USD/JPY hits two-week high on solid US Data, improved US debt ceiling talks

- Solid US housing market data and upbeat sentiment in US equities weaken the Japanese Yen.

- Improved US debt ceiling negotiations and hawkish Fed speakers keep the US Dollar climbing.

- Japanese economy surprises with better-than-expected Q1 GDP and consumption figures.

USD/JPY rises to fresh two-week highs of 137.57, propelled by higher US Treasury bond yields due to solid US data reported on Tuesday and Wednesday. In addition, an improvement in US debt ceiling negotiations between the White House and the US Congress keeps the US Dollar (USD) rising. Therefore, the USD/JPY is trading at 137.49 after hitting a daily low of 136.30.

Rising US Treasury bond yields and upbeat sentiment weaken the safe-haven Yen

US equities portray an upbeat sentiment in the financial markets, to the detriment of safe-haven peers, like the Japanese Yen (JPY). The US housing market shows signs of improvement, as April’s Building Permits dropped to -1.5%, better than the expected -3% plunge, as permits improved from 1.437M to 1.416M. Housing Starts for the same period jumped 2.2%, smashing the prior month’s data of -4.5%, growing at a 1.401M pace.

That data, alongside the latest Retail Sales and Industrial Production figures, showed that the US economy is pointing to a soft landing. The Atlanta Fed GDP Now for Q2 rose from a previous 2.6% to 2.9%.

Therefore, traders had begun to slash their bets of three rate cuts by the US Federal Reserve in 2023 amidst the ongoing hawkish rhetoric by some officials. Loretta Mester, Thomas Barkin, and Raphael Bostic continued to push back against rate cuts, though the latter has moderated its stance. On the dovish front, Aaron Golsbee and Lorie Logan took a cautious stance but emphasized that no rate cuts are expected in 2023.

Odds that the Fed would cut rates by 50 bps toward year’s end lie at 40.8%, compared to Tuesday’s 39%, according to the CME FedWatch Tool.

The US debt ceiling theme continues to grab USD/JPY traders’ attention, though a negotiation improvement calmed investors’ nerves. The US House Speaker McCarthy stated the two sides remain apart. Nevertheless, he acknowledged that a deal could be done by the week’s end. Wall Street cheered Tuesday’s results, as the three major indices posted gains above the 0.30% threshold.

Given the backdrop, US Treasury bond yields advanced, with the 10-year benchmark note rate at 3.570%, gaining three basis points. Consequently, the US Dollar Index (DXY), which tracks the US Dollar performance against a basket of six currencies, advanced 0.23%, up at 102.830.

In the meantime, the Japanese agenda revealed a surprise in Gross Domestic Product in Q1, at 0.4%, exceeding estimates of 0.1%. On a year-over-year (YoY), figures rose by 201%, above the prior’s 1.2%, while Consumption rose by 0.6%, above estimates of 0.4%.

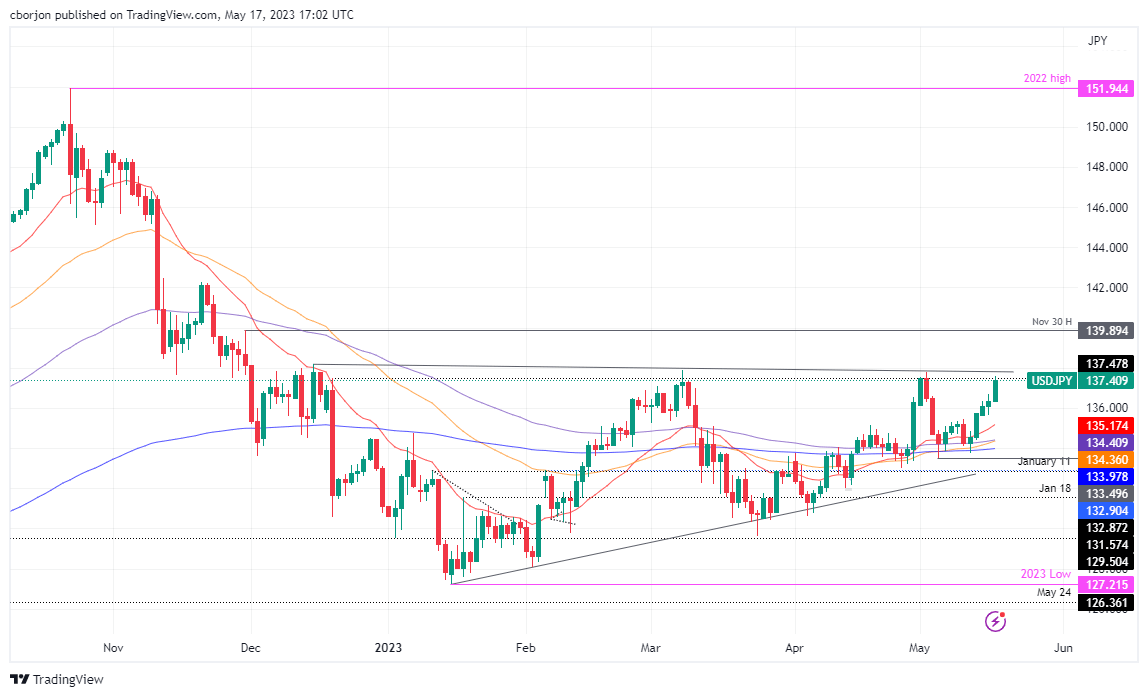

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays a strong uptrend facing solid resistance at around the year-to-date (YTD) highs of 137.91. Additionally, if surpassed, a six-month-old resistance trendline passes around that area, which could pave the way for the USD/JPY to test the November 30 high at 139.89 before testing 140.00. On the downside, failure to crack 138.00, a pullback towards the 137.00 mark is on the cards.

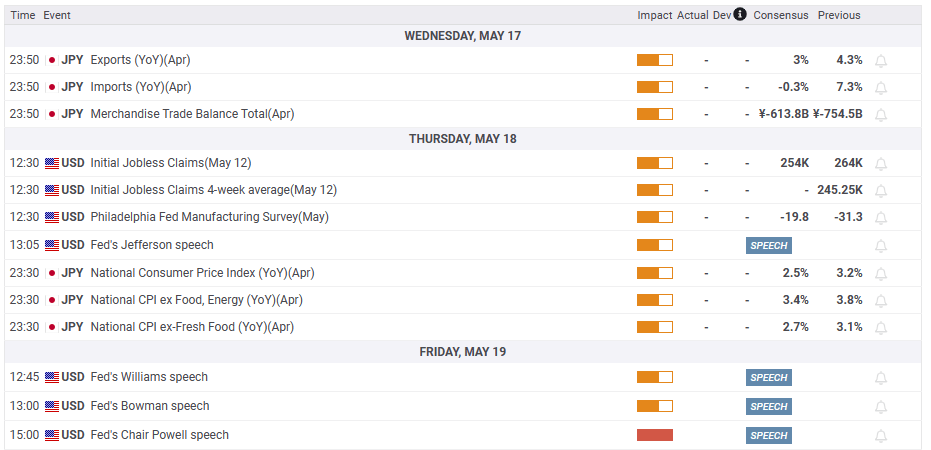

Upcoming events

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.