USD/JPY cycles around 148.00 ahead of BoJ next rate call

- BoJ interest rate decision due during Tuesday market session.

- BoJ press conference and Q4 outlook report to draw trader focus.

- Japan Tokyo inflation due later this week, on Friday.

The USD/JPY cycled around the 148.00 handle on Monday as traders gear up for the Bank of Japan’s (BoJ) latest rate statement on Tuesday, coming ahead of another round of Japanese inflation figures slated for Friday with the Tokyo Consumer Price Index (CPI).

Bank of Japan Preview: Forecasts from eight major banks, BoJ to maintain the status quo and remain dovish

The Bank of Japan is firmly entrenched in a hyper-easy policy stance, and markets don’t expect much movement on interest rates from the Japanese central bank anytime soon as BoJ policymakers continue to fret about Japanese inflation which is expected to possibly slump below their 2% target at some point in the future.

The BoJ’s own inflation outlook forecasts Japanese inflation declining below 2% sometime in 2025, and it will take a significant shift in Japanese economic figures to pushy the BoJ out of its current negative rate regime.

Despite this, investors will be watching the BoJ’s press conference on Tuesday closely; BoJ Governor Kazuo Ueda recently hinged the end of negative rates on wage increases in Japan during 2024’s first quarter.

MUFG: JPY could weaken further barring a stronger signal that rates could be raised in spring

Elsewhere on the data docket for this week, US Purchasing Managers’ Index (PMI) figures are due Wednesday and are expected to hold steady at 47.9 for the manufacturing component in January, while the services sector PMI is forecast to fall back slightly from 51.4 to 51.0 in the same period.

The US will also see fourth-quarter Gross Domestic Product (GDP)< which is expected to decrease from 4.9% to 2.0% on an annualized basis, while Friday brings a fresh round of Tokyo CPI inflation, with YoY Tokyo Core CPI expected to slip from 2.1% to 1.9% in January.

USD/JPY Technical Outlook

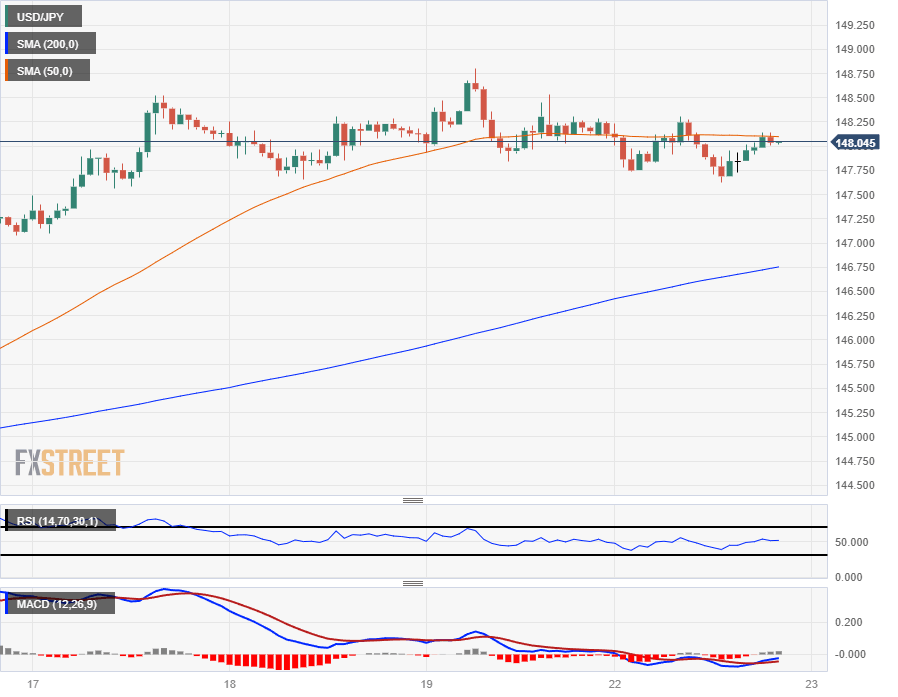

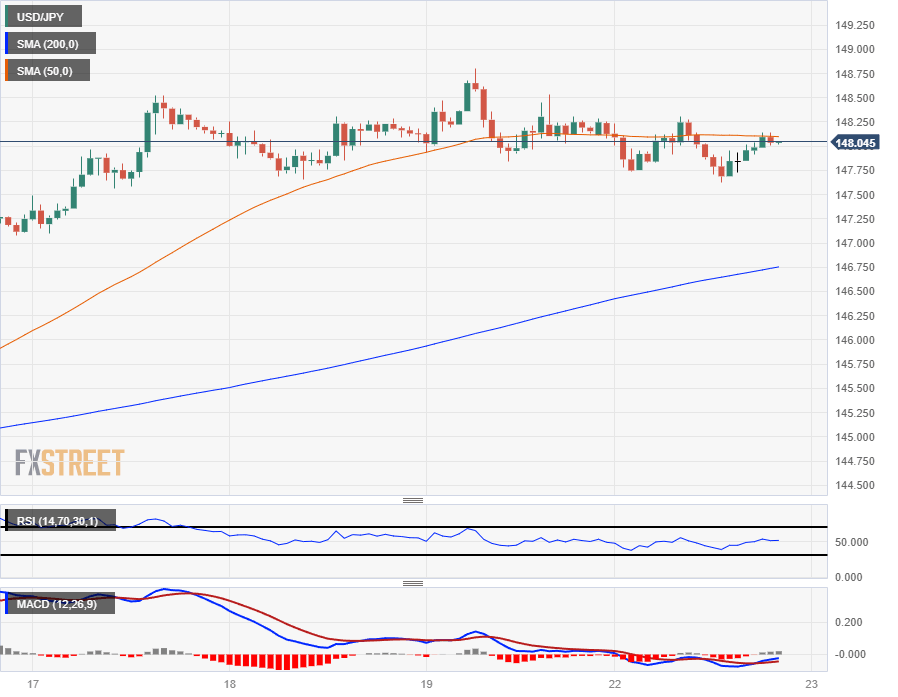

The USD/JPY finds itself mired on the 50-hour Simple Moving Average (SMA) near the 148.00 handle as near-term momentum drains out of the pair. Intraday technical support sits at the 200-hour SMA near 146.75, and short-term traders will note a hard line drawn under the 147.75 price level after last week’s climb into the 148.50 neighborhood.

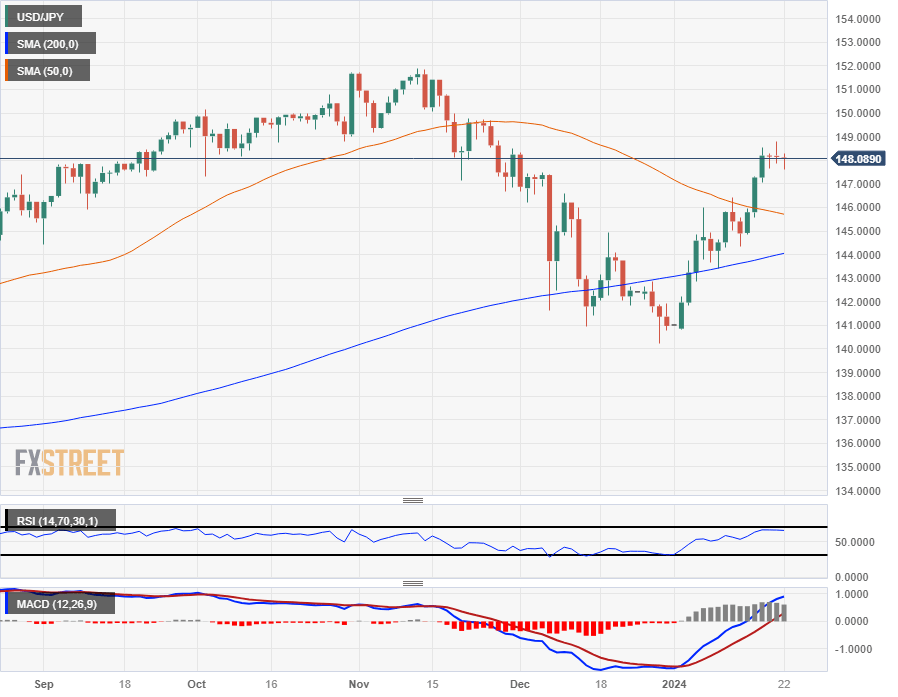

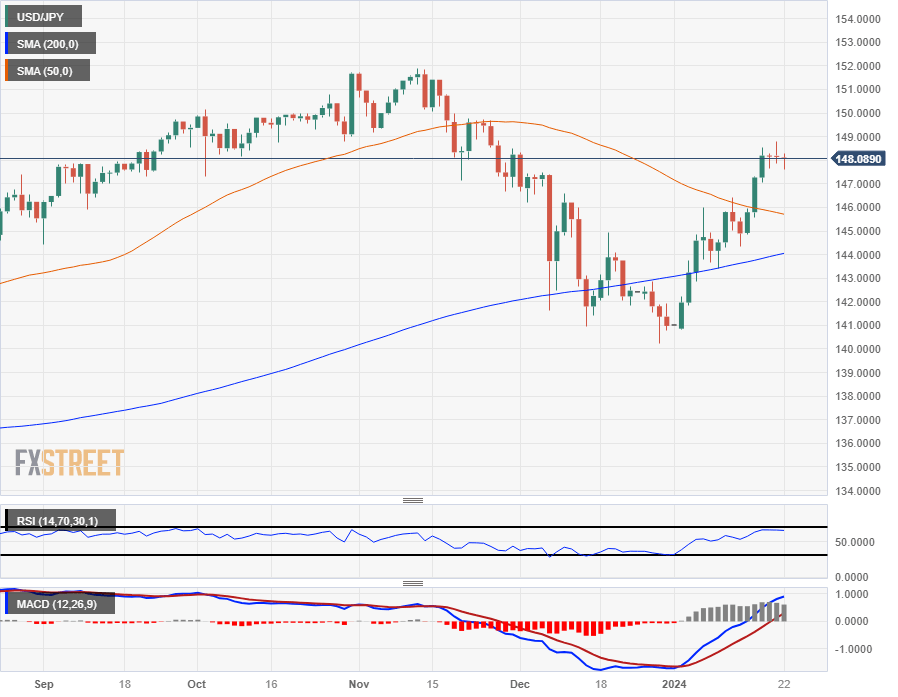

Daily candlesticks have the USD/JPY temporarily frozen as candles spin in place at the top end of a 6% climb from December’s swing low into 140.25.

The 200-day SMA is providing rising support near 144.00, and near-term gains in the pair leave the USD/JPY on the high side of a declining 50-day SMA near 146.00.

USD/JPY Hourly Chart

USD/JPY Daily Chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.