USD/JPY off the lows after US Dollar bulls came in big

- The Japanese Yen is set to lock in a staggering performance for this week against the US Dollar.

- The Yen has appreciated over 3% following Japan’s intervention to propel the currency and the Fed’s less-hawkish rhetoric.

- The US Dollar Index slips below 105.00 with softer NFP print.

The Japanese Yen (JPY) is set to book one of its best weeks in history against the US Dollar. Since last Friday, a string of (un)confirmed interventions have pushed the USD/JPY pair from roughly 160.00 to 153.00. As the dust settles, the question is for how long the effect from these interventions will linger, and if they can keep USD/JPY trading at current levels or lower.

Meanwhile, the DXY US Dollar Index – which gauges the value of the US Dollar (USD) against a basket of six foreign currencies – lost control of 105.00 for now as markets are stepping away in order not to get steamrolled by the Japanese interventions. Still, the recent depreciation of the Greenback could offer a window of opportunity for US Dollar buyers to step in and gear up for a profitable ride higher. The weaker US Nonfarm Payrolls print has in the meantime pushes USD/JPY below 152.00 and sees ample amount of US Dollar buyers coming in to buy the dip at these levels.

Daily digest market movers: Rate differential remains

- At 12:30 GMT, the US Employment Report for April got released:

- US Nonfarm Payrolls changes went from 315,000 to 175,000, a miss on estimates.

- Monthly Average Hourly Earnings fell from 0.3% to 0.2%.

- The Unemployment Rate ticked up from 3.8% to 3.9%, though that number is a bit distorted because a rounding rule has brought it to 3.9%.

- Although traders are pulling forward the Federal Reserve's first rate cut from November to September, the rate differential between Japan and the US should be supportive for a stronger US Dollar.

- Several Japanese companies have reported to Bloomberg that they are facing substantial issues due to the recent weakness in the Japanese Yen. A boom in tourism is also putting pressure on local inflation.

- Japanese markets are closed on Friday for the Greenery Day bank holiday.

- Equities are trading in the green with both European indexes and US Futures up near 0.5% on average.

- The CME Fedwatch Tool suggests an 85.5% probability that June will still see no change to the Federal Reserve's fed fund rate. Odds of a rate cut in July are also broadly out of the cards, while for September the tool shows a 60% chance that rates will be lower than current levels.

- The benchmark 10-year US Treasury Note trades around 4.50%, the lowest level in a month, while Japanese 10-year JGB are trading at the high for this week near 0.889%.

USD/JPY Technical Analysis: Bulls came barging in at 152.00

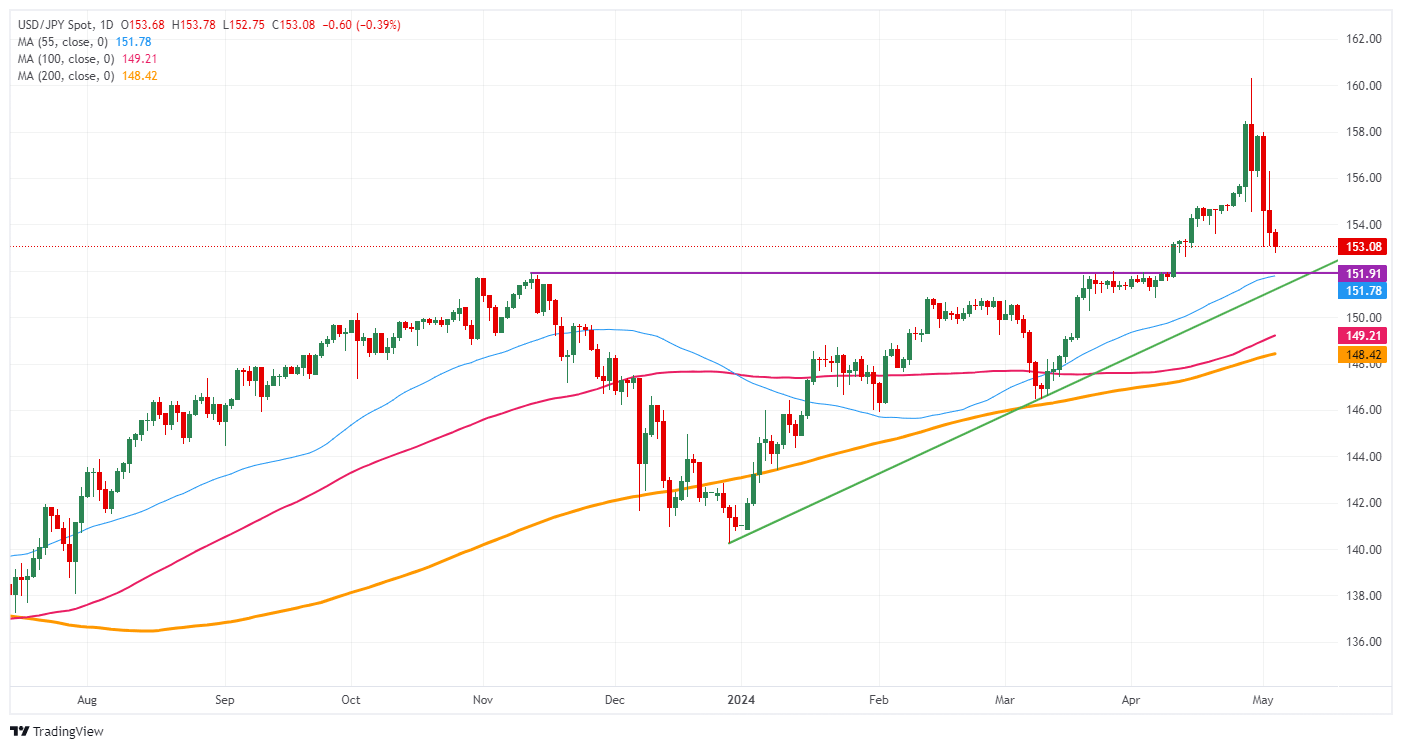

The USD/JPY pair has still some room to fall, though a very lucrative entry level for Dollar bulls is just around the corner. Around 152.00, not only a pivotal level and the 55-day Simple Moving Average (SMA) is nearby, but also there is a long-term ascending trend line just beneath to provide support. This makes it the perfect entry level for any US Dollar buyers who foresee USD/JPY heading back to 160.00.

USD/JPY (daily chart)

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.