USD/JPY Price Analysis: Bears flirt with 144.00 amid limited downside

- USD/JPY holds onto the previous day’s pullback form 24-year top.

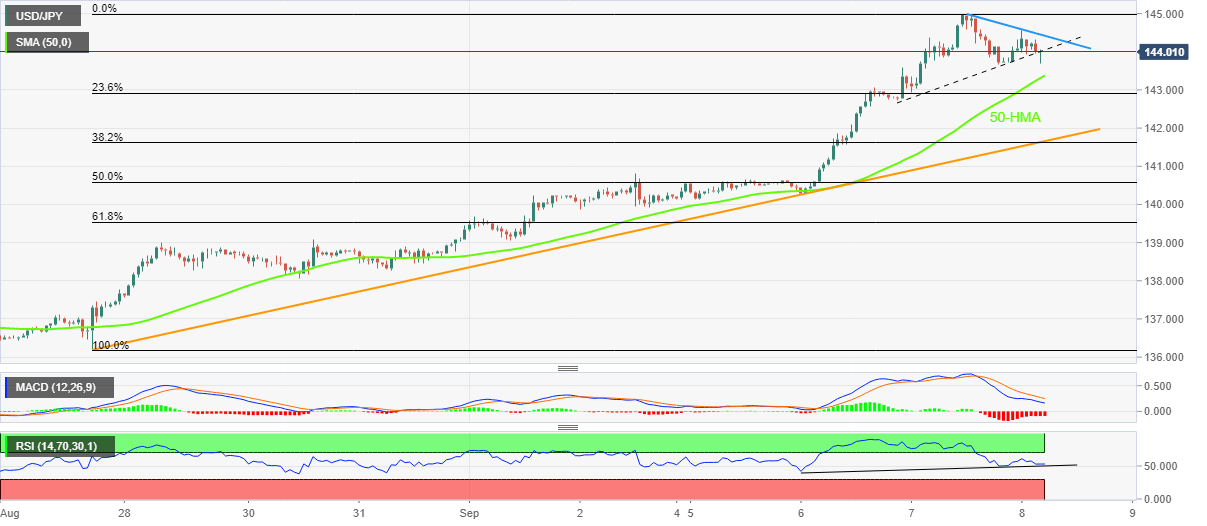

- Break of two-day-old ascending trend line, bearish MACD signals favor sellers.

- 50-HMA, fortnight-old support line restrict short-term downside.

- Bulls need validation from 145.00 to refresh multi-year top.

USD/JPY remains on the back foot around 144.00, despite recently bouncing off the intraday low, heading into Thursday’s European session.

In doing so, the yen pair keeps the previous day’s pullback from the highest levels since 1998 while breaking a two-day-old ascending trend line. Also favoring the pair sellers are the bearish MACD signals.

It should be noted that the RSI portrays a bullish case as a higher low in prices joins the higher low of the indicator, which in turn suggests limited downside room for the pair.

That said, the 50-HMA level surrounding 143.30 could challenge the short-term declines of the USD/JPY. Following that, an upward sloping support line from August 26, close to 141.60, appears important support for the pair traders to watch.

Should the quote drops below 141.60, the odds of witnessing the 140.00 threshold on the chart can’t be ruled out.

Alternatively, a downward sloping resistance line from the previous day, near 144.50, restricts immediate upside moves. Following that, the recent top near 145.00 will be in focus.

In a case where USD/JPY bulls cross the 145.00 hurdle, tops marked during June and August of the year 1998, respectively near 146.80 and 147.70, may flash on their radar.

USD/JPY: Hourly chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.