USD/JPY Price Analysis: Bears eye a run to 135.50

- USD/JPY bulls are keeping the price elevated above key 135.80-70 structure.

- Bears eye 135.50 in the near term on a break of hourly trendline support.

Despite being broadly softer at the start of the week across a basket of currencies, the US Dollar was up 0.24% against the Yen in midday trade on Wall Street. USDJPY is currently trading at 136.05 and has moved between a low of 135.62 and a high of 136.32.

The US Dollar index, DXY, fell to a low of 102.382 on the day and was down from 102.752, a five-week high, pressured by a weak manufacturing index in New York state and amid fears about the debt ceiling and the US economy. This falls into the hands of the Yen and tallies with the following technical analysis:

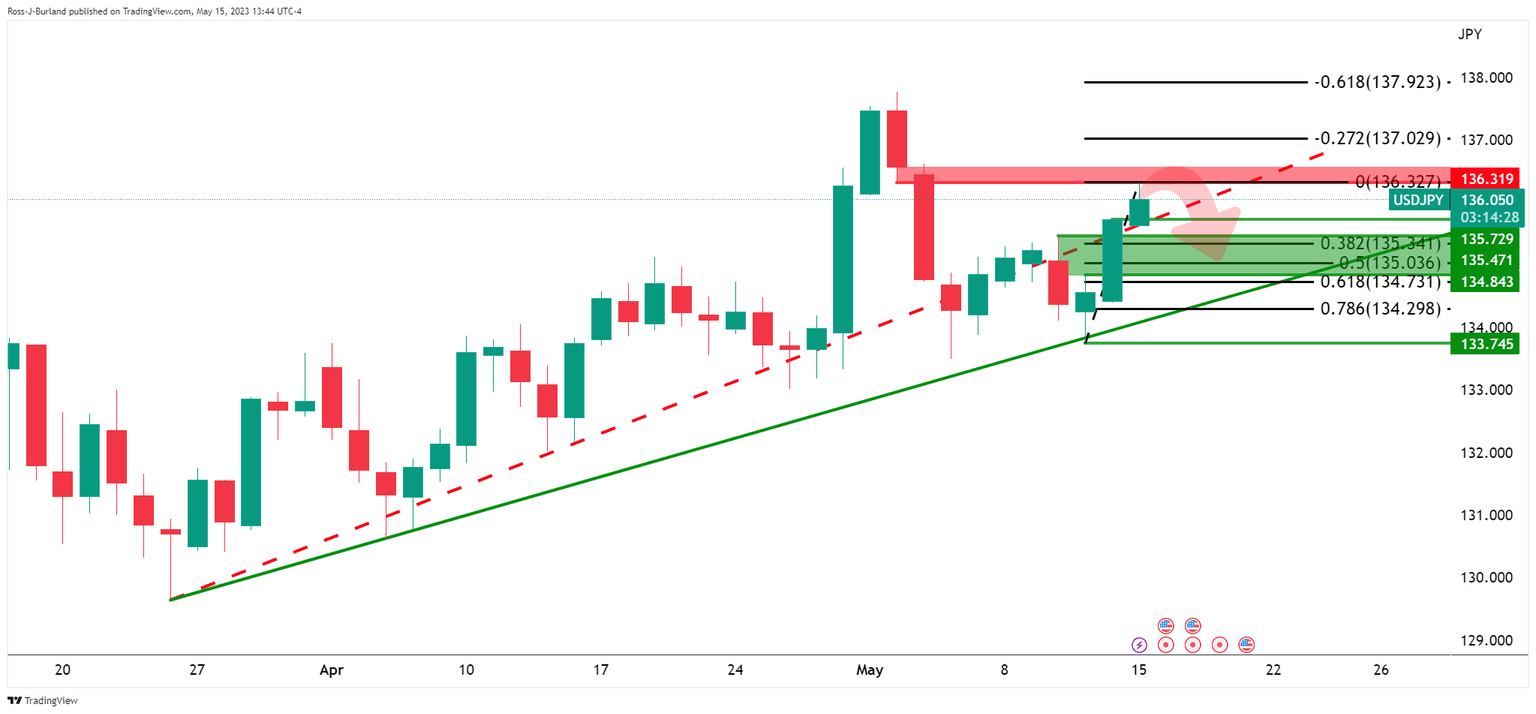

USD/JPY daily charts

The W-formation is a bearish feature on the daily chart that could equate to a downside correction of the latest bullish impùlse from the resistance area as highlighted in the charts above.

USD/JPY H4 chart

The 4-hour chart sees support coming in near 135.70 and 135.50 ahead of 135.00 and 134.80.

USD/JPY H1 chart

The bears will need to get below the hourly chart´s support structure and 135.80-70.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.