USD/JPY hesitates just shy of 143.75

- USD/JPY took a step back from Wednesday’s grind higher after failing to claim 143.75.

- Yen selling pressure eased off after Fed’s latest meeting minutes poised to disappoint markets.

- China Services PMI to drive market sentiment in early Thursday market session.

The USD/JPY drove higher on Wednesday as the US Dollar (USD), the day’s single best-performing currency clambered over the Yen (JPY), the day’s biggest loser. The USD/JPY climbed one and a third percent bottom-to-top for the midweek market session, slipping back from just below 143.75 to wrap up Wednesday’s trading just above the 143.00 handle.

FOMC Minutes: Interest rates seem to be at or near peaks

The Federal Reserve’s (Fed) meeting minutes from the US central bank’s December discussion revealed that Fed policymakers may not be as far along the path towards rate cuts as market have been hoping for. Fed officials noted that, while rates appear to be “at or near” the peak, the main policy rate could hold higher for longer than market participants are currently expecting. The meeting minutes stand in stark contrast to the market’s broad risk-on reaction following Fed Chairman Jerome Powell’s surprise pivot in December which sent market expectations of rate cuts through 2024 skyrocketing.

The upcoming Thursday Asia market session is set for the second half of Purchasing Managers’ Index (PMI) figures from China with the China Caixin Services PMI slated to drop early at 01:45 GMT, and markets are expecting a slight uptick from November’s 51.5 to 51.6 in December.

China’s Caixin Manufacturing PMI on Tuesday came in above expectations, surprising to the upside and ticking higher from 50.7 to 50.8 in December, easily clearing the median market forecast of 50.4. A matching beat for Thursday’s Services PMI will help bolster risk appetite as markets kick off the back half of the first trading week of 2024.

High-impact data will wrap up the trading week with Friday’s US Nonfarm Payrolls, expected to slip back slightly from 199K to 168K in December.

USD/JPY Technical Outlook

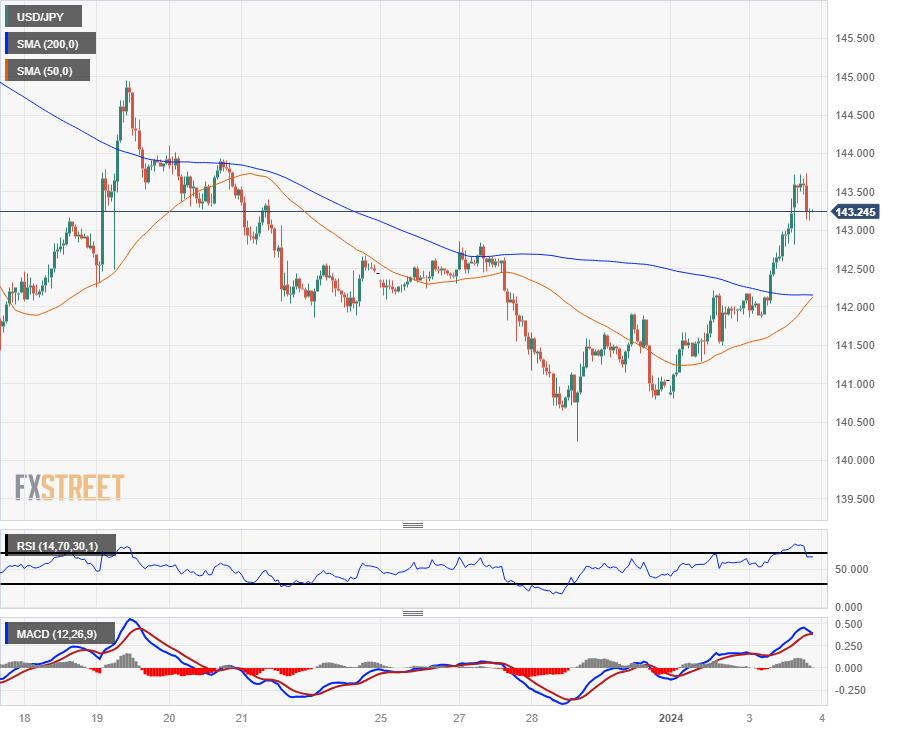

The USD/JPY’s rally on Wednesday took the pair cleanly through the 200-hour Simple Moving Average (SMA) just above 142.00, sending the pair just shy of 143.75 before settling back towards the 143.00 handle.

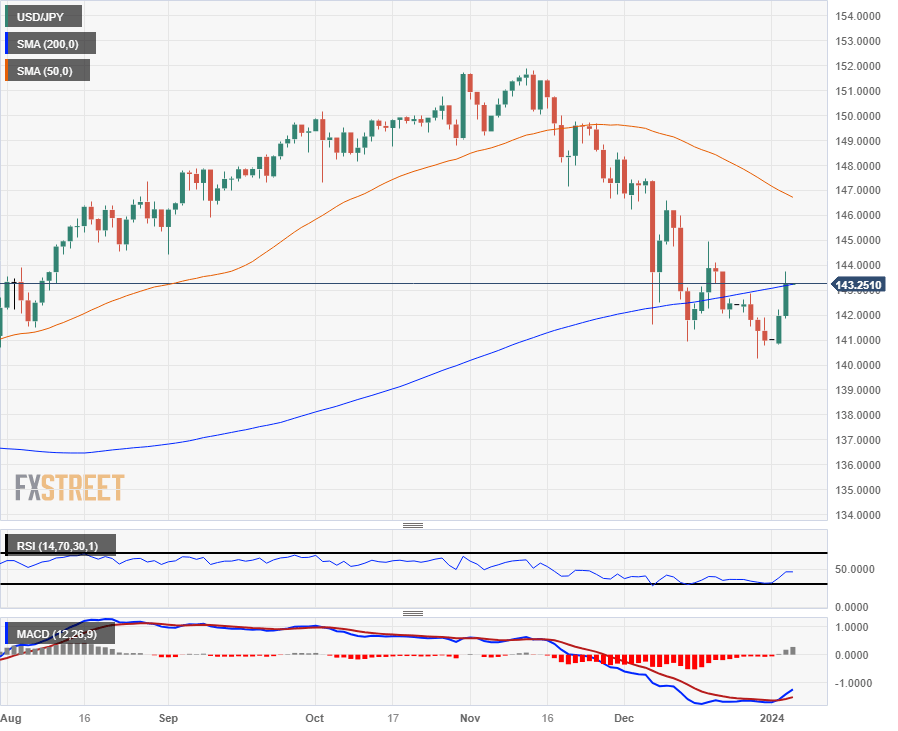

Daily candlesticks have the pair running directly into technical resistance from the 200-day SMA just above 143.00, and the pair’s 7.5% peak-to-trough decline from November’s peak of 151.91 remains intact.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.