USD/INR remains solid as Indian Rupee struggles due to foreign outflows, higher Oil prices

- The Indian Rupee loses momentum in Monday's European session.

- The Indian HSBC Manufacturing PMI came in at 57.5 in October vs. 56.5 prior, stronger than expected.

- Persistent selling by overseas investors and higher crude prices weigh on the INR.

The Indian Rupee (INR) edges lower on Monday. The sustained foreign outflows from domestic stocks and rising crude oil prices exert some selling pressure on the local currency. However, the decline in the US Dollar (USD) amid the likely unwinding of long positions in the lead-up to the US presidential election might cap the INR’s downside.

The latest data released on Monday showed that the HSBC India Manufacturing Purchasing Managers Index (PMI) improved to 57.5 in October. This figure was above the market consensus of 57.4 and the previous reading of 56.5. The local currency remains strong in an immediate reaction to the upbeat PMI data.

The US presidential election and the Federal Reserve's (Fed) interest rate decision will be in the spotlight this week and might trigger volatility in the market. The Federal Reserve is widely anticipated to cut rates by 25 basis points (bps) at its November meeting on Thursday.

Daily Digest Market Movers: Indian Rupee weakens ahead of looming US presidential election

- The benchmark BSE Sensex and Nifty 50 equity indexes fell about 1.5% each on the day, pressured by likely selling by overseas investors and caution ahead of the US presidential election outcome.

- "India's headline manufacturing PMI picked up substantially in October as the economy's operating conditions continue to broadly improve," noted Pranjul Bhandari, chief India economist at HSBC.

- The Reserve Bank of India (RBI) is likely selling US Dollars near 84.1125-84.1150 rupee levels, per Reuters.

- According to a Reuters poll, the Indian rupee will trade in a tight range around current levels against the dollar over the coming year as the Reserve Bank of India (RBI) routinely dips into its FX reserves to manage the currency's stability.

- "The (FX) intervention has been an ongoing affair and it's not just this year, it's been continuing post-COVID so we would expect two-sided interventions to continue," noted Vivek Kumar, an economist at QuantEco Research.

- The Nonfarm Payrolls (NFP) in the US rose by 12K in October, following the 223K increase (revised from 254K) seen in September, the US Bureau of Labor Statistics (BLS) showed Friday. The figure was weaker than the market expectations of 113K by a wide margin.

- The Unemployment Rate held steady at 4.1% in October, in line with the consensus.

- "It is widely considered that a Trump win will be positive for the USD, though many feel this outcome has been discounted," noted Chris Weston, an analyst at broker Pepperstone.

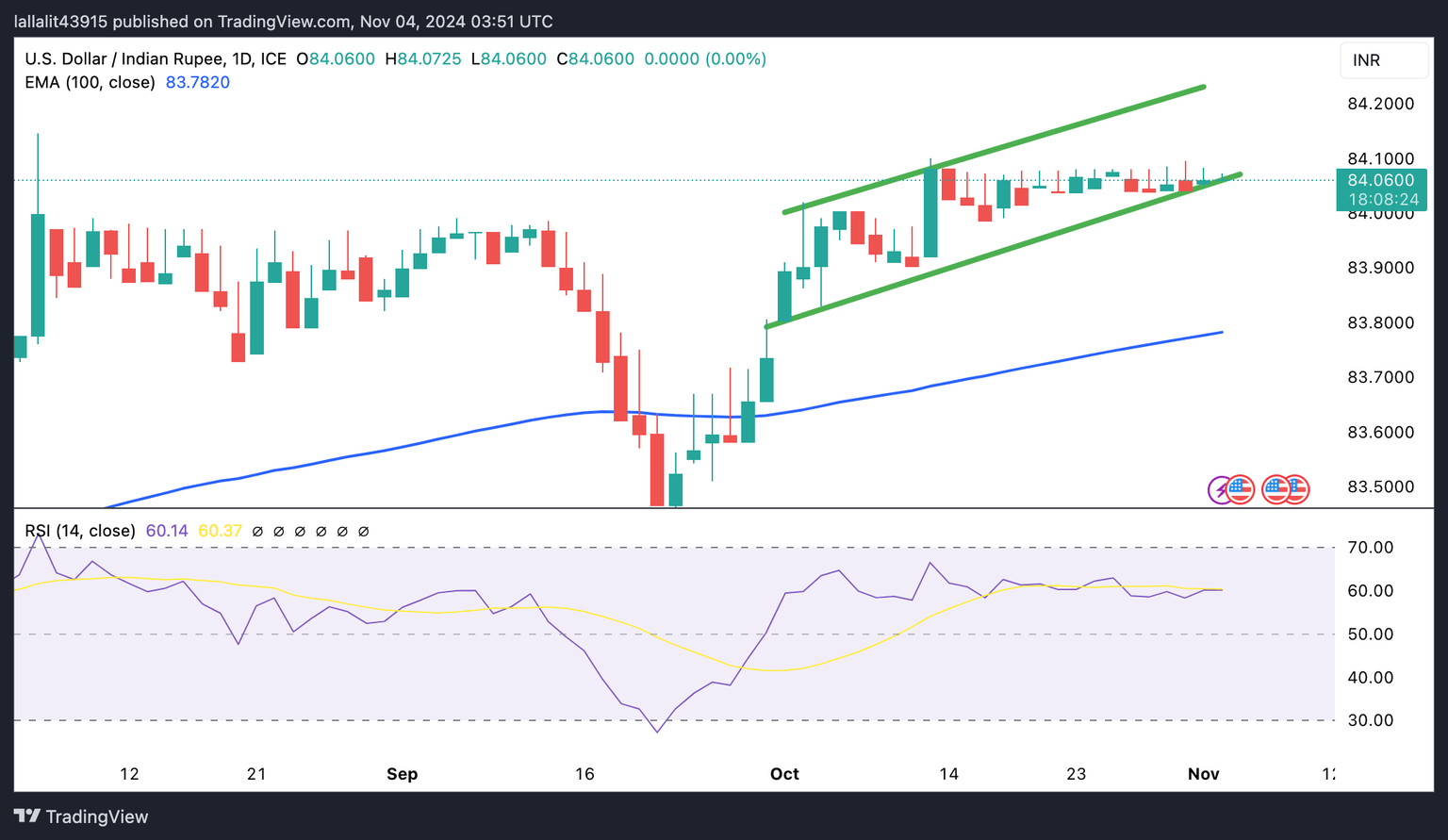

Technical Analysis: USD/INR’s positive view remains in play in the longer term

The Indian Rupee trades weaker on the day. However, the bullish outlook of the USD/INR pair remains intact, with the price holding above the key 100-day Exponential Moving Average (EMA). The upward momentum is reinforced by the 14-day Relative Strength Index (RSI), which stands above the midline near 57.70.

The first upside barrier for USD/INR emerges at the upper boundary of the ascending trend channel of 84.24. Extended gains break above this level could draw in enough buying demand to 84.50, en route to the 85.00 psychological level.

On the downside, a decisive close below the lower limit of the trend channel near 84.05 could pave the way to 83.78, the 100-day EMA.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.