USD/JPY bears testing the daily support awaiting BoJ

- USD/JPY sits firmly towards the prior daily lows.

- The Bank of Japan announces its policy decision.

USD/JPY was little changed on Thursday, oscillating either side of 110.00 albeit with a bias to the downside.

The pair was unconvincing on attempts beyond 110 the figure, scoring a high of just 110.09 from a low of 109.71.

The focus again was on the prospects of QE tapering in the US by the close of the year as the Federal Reserve's Chair, Jerome Powell, repeated his semi-annual testimony, this time to the Senate.

As well as Powell, markets digested comments from some of his colleagues and other FOMC board members.

Powell said that inflation is "well above 2%" and that they are uncomfortable with that and he sticks to the transitory script.

Meanwhile, Chicago Fed president Evans sees QE tapering by year-end as possible if things progress as he expects.

He too is confident that the surge in inflation will be "transitory" and that a more normal inflation environment will emerge in 2022.

However, to the contrary, St. Louis Fed president Bullard feels it is already time to end emergency measures as he is less convinced the inflation will be temporary and is worried that some of the strength may persist into 2022.

Bank of Japan to announce policy decision

Meanwhile, the Bank of Japan announces its policy decision today.

Analysts at Westpac explained that ''no change is expected in key settings such as the 0% 10-year JGB yield target but there should be some tweaks to the growth forecasts (down in 2021, up in 2022) and some details on its green lending program.''

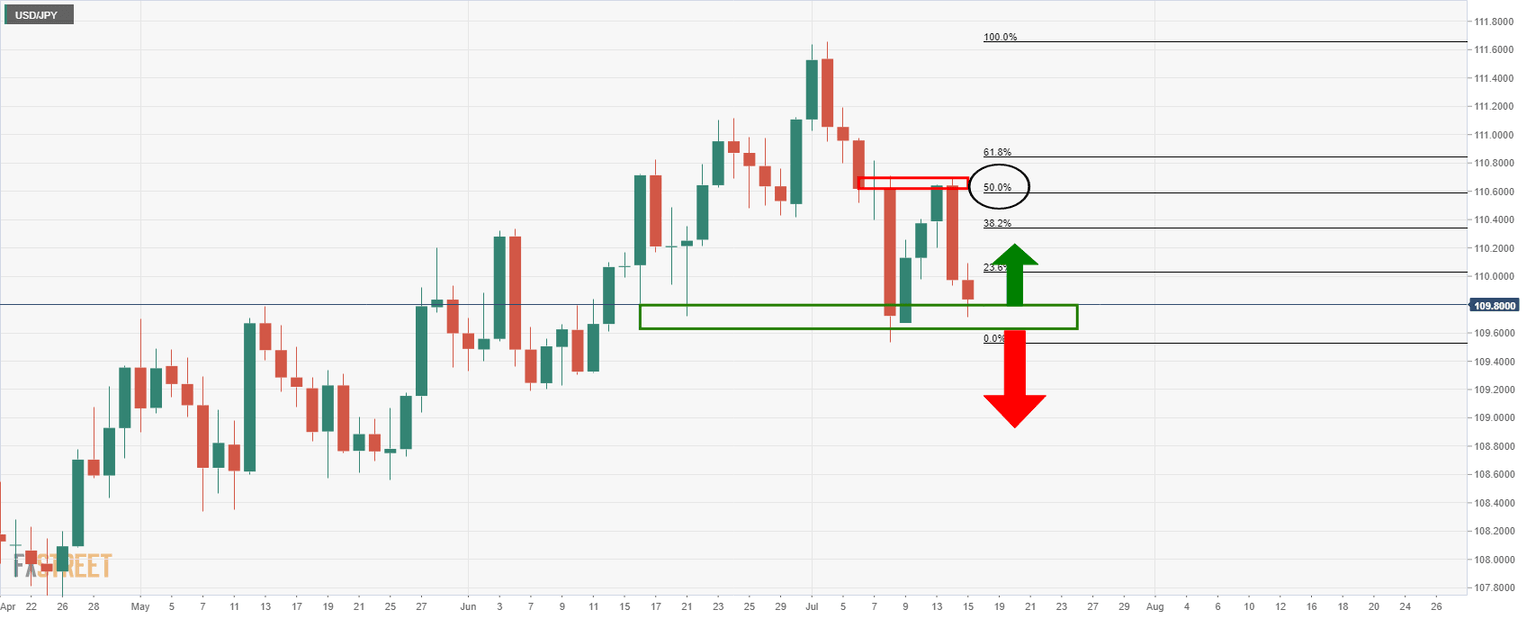

USD/JPY technical analysis

The price is testing daily support structure, and if it were to break below, then there would be a focus on a downside extension of the current daily trend:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.