USD/JPY Price Analysis: Bulls move in and target 133.00 ahead of the 200-DMA

- USD/JPY gapped up since the Asian session by about 30 pips, reaching a daily high of 132.90.

- USD/JPY Price Analysis: Neutral biased, but tilted upwards, with bulls eyeing 133.00.

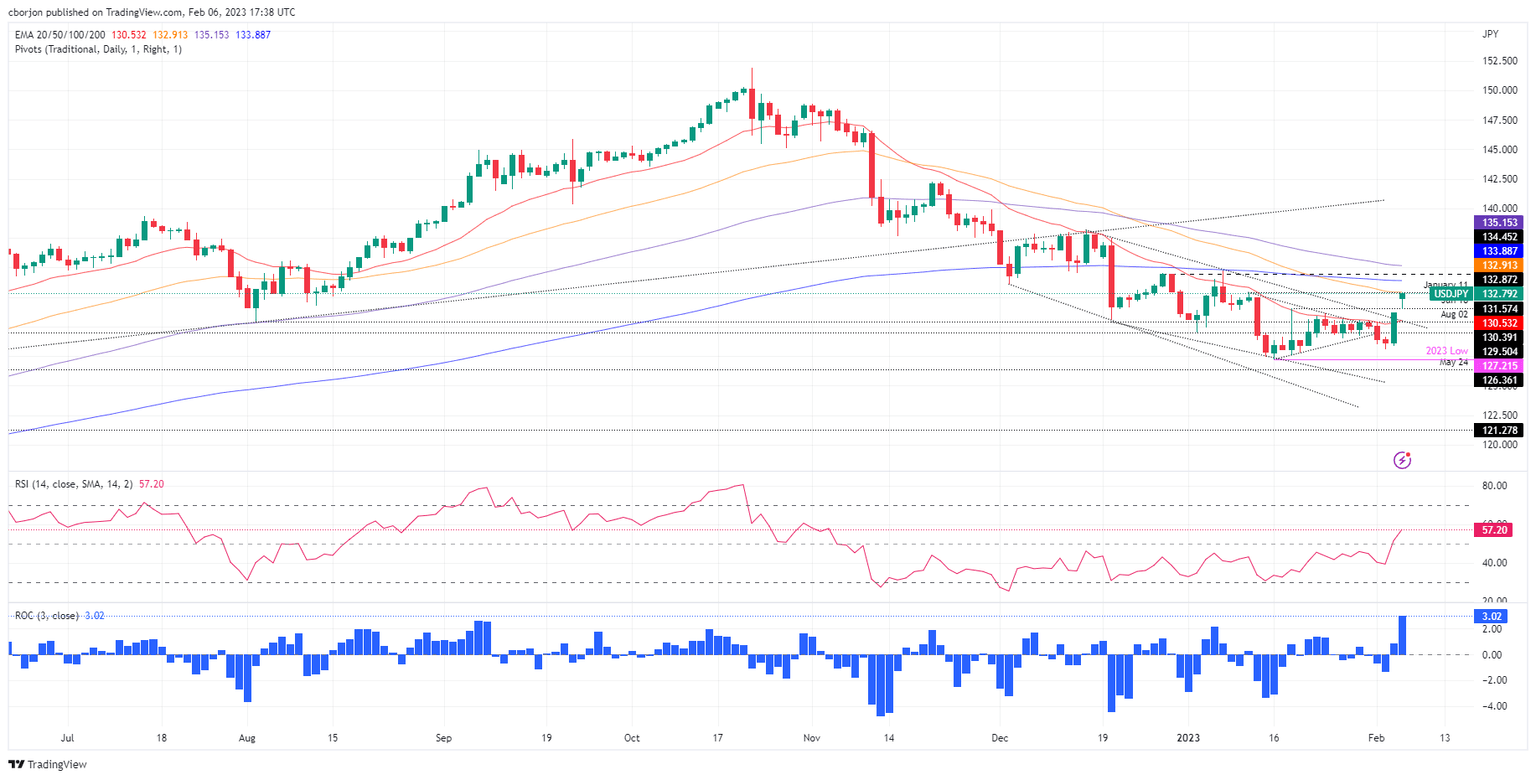

The USD/JPY gapped toward new 5-week highs shy of the 50-day Exponential Moving Average (EMA) by just two pips at 132.89 and remained nearby, about to challenge the 133.00 psychological price level. The last US jobs report crushed estimates, bolstering the US Dollar (USD) on speculations for further Federal Reserve’s (Fed) aggression. Therefore, the USD/JPY rallied 3.45% since Friday and exchanged hands at 132.79 after hitting a low of 131.51.

USD/JPY Price Analysis: Technical outlook

The USD/JPY shifted neutral biased after gapping up from around 131.20 to current exchange rates. On its way up, the major reclaimed the 20-day Exponential Moving Average (EMA) at 130.53, and it’s poised to crack the 50-day EMA at 132.91, ahead of the 133.00 figure.

With the Relative Strength Index (RSI) and the Rate of Change (RoC), oscillators shifted bullish, opening the door for further upside. However, it should be said that the USD/JPY would face the trend-setter 200-day EMA at 133.88, which, once cleared, would pave the way to test the 100-day EMA above the 135.00 figure.

As an alternate scenario, the USD/JPY first support would be 132.00. A breach of the latter and the USD/JPY could test the day’s low at 131.51, followed by last Friday’s high at 131.20. Once those demand zones are broken, it would expose the 20-day EMA at 130.29.

USD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.