USD/JPY Price Analysis: Bullish momentum remains as a falling wedge forms

- The USD/JPY 1-hour chart portrays the formation of a bullish continuation chart pattern, keeping bulls hopeful of higher prices.

- USD/JPY Price Analysis: Long-term is still downward biased unless it breaks resistance around 133.00.

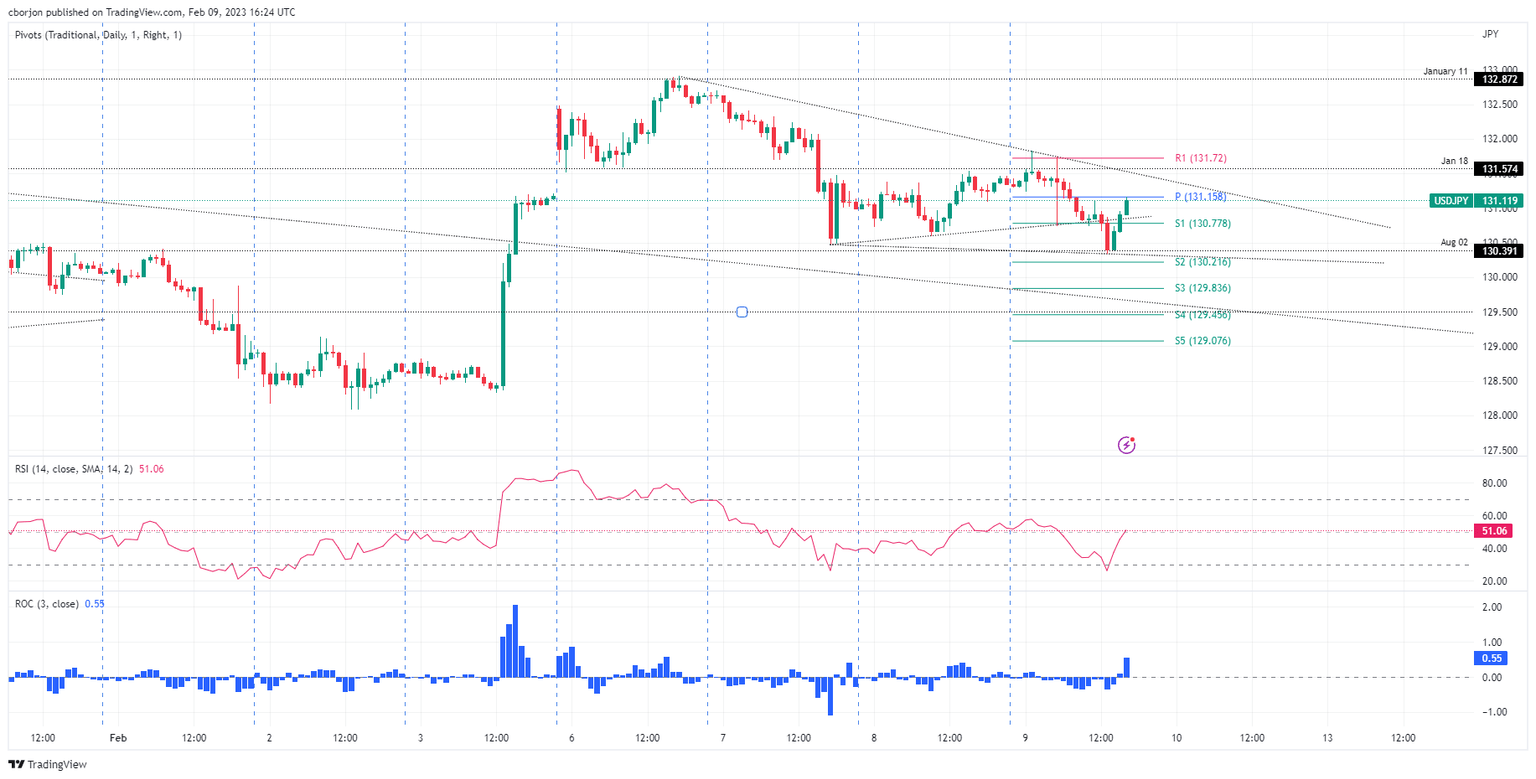

The USD/JPY erases Wednesday’s gains and aims toward the lows of the 130.30-132.90 range during the North American session, eyeing a break below the 20-day Exponential Moving Average (EMA) at 130.66. At the time of writing, the USD/JPY exchanges hands at 131.11, below its opening price by 0.18%.

From a daily chart perspective, the USD/JPY remains downward biased, though it has been tracking the 20-day EMA during the last three days, unable to breach the 130.00 mark. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest a bearish continuation. But the Bank of Japan’s (BoJ) dovish stance kept market participants from committing to short positions.

In the near term, the USD/JPY one-hour chart portrays the formation of a falling wedge, suggesting a bullish continuation, which could lift prices towards 131.60 and the January 11 high at 132.87. Albeit the Relative Strength Index (RSI) aims upward, it remains in bearish territory, with its slope shifting flat, but the Rate of Change (RoC) depicts buyers gathering momentum. Hence, mixed signals suggest caution is warranted.

USD/JPY buyers need to reclaim 131.82, Thursday’s high. Once done, that would pave the way towards 132.00, 132.87, and the psychological 133.00 barrier. As an alternate scenario, the bearish continuation would resume if the falling wedge breaks downwards. Therefore, the USD/JPY first support would be 130.34, February 9 low. The break below will expose the S2 and S3 daily pivot points, each at 130.21 and 129.83.

USD/JPY One-hour chart

USD/JPY key technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.