USD/JPY drops heavily and rocks the forex space

- USD/JPY drops hard and BoJ intervention is suspected but not confirmed.

- USD/JPY bears have eyes on the upper quarter of the 147 area and then the 146.50s.

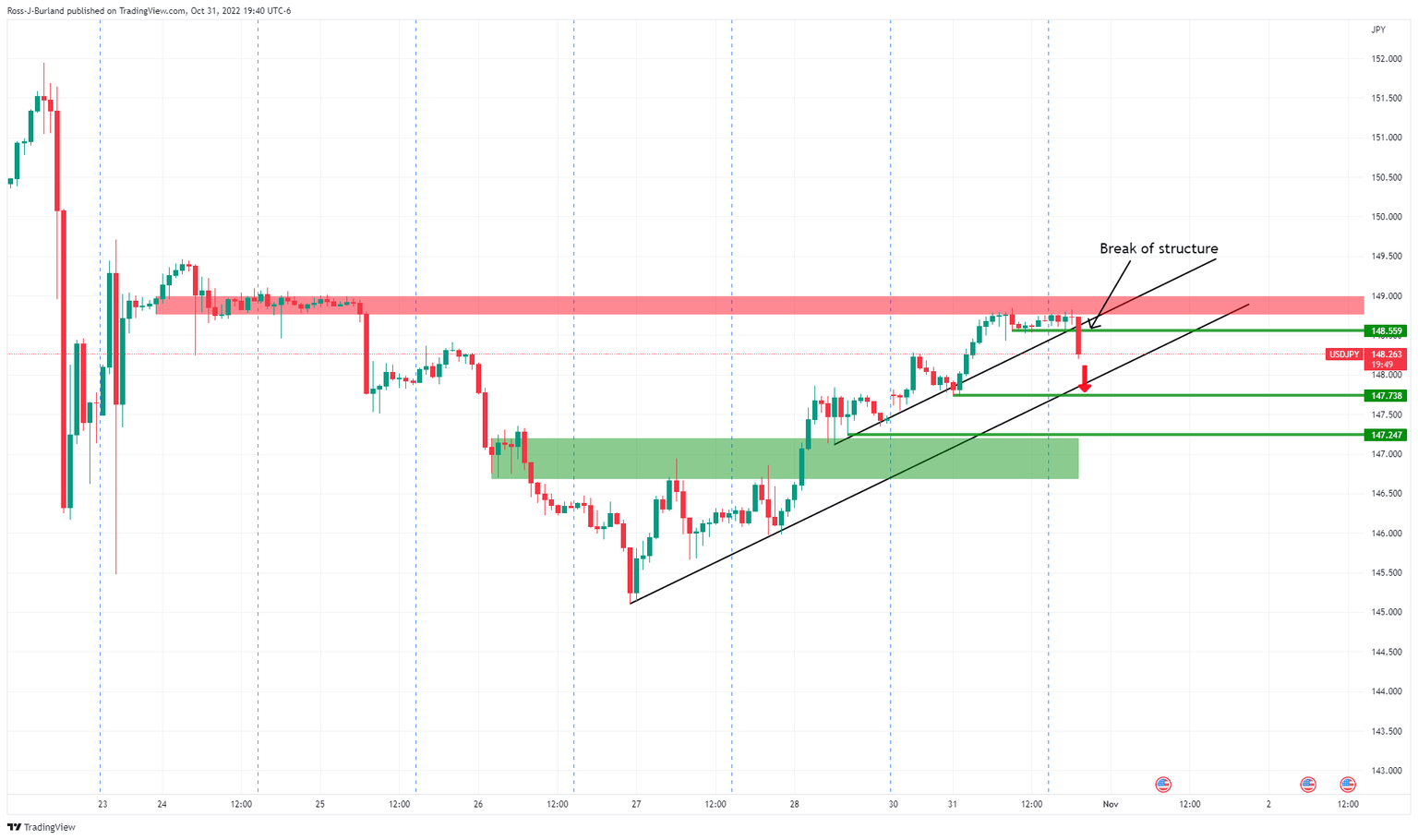

USD/JPY has moved the forex space again in a sizeable drop in recent trade. The pair fell from a high of 148.82 to a low of 148.26 with the bulk of the happening in the last 15-min candle.

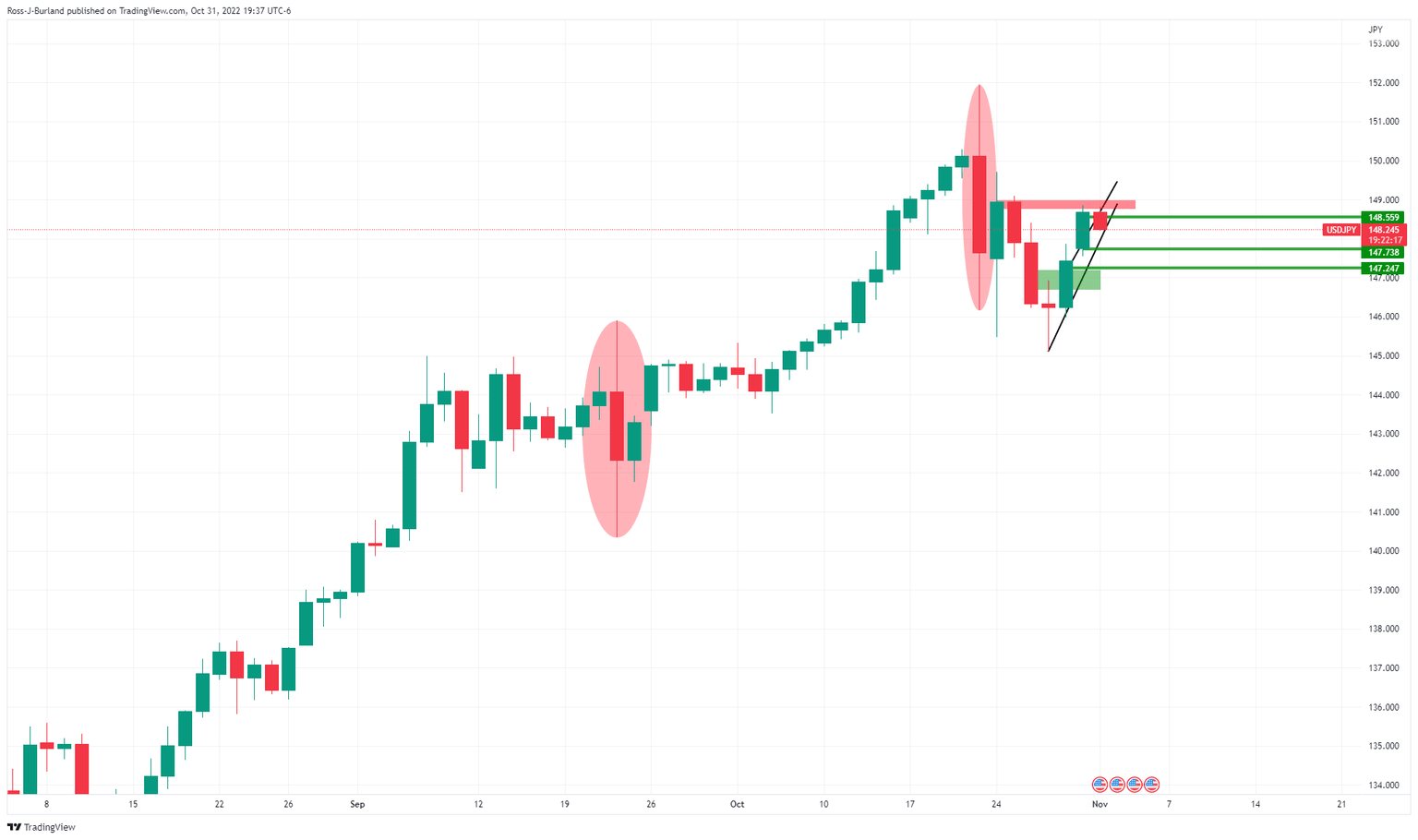

there has been a series of 'out-of-nowhere'' moves in the yen in recent weeks as the currency falls to intolerable levels for the Bank of Japan and the Ministry of finance. The verbal and physical intervention has occurred on numerous occasions with moves as great as 500 pips, which dwarfs today's price action tenfold:

Nevertheless, there has been an offer int he greenback and shock waves felt throughout forex.

Earlier today, Japan's Finance Minister, Shun'ichi Suzuki, stated that they will respond appropriately to sharp FX moves and that they are closely watching FX moves with a high sense of urgency. He did not comment on levels, however.

With regards to intervention, he explained that it has yielded certain effects and they cannot tolerate excess FX volatility in speculative trading.

Japan's recent currency intervention has yielded "certain effects", Suzuki said after the government spent a record amount supporting the yen last month.

Meanwhile, the yen fell to 148.80 vs. the greenback at the start of this week and was under pressure following a dovish Bank of Japan kept ultra-low interest rates, bucking the trend among other major central banks. The move may well have promoted the MoF once again but there has not been any confirmation.

USD/JPY technical analysis

The price has broken a key level of structure in this move which could equate to further downside for the day ahead, with eyes on the upper quarter of the 147 area. Below there, the bears will be focussed on the lower quarter that guards room all the way through to a test of the broader trendline and the 146.50s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.