USD/JPY Price Analysis: 149.00 is being eyed by the bears

- USD/JPY bears looking for fuel into critical support structures.

- 149.00 is beckoning as risks of BoJ forex market operations hangover head.

Attempting to draw technical analysis on a market that is so out of whack with normality is a tall order if not just outright futile, but USD/JPY has rallied to draw droppingly high levels as per the following 5-monthly chart:

The price is resting in the 150s following a European drop that followed the test of the level to 149.67 and then the US lows of 149.55. Bank of Japan intervention risk is brewing up and if the market decides to front run such a risk, a 100 pip move to 149.00 could evolve in the near term, and lower ahead of the Federal Reserve November 1/2.

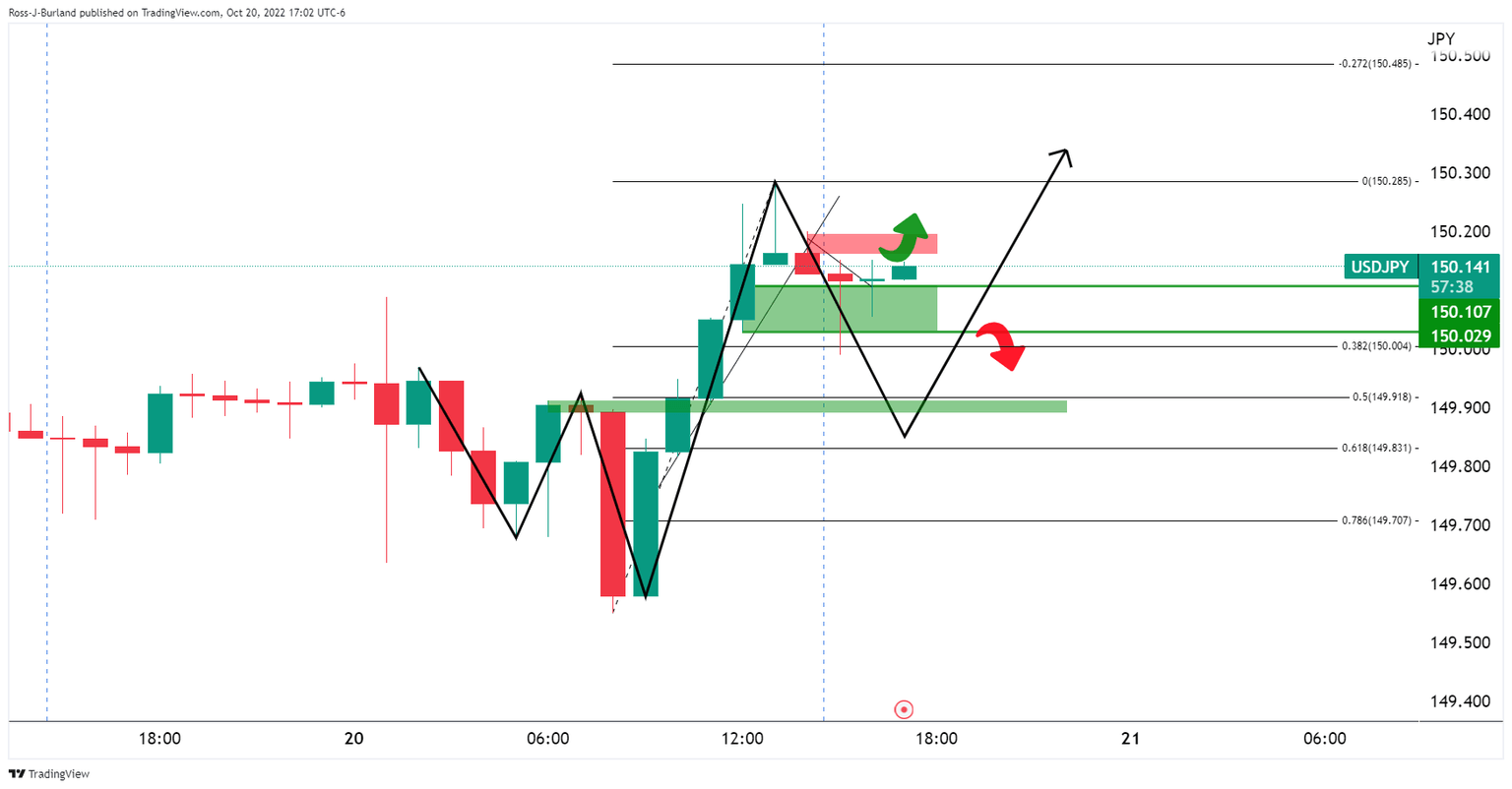

USD/JPY M15 chart

The 15 min chart see the price testing recent support ahead of the Tokyo open. However, a break of 150.00 opens the risk of a significant drop for the day ahead.

USD/JPY H1 update

On the hourly chart, the W-formation, which was illustrated prior to this article below, is starting to play out as seen above. This is a reversion pattern.

As seen, there was a 100 pip move in the yen which coincided with a hot inflation report from the US and it was suspected to have been BoJ intervention. We saw something similar in Europen markets on Thursday following the test of 150.00.

If the bears commit, then a move to 149.00 may satisfy the BoJ, and indeed exporters will still be locking in the weakest levels seen in decades at those levels.

USD/JPY daily chart

When the BoJ announced they had intervened after the Federal Reserve raised rates by 75bps, the price moved 500 pips on the day

Meanwhile, we have the 2-year yields soaring:

This is fuelling bullish prospects for the the US dollar:

The confluence of the bullish flag pattern and W-formation, with the correction, supported the neckline meeting a 50% mean reversion and trendline likely give fuel for the bulls.

So markets will be wary of further intervention from the Bank of Japan that could come soon considering the time of the month (last intervened a month ago)and the Fed at the start of November, one trading week away.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.