- USD/INR is trading off the daily lows in the New York session.

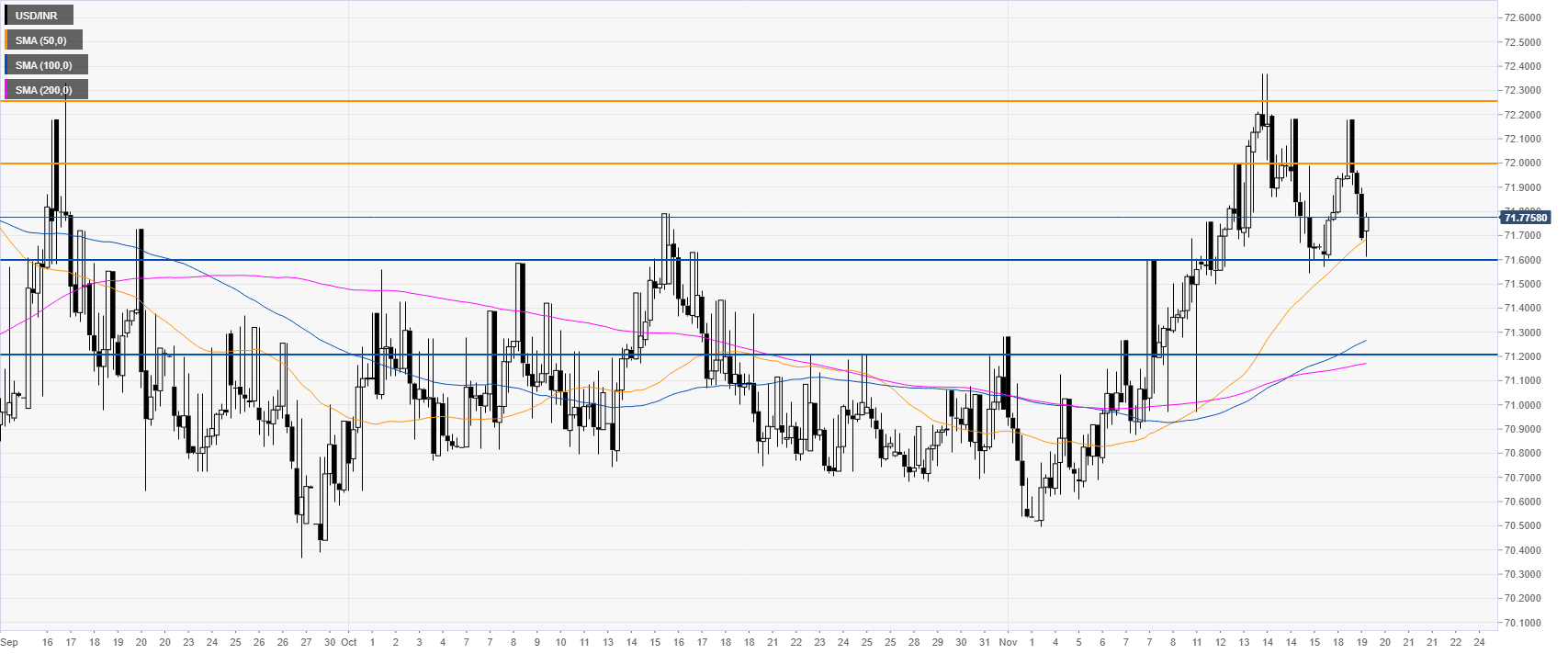

- The level to beat for bears is the 71.60 level.

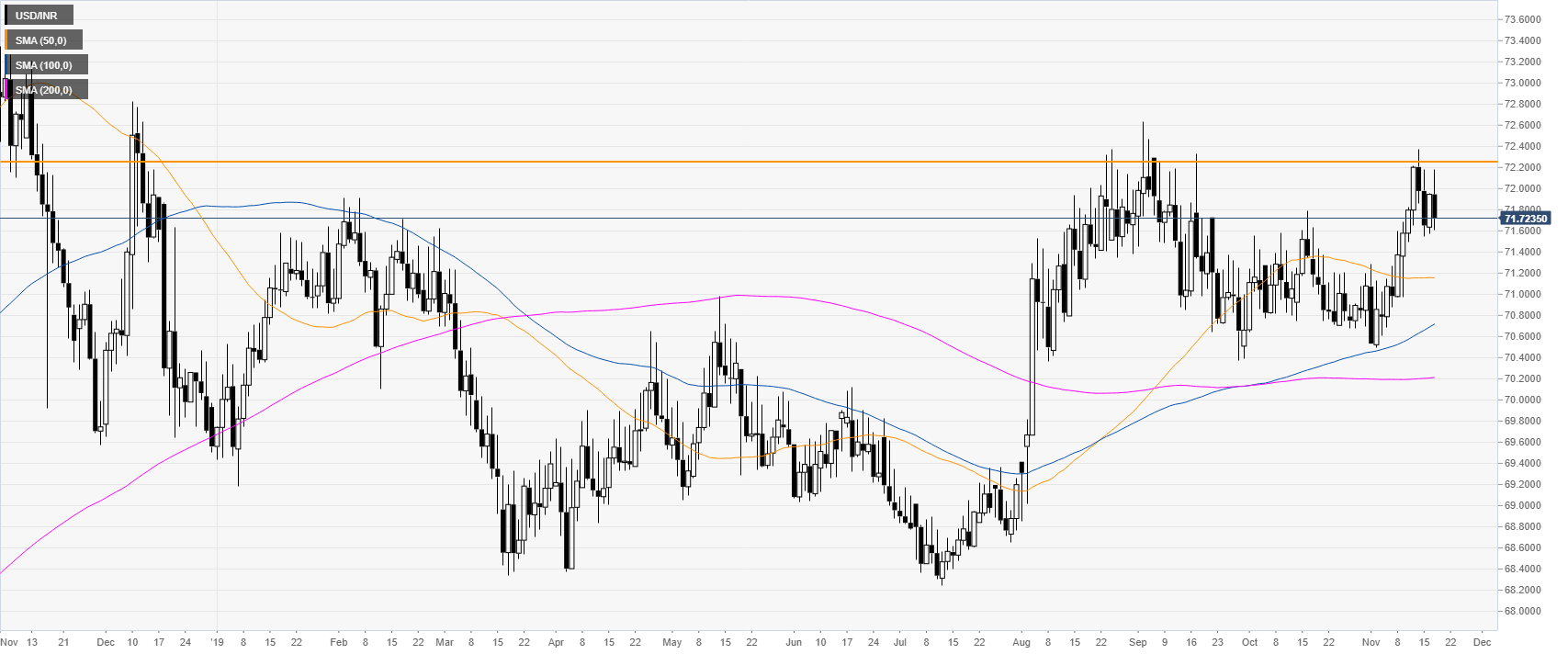

USD/INR daily chart

USD/INR four-hour chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains below 1.0800

EUR/USD is trading under 1.0800, holding the recovery from three-week lows in European trading on Thursday. The pair holds gains amid renewed US Dollar selling as traders digest latest tariff threats from US President Trump. Traders resort to repositioning ahead of Friday's US PCE inflation data.

GBP/USD holds gains above 1.2900 on US Dollar weakness

GBP/USD trades with positive bias above 1.2900 in Thursday’s European morning. The pair holds the latest uptick amid renewed US Dollar weakness as fresh Trump tariff threats rekindle US economic slowdown concerns. Focus remains on tariff updates and mid-tier US data.

Gold price retreats from weekly high; sticks to positive bias amid concerns over Trump's tariffs

Gold price retreats slightly after touching a fresh weekly high earlier this Thursday and trades with modest intraday gains, just below the $3,030 level heading into the European session. An improvement in the global risk sentiment turns out to be a key factor acting as a headwind for the precious metal.

Cardano bulls target double-digit gains as bullish bets increase among traders

Cardano price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.