- USD/JPY bulls denied as the greenback suffers another blow.

- The yen is an attractive safe haven into an uncertain December for stock markets.

- Yen long positioning has bounced back and spot is firming also.

USD/JPY is trading at 104.35 between a range of 104.18 and 104.57, flat on the day following a partial round-turn with the highs being strongly rejected.

Stock markets have been buoyed by positive US data and signs that the first coronavirus vaccinations could be administered by the end of the year.

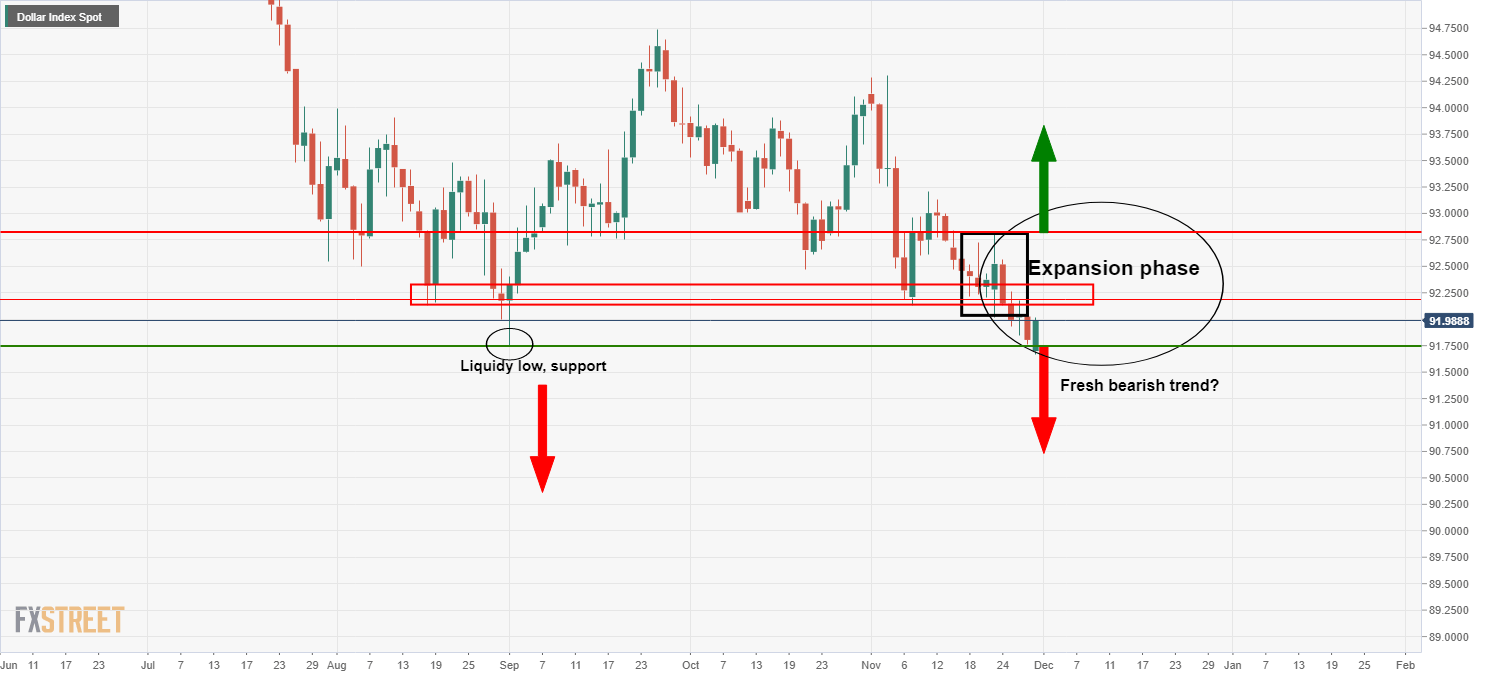

Risk assets have benefitted despite an acceleration of the pandemic and the US dollar has plummeted well away from the 92 level in the DXY yet again.

Eyes on the Fed and USD

The DXY is now trading at 91.30 and in a new lower-low, the lowest levels since April 2018.

This was a move telegraphed in yesterday's analysis of the DXY which forecasted a downside extension and a potential new bearish trend:

The focus will soon turn to the US Federal Reserve where further easing is expected to help the economy through what is likely to be a horrid winter of rising coronavirus deaths.

The prospects of an easier Fed have seen net short USD positions climb last week, consistent with the soft tone of the greenback in the spot market.

''That said,'' analysts at Rabobank explains, ''despite the positive vaccine news and the perception that the Fed will lean on the yield curve if necessary, it is possible that risk appetite could be kept in check by the realisation that economic data are likely to worsen before they improve.

Continued delays over US fiscal stimulus is also a dampener on risk appetite.''

US stock sin focus and vaccine hopes

The US stock market will be a driver in forex and the uncertain outlook as been discussed in this week's S&P 500 Index forecast as follows:

Ultimately, coronavirus vaccine news will be in the spotlight and Pfizer Inc PFE on Tuesday said it had asked for emergency European Union authorization of its vaccine, taking it closer to launch following a similar move in the United States last month, Reuters reported.

Reuters also reported that ''Moderna Inc MRNA applied for US authorization on Monday after full results from the late-stage study showed it was 94.1% effective with no serious safety concerns.

'We believe the rally can continue, with the current pipeline of expected vaccine rollouts, in line with our central scenario of widespread availability in the second quarter of 2021' said Mark Haefele, chief investment officer at UBS Global WealthManagement in Zurich.''

China is bouncing back, helping risk appetite

In other news which has been welcomed by markets is that a business survey showed activity in China's factory sector accelerated at the fastest pace in a decade in November.

Expected to print close to October’s 53.5, around a 3-year high, the Markit Manufacturing PMIs arrived at 54.9 beats 53.5 expected and 53.6 prior, 10-year highs.

Yen longs jumping back

The analysts at Rabobank explained that ''after the previous week’s fall, JPY net long positions bounced back almost to their early November high which was the strongest level since 2016.

Lower interest rates in other G10 countries could be forcing domestic investors to re-evaluate domestic Japanese .''

The yen will continue to act as a safe haven so long as Japan avoids a bad second wave and the scope for growth to be faster than 2% in both 2021 and 2022 is high and no worse than most of its G-7 peers.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.