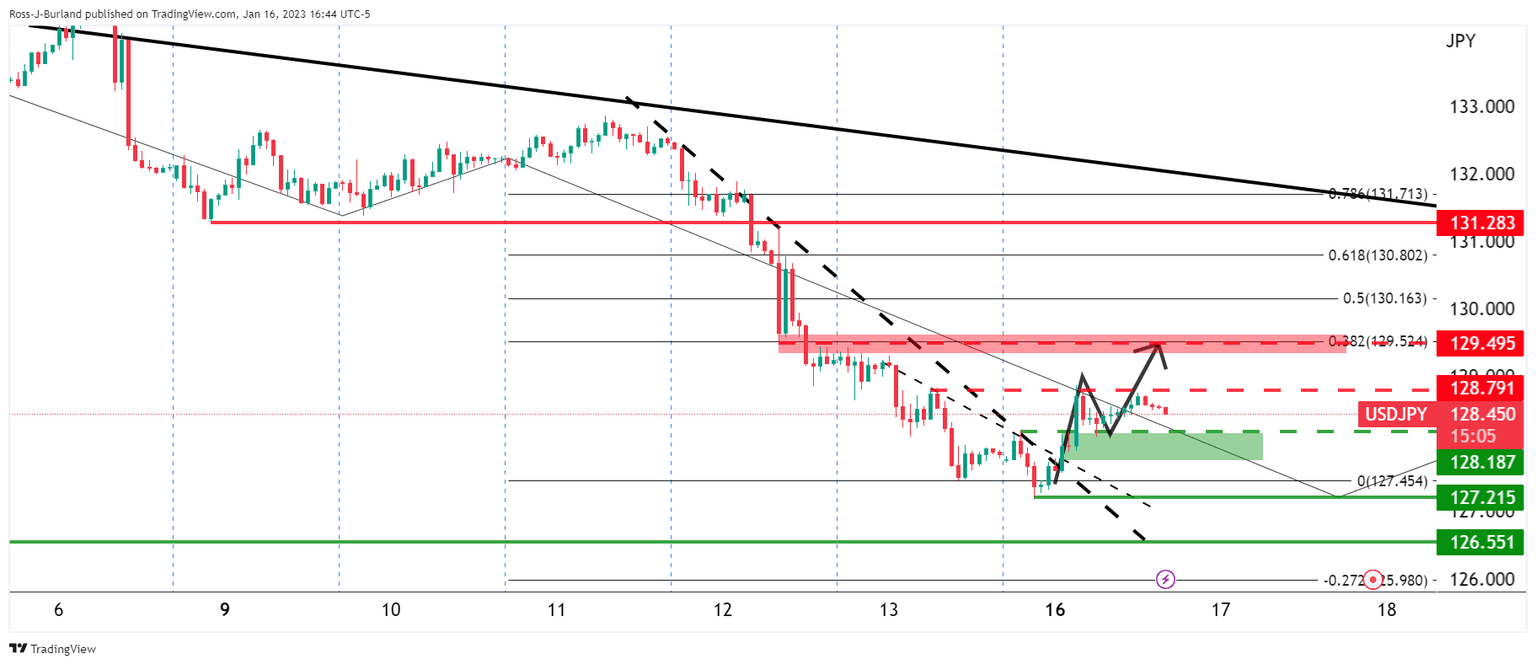

USD/JPY H1 chart

We are seeing this correction get underway and bulls will now be looking for a bullish structure to lean against in aiming for a reversion of sorts as follows:

As illustrated, the price is on the backside of the trend and a breakout to the upside is gathering momentum after a test of the structure around 128.80. The 38.2% Fibonacci is a first target near 129.50 with 131.20's eyed thereafter.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.