USD/JPY Price Analysis: Bulls are throwing in the towel and H4 bear M-formation is in play

- USD/JPY's H4 M-formaition is a reversion pattern.

- Bears need to stay below the neckline for a move to test the recent lows near 140 the figure.

USD/JPY is crumbling away in Asia as the US dollar folds from the recently scored fresh highs in the monthly bull cycle. The price of the DXY has broken a key structure on the 4-hour charts and this could lead to a significant move to the downside for the week ahead. The following illustrates the market structure and price action on both the DXY and the USD/JPY charts.

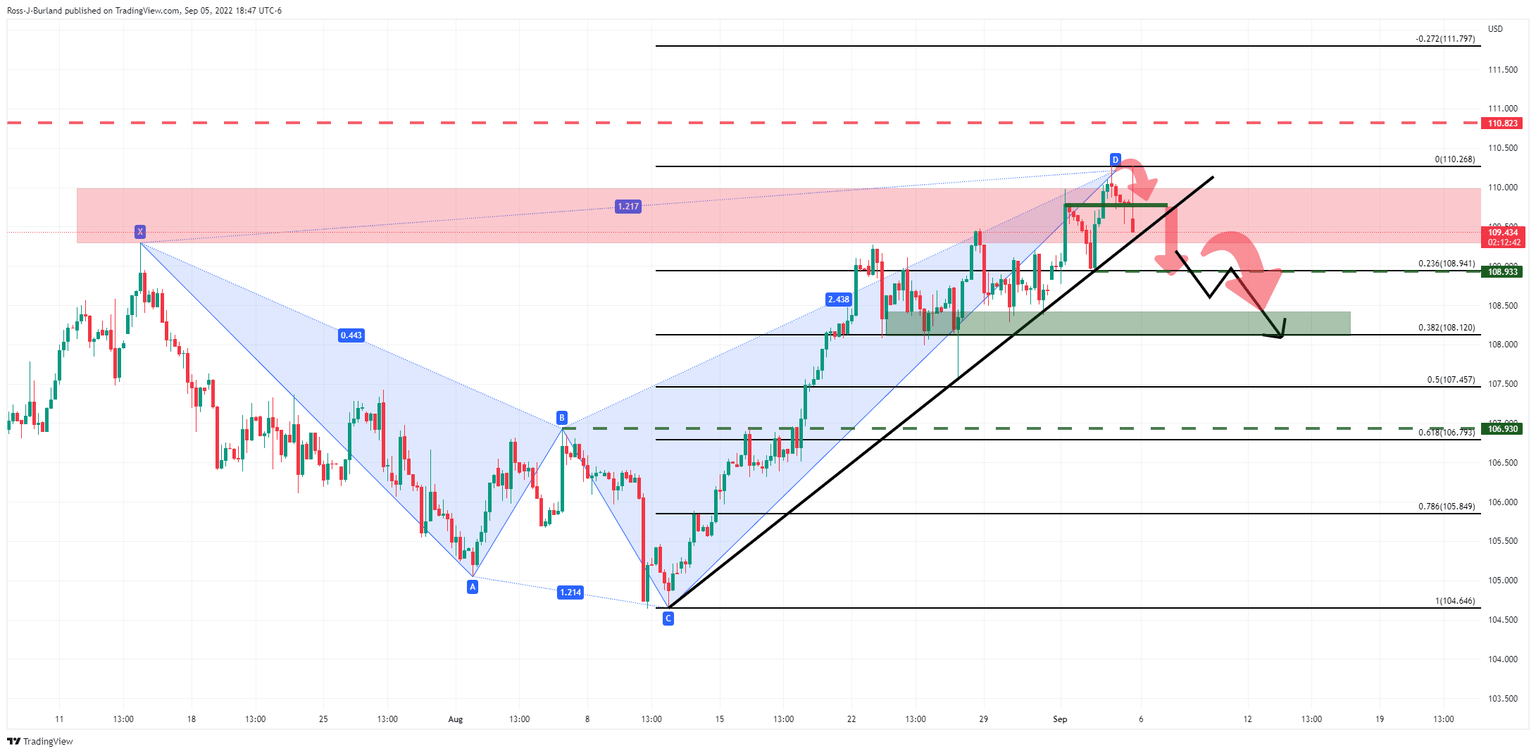

DXY chart, H4

The price broke below the 109.80s and is not headed towards a key area in the 108.90s for the day ahead. If this were to break, it could act as a resistance and if so, then the gates will be open for an even deeper correction where a 38.2% Fibonacci retracement level is located down near 108.12.

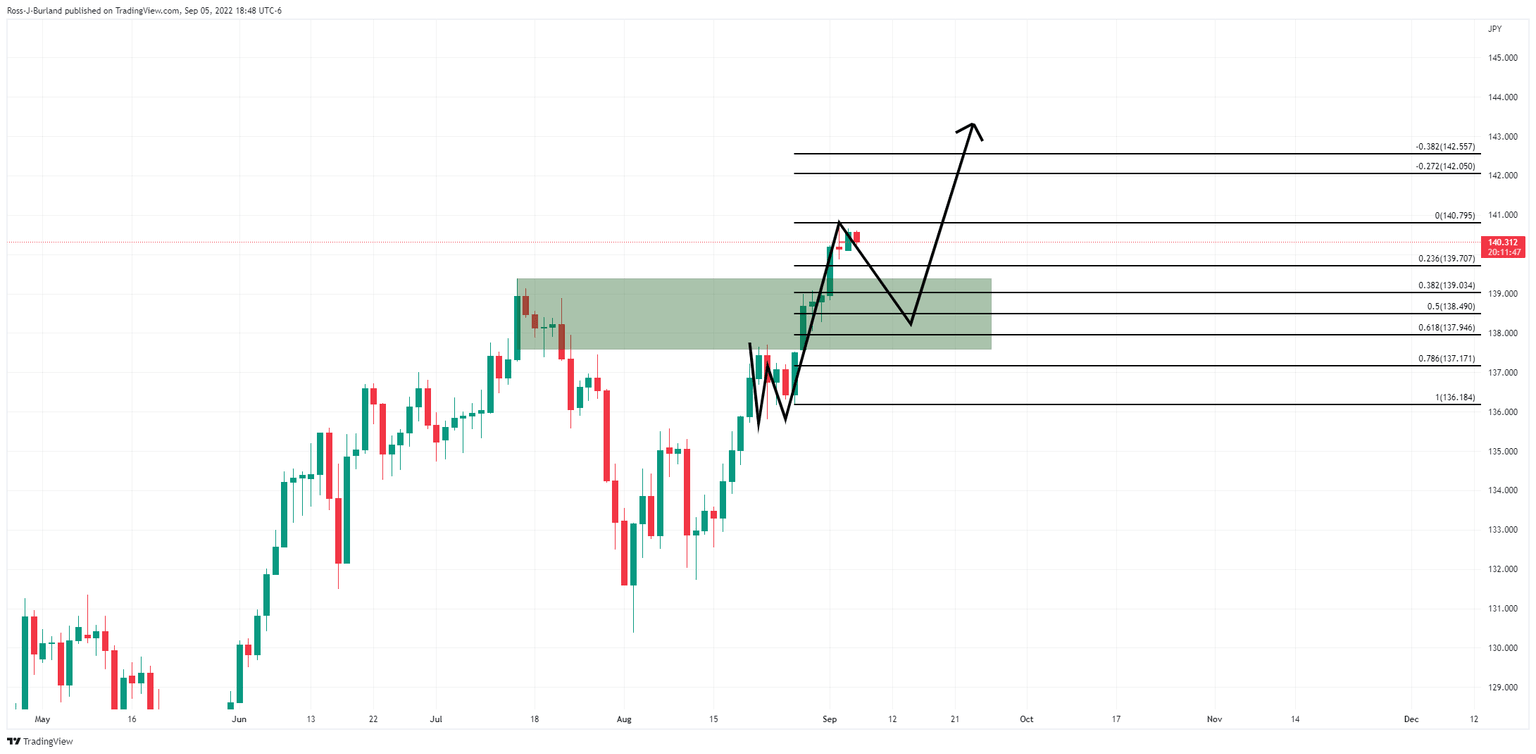

USD/JPY daily chart

The yen is benefitting from the move in the greenback. There is a harmonic pattern that could be about to play out. A peak at this juncture could lead to a significant sell-off towards the prior highs and through the Fibo scale for the days ahead. If this were to hold, however, in the area highlighted above, then there will be prospects of a continuation thereafter.

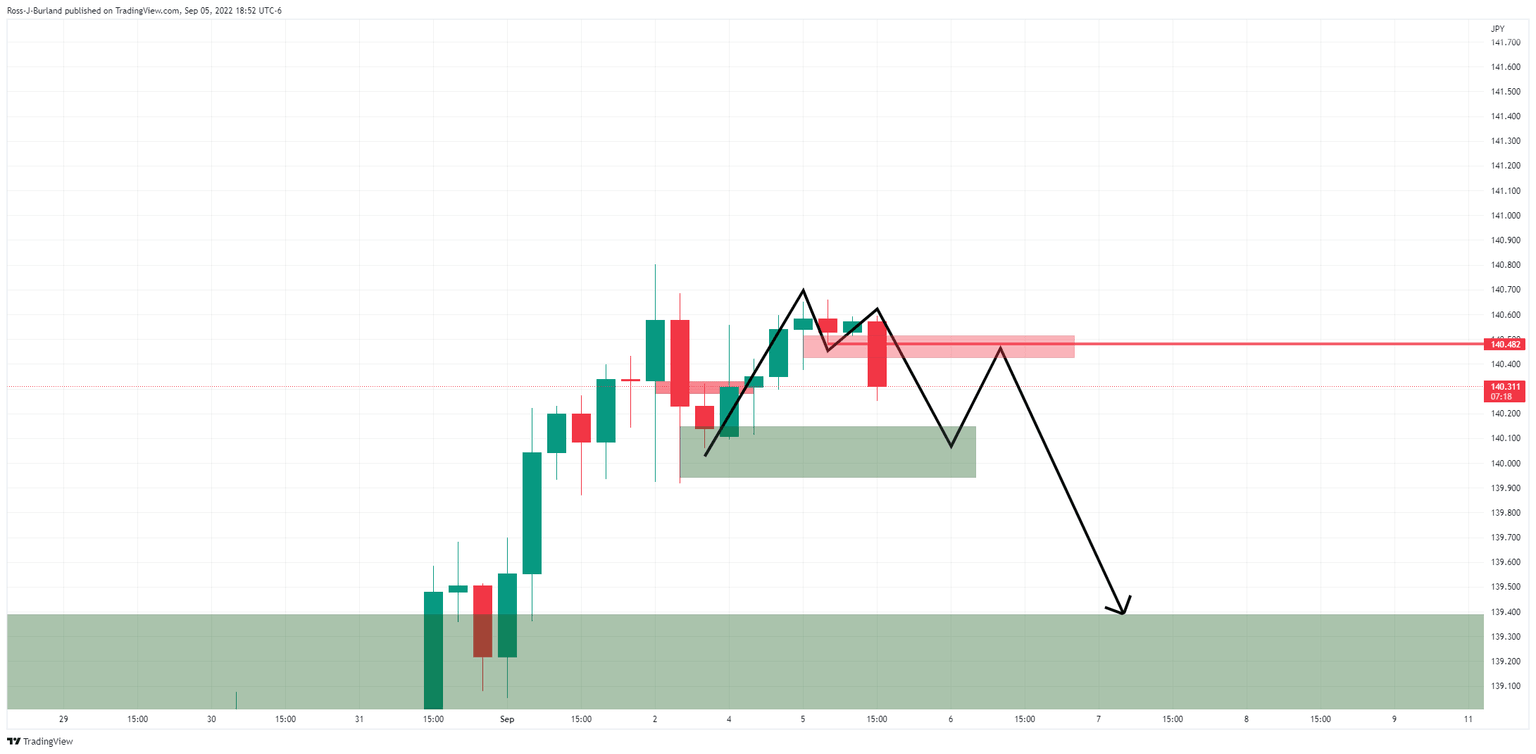

USD/JPY H4 chart

The M-formaition is a reversion pattern. The recent bearish impulse will eventually run out of steam and that makes for a move back towards the neckline before further supply that would then tackle the recent lows near 140 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.