USD/JPY looking for a bullish rebound after four straight down days, testing 148.00

- US Dollar sees a limited recovery against the Yen on Thursday.

- US data brought few surprises, Japanese data came in mixed on the day.

- Up Next: Friday sees Japanese Unemployment Rate, US ISM Manufacturing PMI

The US Dollar (USD) is trying to claw back chart paper from the Japanese Yen (JPY) on Thursday, but struggling to decisively re-mount the 148.00 handle.

US Core Personal Consumption Expenditures (PCE) Price Index figures for October came in exactly as expected, with the MoM printing at 0.2% versus September's 0.3%, while the annualized figure for the year into October printed at 3.5% compared to September's annualized print of 3.7%.

US PCE inflation brings no surprises, but jobless claims & Chicago PMI beat the street

US Initial Jobless Claims surprised to the upside, showing fewer new unemployment benefits seekers than markets anticipated, with 218K new claimants for the week into November 24th, where market participants expected 220K. However, the previous week did see an upside revision from 209K to 211K.

The US Chicago Purchasing Managers' Index also saw an upside surprise for investors, leaping back into expansionary territory at 55.8 in November compared to the median forecast of a slight increase from 44.0 to 45.4.

Japanese economic data came in mixed early Thursday, with Japan Retail Trade missing the mark and large retailers reporting declining sales. Japanese indexed consumer confidence and new housing construction both beat expectations.

November's Japanese Consumer Confidence Index printed at 36.1 compared to October's 35.7, a relatively positive outcome for an indicator that has not come in above 40.0 in nearly five years. Markets were expecting a 35.6 printing.

Friday is set to close out the trading week with Japanese unemployment as well as the US' ISM Manufacturing PMI.

The Japanese Unemployment Rate is broadly expected to hold steady at 2.6%, while the US' ISM Manufacturing-focused PMI is expected to squeeze out a gain from 46.7 to 47.6 in November.

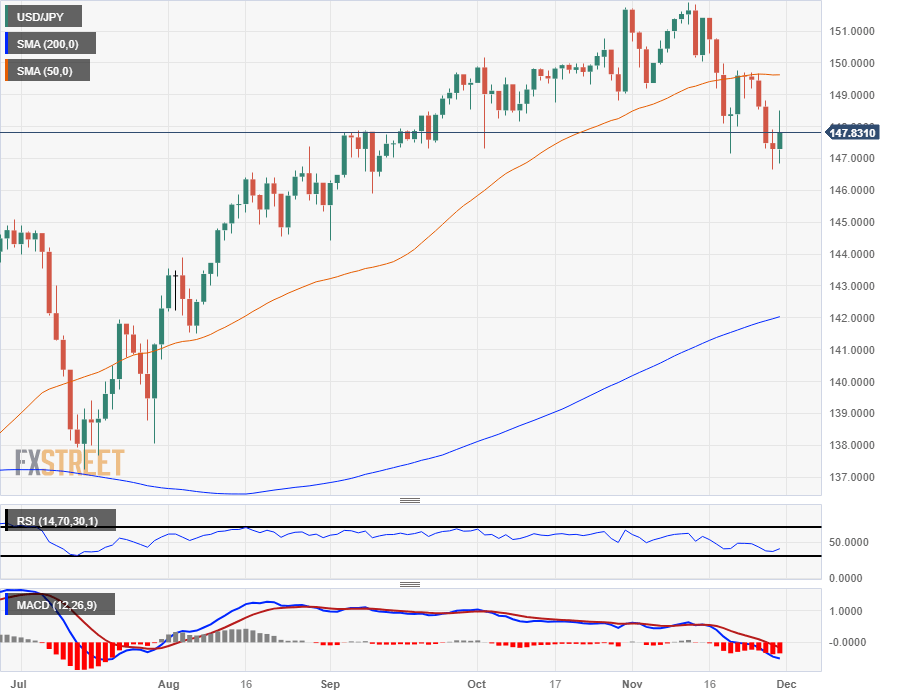

USD/JPY Technical Outlook

The USD/JPY rallied on Thursday, making it to 148.50 before facing a rejection from the 200-hour Simple Moving Average (SMA) and the pair is now trading back under the 148.00 handle, but the pair remains in the green on the day.

The US Dollar has closed flat or in the red for five straight trading days, and Thursday looks set to buck the trend.

The USD/JPY remains capped under the 50-day SMA, with current price action trading well above the technical floor of 142.00 at the 200-day SMA.

USD/JPY Hourly Chart

USD/JPY Daily Chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.