USD/INR gathers strength as equity outflows drag Indian Rupee to record low

- The Indian Rupee edges lower in Tuesday’s early European session.

- Sustained outflows from local equities weigh on the INR.

- Investors will monitor India’s October Consumer Price Index (CPI) and Fedspeak on Tuesday.

The Indian Rupee (INR) remains weak near an all-time low on Tuesday. The downward pressure for the local currency is pressured by persistent foreign fund outflows and a muted trend in domestic equities. Additionally, the renewed US Dollar (USD) demand from oil companies and foreign banks contributes to the INR’s downside.

Nonetheless, the significant depreciation of the INR might be capped by the decline in crude oil prices and the likely foreign exchange intervention by the Reserve Bank of India (RBI). Looking ahead, traders brace for India’s October Consumer Price Index (CPI), which is due on Tuesday. On the US front, the Federal Reserve’s (Fed) Christopher Waller, Thomas Barkin, Neel Kashkari and Patrick Harker are scheduled to speak later in the day. On Wednesday, the attention will shift to the US October CPI inflation data.

Indian Rupee slips to near a fresh low, hurt by outflows from local equities

- Foreign investors have withdrawn more than $2.5 billion from Indian stocks over November so far, adding to the $11 billion of outflows in October.

- "In the medium term, the rupee is expected to trade within the 83.80 to 84.50 range, as the Reserve Bank seems to cap the downside of the rupee with sufficient Forex reserves in its kitty," said Amit Pabari, CR Forex Advisors MD.

- India's foreign exchange reserves declined by $2.675 billion to $682.13 billion for the week ended November 1, the RBI said on Friday.

- The Indian Rupee could undergo a depreciation of 8%-10% against the US Dollar with Trump's return to power, even as the local currency recorded an all-time low of 84.38 on Monday, according to the State Bank of India (SBI).

- The Indian CPI is expected to show an increase of 5.80% YoY in October versus 5.49% prior.

- The markets have priced in nearly 65.3% of the 25 basis points (bps) rate cut by the Fed at the December meeting, down from 75% last week, according to the CME FedWatch Tool.

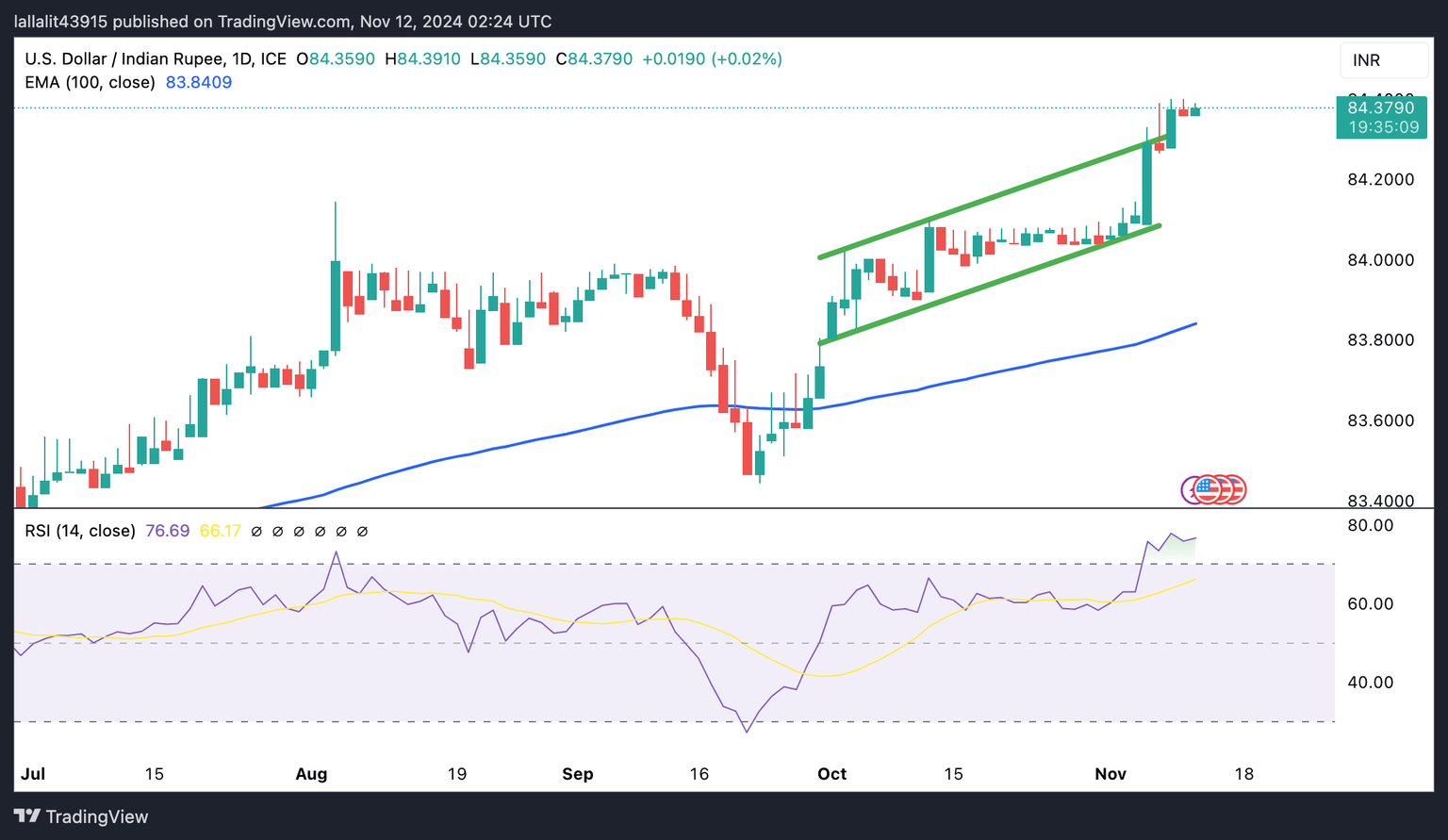

USD/INR keeps the bullish vibe in the longer term, though overbought RSI suggest caution

The Indian Rupee weakens on the day. The strong uptrend of the USD/INR pair remains intact, with the pair holding above the key 100-day Exponential Moving Average (EMA) on the daily timeframe. However, further consolidation looks favorable before positioning for any near-term USD/INR appreciation as the 14-day Relative Strength Index (RSI) exceeds 70, indicating an overbought condition.

The first upside barrier for USD/INR emerges at 84.50. A strong rally past the mentioned level could clear the way for the 85.00 psychological level.

In the bearish event, any follow-through selling below the lower limit of the trend channel and the high of October 11 in the 84.05-84.10 zone could see a drop to 83.84, the 100-day EMA. Further south, the next support level to watch is 83.46, the low of September 24.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.