- USD/JPY traders await the US CPI data for the next major scheduled catalyst.

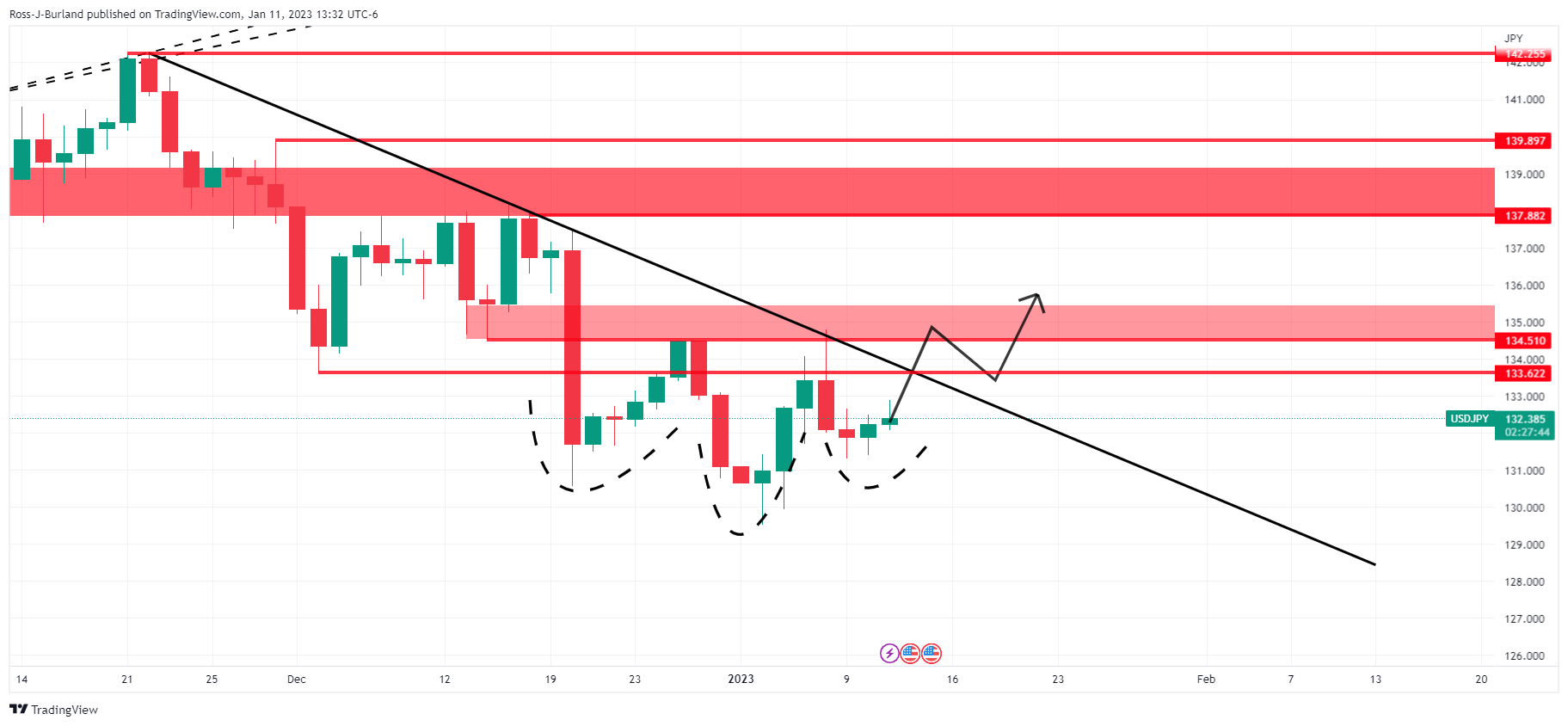

- The price is coiled and an inverse daily head and shoulders could be in the making.

USD/JPY is attempting to move higher during a light schedule in the North American session but has run into offers as US stocks climb to fresh highs for the week. at the time of writing, USD/JPY is trading back to flat for the day at 132.35 but has travelled between a low of 132.06 and 132.87 the high for Tuesday and the week so far.

Wall Street's main indexes are bid as investors keenly await the US consumer price index which seems to have weighed on the US Dollar and US Treasury yields in the recent hours of the session. The 10-year yield is now down by 1.66% and meeting an hourly support structure near 3.563%. If this were to hold, this would offer the greenback some support also and fend off the USD/JPY bears leaving the cross to tread water into the CPI data on Thursday where traders expect to get more clarity on the Federal Reserve's rate hike trajectory.

In this regard, analysts at TD Securities explained that they are looking for core prices to have edged higher on a monthly basis in December, ''closing out the year on a relatively stronger footing,'' they said.

''Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect CPI inflation to register a slight decline on an unrounded basis in December, but rounded up to flat MoM, as energy prices offered large relief again. Our MoM projections imply that headline and core CPI inflation likely lost speed on a YoY basis in December.''

As for the US Dollar, the analysts said ''Unless the core measure significantly surprises to the upside, USD rallies should be sold into. We think the bar is high to compel a reversal of fortune despite the USD tactically stretched.''

USD/JPY technical analysis

As per the prior analysis, USD/JPY Price Analysis: Consolidation into US CPI, bulls on the prowl, the price is coiled and an inverse daily head and shoulders could be in the making:

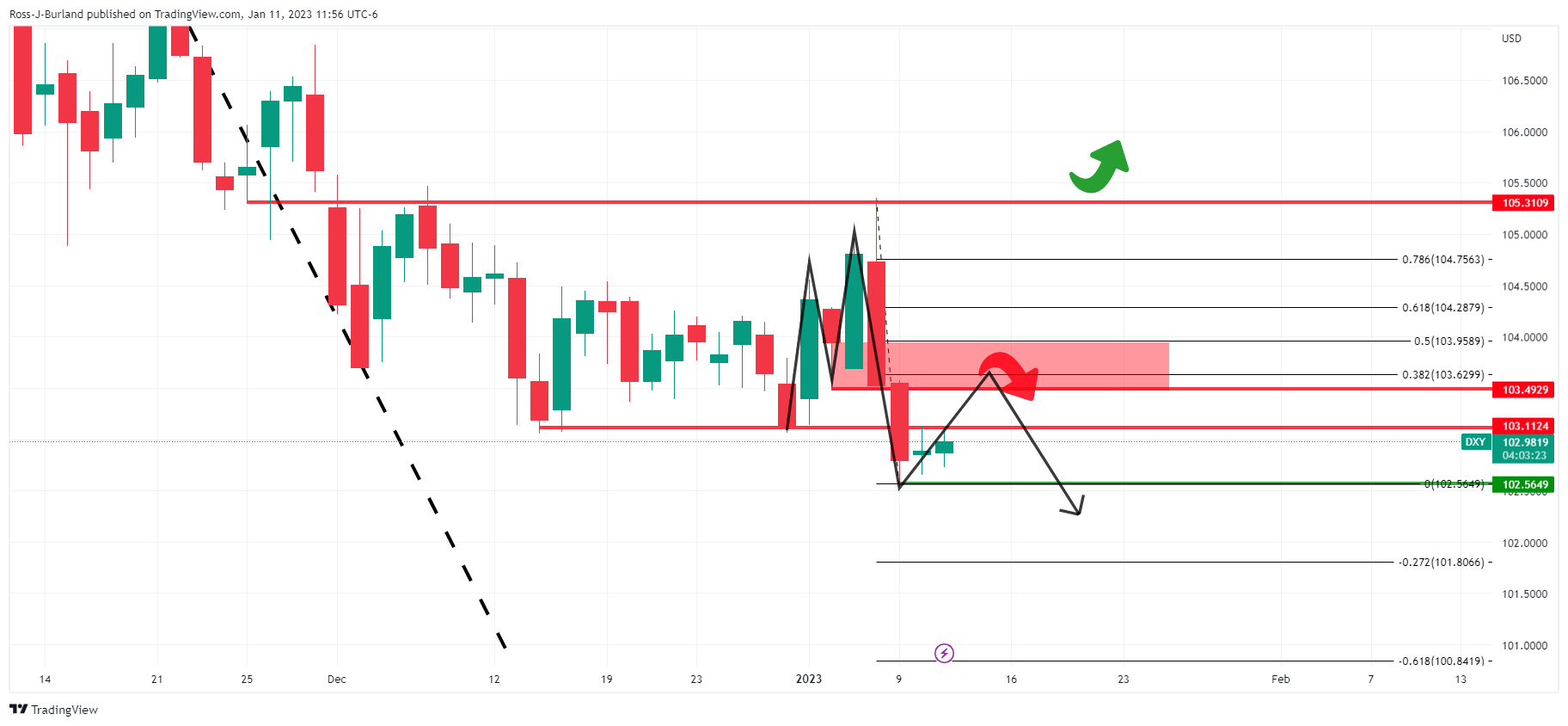

Such an outcome would take out the daily resistance and tie in with the bullish outlook for DXY as follows, where an M-formation is in play:

The M-formation is a reversion pattern and the price would be expected to move in for the restest of the resistance structures and neckline of the pattern between 103.50 and 104.00. Such a move would align with a 38.2% Fibonacci retracement and a 50% mean reversion at the extreme.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold picks up pace and flirts with $3,330, all-time peaks Premium

Gold now gathers extra steam and advances to the $3,330 region per troy ounce, reaching an all-time high. Ongoing worries over escalating US-China trade tensions and a softer US Dollar continue to underpin demand for the metal ahead of Powell's speech.

EUR/USD gathers traction and approaches 1.1400 ahead of Powell

EUR/USD remains well bid and approaches the key 1.1400 milestone, bolstered by a renewed bearish sentiment in the Greenback prior to Fed Chairman Powell’s remarks on the US economic outlook.

GBP/USD clings to daily gains near 1.3250

Despite the marked pullback in the US Dollar, GBP/USD now trims part of its earlier advance to the vicinity of 1.3300 the figure, or multi-month highs, as investors digest easing inflationary pressures in the UK ahead of Powell’s speech.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.