USD/INR drifts higher as geopolitical risks, foreign fund outflows weigh on Indian Rupee

- The Indian Rupee softens in Wednesday’s early European session.

- Sustained portfolio outflows and geopolitical risks could weigh on the INR, but RBI interventions might cap its downside.

- Investors await the speeches from the Fed’s Cook and Bowman on Wednesday.

The Indian Rupee (INR) loses traction on Wednesday. The local currency remains under some selling pressure due to the renewed US Dollar (USD) demand from importers and rising geopolitical tensions after Russian officials said that Ukraine used US ATACMS missiles to strike Russian territory for the first time, while Russian President Vladimir Putin approved an updated nuclear doctrine.

Furthermore, sustained portfolio outflows contribute to the INR’s downside. However, any significant depreciation of the Indian Rupee might be limited as the Reserve Bank of India (RBI) is likely to sell the USD to support the INR.

In the absence of top-tier economic data released from the US and India, the USD price dynamics will continue to play a key role in influencing the pair. The Federal Reserve (Fed) Lisa Cook and Michelle Bowman are scheduled to speak later on Wednesday.

Indian Rupee remains weak amid mounting geopolitical tensions

- "Mild weakness in the dollar will not lead to any major appreciation in the rupee because the RBI will look to replenish its foreign exchange reserves, but if the dollar index moves 2-3% lower, we may see half a per cent of move (in the rupee)," noted Nitin Agarwal, head of treasury at ANZ India.

- Foreign Portfolio Investment (FPI) inflows into India are estimated to remain positive in FY25, with an expected inflow of USD 20-25 billion, according to the Bank of Baroda.

- Markets have pared bets for a 25 basis points (bps) interest-rate cut at the December meeting to less than 59%, down from 76.8% a month ago, according to the CME FedWatch Tool.

- The US Building Permits declined by 0.6% from 1.425 million to 1.416 million in October. Meanwhile, Housing Starts fell by 3.1% from 1.353 million to 1.311 million during the same period.

- Kansas City Fed President Jeffrey Schmid said it remains uncertain how far interest rates can fall, but the recent cuts by the Fed indicate confidence that inflation is heading toward its 2% target.

USD/INR’s bullish outlook remains in play

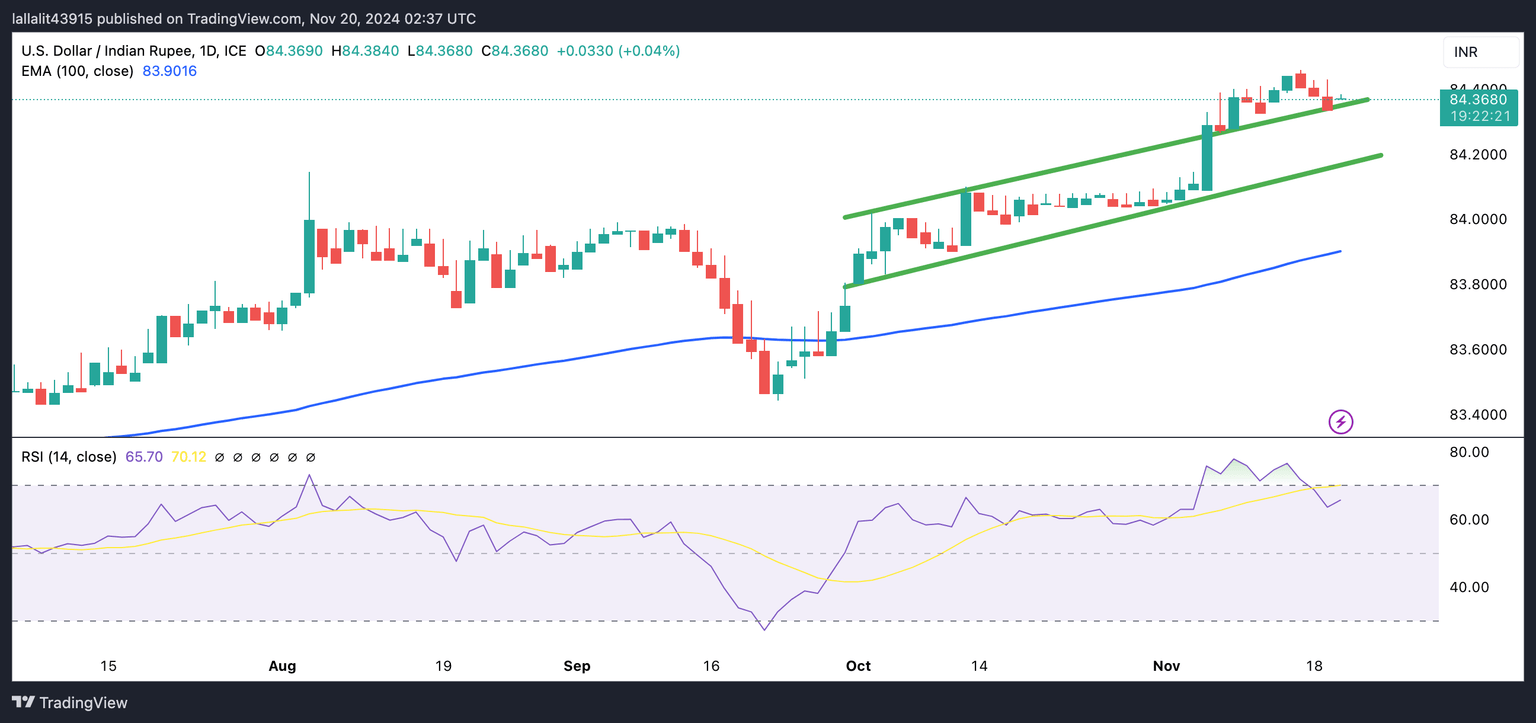

The Indian Rupee weakens on the day. However, the constructive view of the USD/INR pair remains intact, with the price holding above the ascending channel throwback support on the daily chart. The upward momentum of the pair is reinforced by the 14-day Relative Strength Index (RSI), which stands above the midline near 65.55, suggesting that the path of least resistance remains to the upside.

The all-time high of 84.45 acts as an immediate resistance level for USD/INR. A break above this level could pave the way to the 85.00 psychological level.

In the bearish case, any follow-through selling below the resistance-turned-support level at 84.35 could be enough to attract some sellers and take the pair back down to the 84.00-83.90 region, representing the round mark and the 100-day EMA.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.