USD/JPY Price Analysis: Bulls approach 133.60 hurdle ahead of BOJ

- USD/JPY takes the bids to refresh daily top, snaps a two-day downtrend.

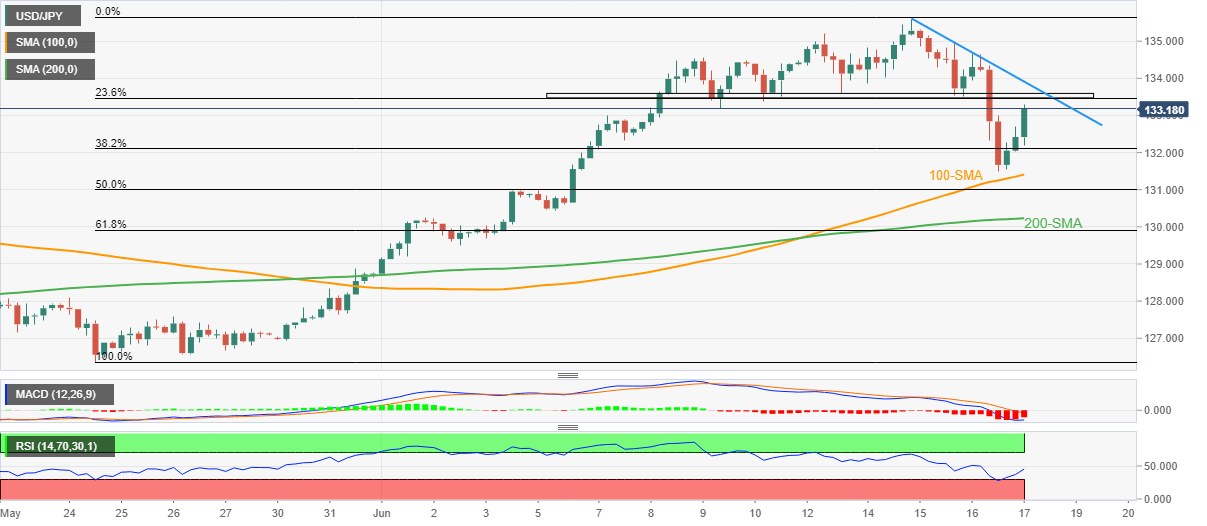

- Weekly horizontal resistance, descending trend line from Tuesday test buyers.

- MACD, RSI hints at further recovery moves until the quote stays beyond 100-SMA.

- BOJ is widely anticipated to keep the monetary policy intact.

USD/JPY extends the bounce off weekly low while refreshing intraday high around 133.30 during Friday’s Asian session.

In doing so, the yen pair stretches the bounce off 100-SMA while approaching a one-week-old horizontal resistance area, surrounding 133.50-60.

Given the RSI rebound from the oversold territory, coupled with the receding bearish bias of the MACD, the USD/JPY prices are likely to defend the latest recovery.

However, a downward sloping resistance line from Tuesday, around 133.95, as well as the 134.00 threshold, will act as additional upside filters, other than the immediate 133.50-60 zone, to challenge the pair buyers.

Also, the Bank of Japan (BOJ) is likely to keep its easy-money policy untouched and may add strength to the USD/JPY upside.

Read: BOJ set to maintain ultra-low rates, sound warning over weak yen

Alternatively, pullback moves may remain elusive until the quote stays beyond the 100-SMA level of 131.40.

Following that, the 200-SMA and the early June swing high, around 130.25-20, could challenge the USD/JPY bears.

USD/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.