USD/JPY Price Analysis: 111.00 remains a tough nut to crack ahead of US data

- USD/JPY is off 15-month highs, under pressure below 111.00.

- DXY sees some fresh selling while the yen cheers Japan’s PM Suga’s comments.

- Focus shifts to US Durable Goods Orders for fresh impetus.

USD/JPY is making another attempt to regain the 111.00 level, reversing a dip from daily lows of 110.77.

At the time of writing, the spot trades 0.09% lower at 110.84, undermined a fresh bout of selling seen in the US dollar despite the higher Treasury yields.

Meanwhile, the yen draws support from the latest comments from the Japanese Prime Minister Yoshihide Suga, as he pledged to speed up vaccinations to boost the economic recovery.

Attention now turns towards the US data dump, including the Durable Goods, and the infrastructure stimulus updates for fresh trading impulse.

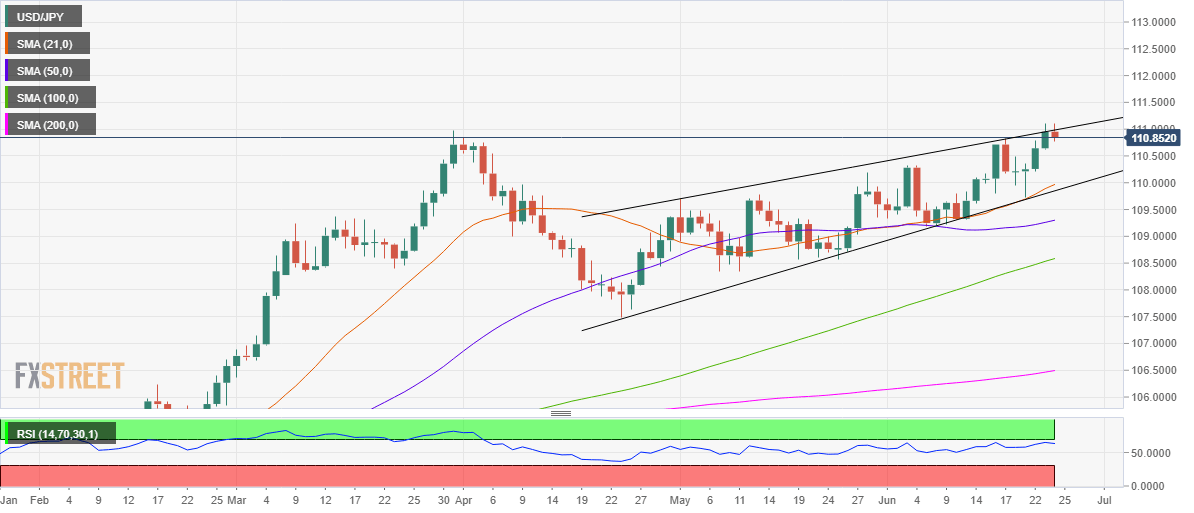

From a near-term technical perspective, the spot is testing the rising wedge hurdle at 111.00 on the daily chart, eyeing a daily closing above the last in order to confirm an upside breakout.

The bulls will then retest the 15-month tops of 111.11 reached a day before. The bullish target is envisioned at 111.50, a psychological level.

The 14-day Relative Strength Index (RSI) has turned south after testing the overbought territory, backing the latest correction.

However, the bullish bias remains intact, given that the leading indicators still hold comfortably above the midline.

USD/JPY daily chart

However, if the bulls continue to face rejection above the rising wedge hurdle, a retracement towards Wednesday’s low of 110.62 cannot be ruled out.

June 18 highs at 110.48 could come to the rescue of the buyers.

Further south, the 21-Daily Moving Average (DMA) at 109.96 could challenge the bearish commitments.

USD/JPY additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.