USD/INR faces some selling pressure as likely inflows boost Indian Rupee

- Indian Rupee gains traction in Friday’s Asian session.

- Softer USD and portfolio inflows support the INR, while higher crude oil prices might cap its upside.

- Investors await the Fed’s Harker speech on Friday.

The Indian Rupee (INR) extends its upside on the weaker US Dollar (USD) on Friday. The INR trades near the two-month highs, bolstered by likely portfolio inflows and an appreciation in the Chinese Yuan after the US Federal Reserve (Fed) began its easing cycle with an unexpected 50 basis point rate cut at its September meeting. Additionally, the USD sales likely from large foreign banks on behalf of custodial clients contribute to the local currency’s upside.

However, the further rise in crude oil prices might limit the upside for the INR as India is the third-largest oil consumer after the United States (US) and China. The Fed Philadelphia President Patrick Harker is scheduled to speak later on Friday.

Daily Digest Market Movers: Indian Rupee trades stronger amid favorable economic factors

- According to the Reserve Bank of India (RBI), the foreign exchange reserves have grown by USD 66 billion in 2024, reaching a total of USD 689.235 billion.

- “The rupee’s recent rally reflects favorable domestic conditions and the impact of global monetary policy shifts. As the Fed's decisions continue to sway markets, all eyes will be on the Reserve Bank of India’s response and whether the rupee can maintain its upward trajectory. For now, 84 will serve as a strong resistance level, while 83.50 will act as robust support,” said Amit Pabari, managing director at CR Forex.

- The US weekly Initial Jobless Claims came in at 219K for the week ending September 14, the US Department of Labor (DoL) showed Thursday. This figure was below the market consensus of 230K and lower than the previous week of 231K (revised from 230K).

- US Existing Home Sales dropped 2.5% MoM in August to 3.86 million from 3.96 million in July.

- The Philadelphia Fed Manufacturing index unexpectedly rose to 1.7 in September, compared to a fall of 7 in the previous reading, better than the estimation of -1.

Technical Analysis: USD/INR resumes its broader bearish trend

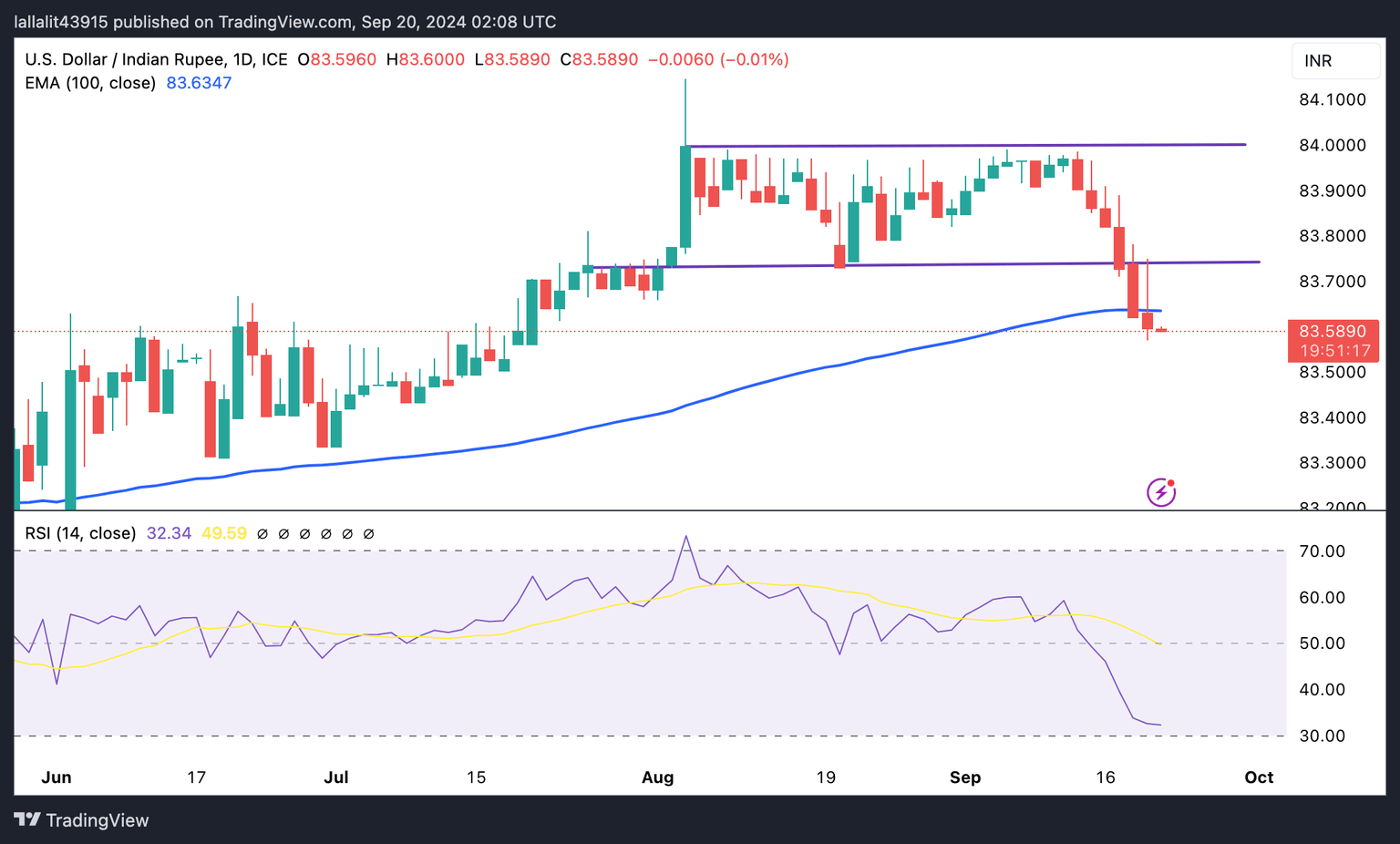

The Indian Rupee trades stronger on the day. The downtrend of the USD/INR pair resumes as the pair broke below the rectangle and the key 100-day Exponential Moving Average (EMA) on the daily chart. The downward momentum is supported by the 14-day Relative Strength Index (RSI), which stands below the midline near 32.40, supporting the sellers for the time being.

The initial support level for the pair emerges at 83.50, the low of July 17. Sustained bearish momentum could pave the way to 83.31, the low of June 18. The next cushion level is seen at the 83.00 psychological mark.

On the bright side, the 100-day EMA at 83.64 will be the immediate resistance level for USD/INR, followed by 83.75, the lower limit of the rectangle. The key upside barrier to watch is the 83.90-84.00 zone.

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.