- USD/JPY hangs in the balance of risk appetite, covid and stimulus.

- Bulls are testing the bear's commitments and a stubborn resistance level.

USD/JPY is currently higher by 0.07% trading at 103.77 and between a range of 103.67/93 on the day so far.

Risk appetite is mixed with stimulus hopes offset by covid concerns. US stocks are caught up in choppy trade after midday on Monday with the Treasuries making gains.

The S&P 500 was down by 0.2% to 3,834.17 and the US 10-year yield declined by 5.1 basis points to 1.04%.

Global stock markets have lacked direction despite the optimism over a $1.9 trillion US stimulus plan.

Increasing COVID-19 cases and delays in vaccine supplies are troubling investors and stocks are pulling back from record highs made in recent days.

Risk had been elevated at the start of the year on bets vaccines will start to reduce infection rates worldwide and on a stronger US economic recovery under President Joe Biden.

However, US lawmakers continue to debate the coronavirus aid package and investors are also wary about towering stock valuations amid questions over the efficacy of the vaccines in curbing the pandemic.

A bipartisan group of senators, the same group that was key to passing a $900 billion package in December, told White House officials on Sunday that the stimulus spending in President Joe Biden’s coronavirus relief plan provides too much money to high-income Americans.

Senator Susan Collins pressed the Biden officials on why families making $300,000 would be eligible and urged a focus on lower-income workers.

“I was the first to raise that issue, but there seemed to be a lot of agreement … that those payments need to be more targeted,” Collins said in an interview. “I would say that it was not clear to me how the administration came up with its $1.9 trillion figure for the package.”

This is an opening setback in the new administration's complex pandemic negotiations with Congress for which markets will be watching hawk-eyed.

A race against viral evolution

Meanwhile, Global COVID-19 cases are inching toward 100 million, with more than 2 million dead.

Investors are watching carefully as to the progress with vaccinations and the implications of the variants of the disease.

The variants of coronavirus have swept across the United Kingdom, South Africa and Brazil and were detected in the United States, Canada and elsewhere. Scientists are concerned that these new strains may spread more easily.

''We're in a race against viral evolution. We must roll out vaccines as quickly as possible, stem the flow of variants by restricting interactions and travel, and get in front of spread by ramping up surveillance and contact tracing,'' Sarah Otto, Killam University Professor in Evolutionary Biology, University of British Columbia said.

Yen positioning consolidating

As for the markets take of yens, the JPY net long positions are consolidating after their recent push to the highest levels since October 2016, analysts at Rabobank explained.

''Even when risk appetite is strong, lower interest rates in other G10 countries could be reducing scope for the carry trade and forcing domestic investors to re-evaluate domestic Japanese assets.''

USD/JPY technical analysis

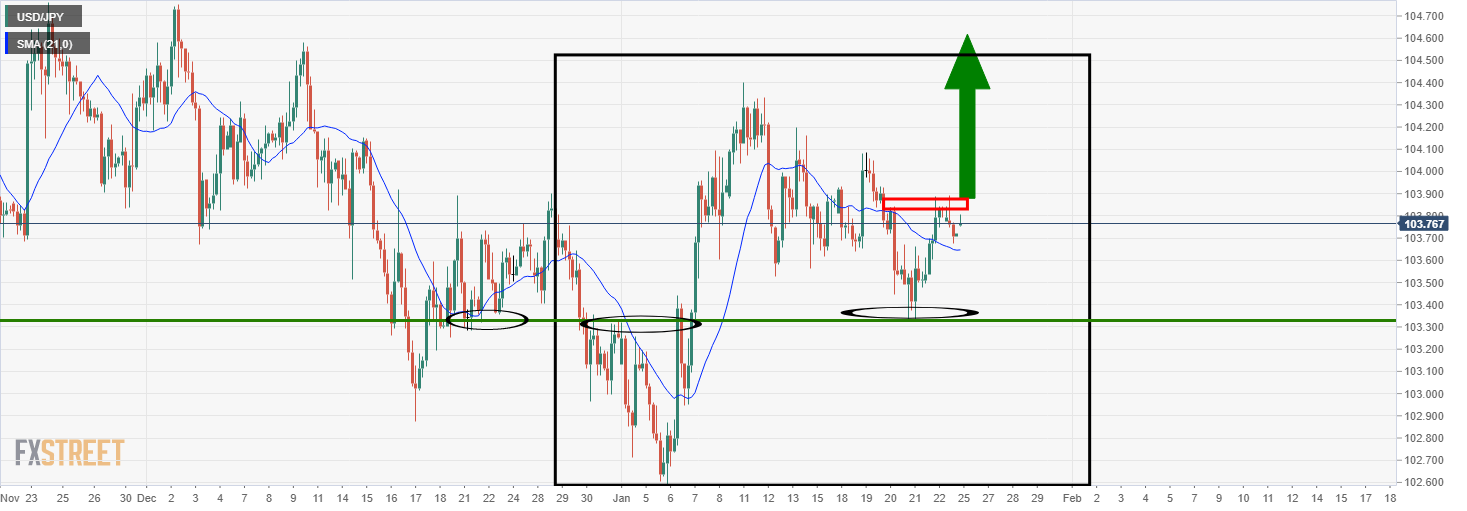

As per the prior analysis above, in the 4-hour chart below, it is illustrated that there is a strong level of resistance for which the bulls will need to conquer to open prospects for an upside continuation:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD maintains its constructive tone near 1.1400

EUR/USD remains well bid in the proximity of the 1.1400 hurdle on Thursday, deriving support from the renewed selling pressure in the US Dollar as investors continue to assess the ongoing absence of further progress in the US-China trade conflict.

GBP/USD appears sidelined around 1.3300, USD remains offered

GBP/USD holds its ground near the 1.3300 mark on Thursday amid a strong rebound in the broader risk-linked universe, all against tha backdrop of renewed weakness around the Greenback and steady uncertainty over US–China trade relations.

Gold eases from tops, back near $3,300

Gold manages to regain composure and reverses two daily drops in a row, currently approaching the $3,300 mark per troy ounce following the earlier bull run to the boundaries of $3,370. Furthermore, XAU/USD attracted safe-haven flows amid renewed concerns of a US-China trade flare-up.

Bitcoin Price corrects as increased profit-taking offsets positive market sentiment

Bitcoin (BTC) is facing a slight correction, trading around $92,000 at the time of writing on Thursday after rallying 8.55% so far this week. Institutional demand remained strong as US spot Exchange Traded Funds (ETFs) recorded an inflow of $916.91 million on Wednesday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.