USD/INR tumbles ahead of US Fed rate decision

- Indian Rupee gathers strength in Wednesday’s early European session.

- Firmer Fed rate cuts bets and robust USD sales weigh on the pair, but higher oil prices might cap its downside.

- The Fed rate decision will be in the spotlight on Wednesday.

The Indian Rupee (INR) extends the rally and reaches monthly highs near 83.65 on Wednesday. The downtick of the pair is pressured by the rising expectations of a deeper Federal Reserve (Fed) rate cut and robust US Dollar sales. Nonetheless, the extended recovery of crude oil prices might undermine the local currency and help limit USD/INR losses.

Later on Wednesday, all eyes will be on the Fed interest rate decision, which is widely expected to cut the rate in its September meeting. Fed officials will also release a Summary of Economic Projections, or ‘dot-plot’ after the policy meeting, which could give insight into just how much the US central bank plans to cut over the next year. The expectation of the jumbo rate cuts might exert some selling pressure on the Greenback in the near term.

Daily Digest Market Movers: Indian Rupee remains strong ahead of US key event

- India's Wholesale Price Index (WPI)-based inflation declined to a four-month low of 1.31% YoY in August from 2.04% in the previous reading. This figure came in below the market consensus of 1.80%.

- India’s merchandise trade deficit stood at $29.65 billion in August compared with $23.5 billion in July, according to Ministry of Commerce and Industry data released on Tuesday.

- India's foreign exchange reserves rose to a record high of $689.2 billion as of September 6, according to the Reserve Bank of India (RBI).

- The US Retail Sales unexpectedly rose 0.1% MoM in August versus 1.1% prior, above the market consensus of -0.2%. Industrial Production climbed 0.8% MoM in August, compared to a decline of 0.6% in the previous reading, better than the estimation of 0.2%.

- According to the CME Fedwatch Tool, Fed funds futures have priced in nearly 63% probability of a 50 basis points (bps) rate cut, up from 30% a week ago, while the chance of a 25 bps cut was at 37%.

Technical Analysis: USD/INR’s positive stance prevails in the longer term

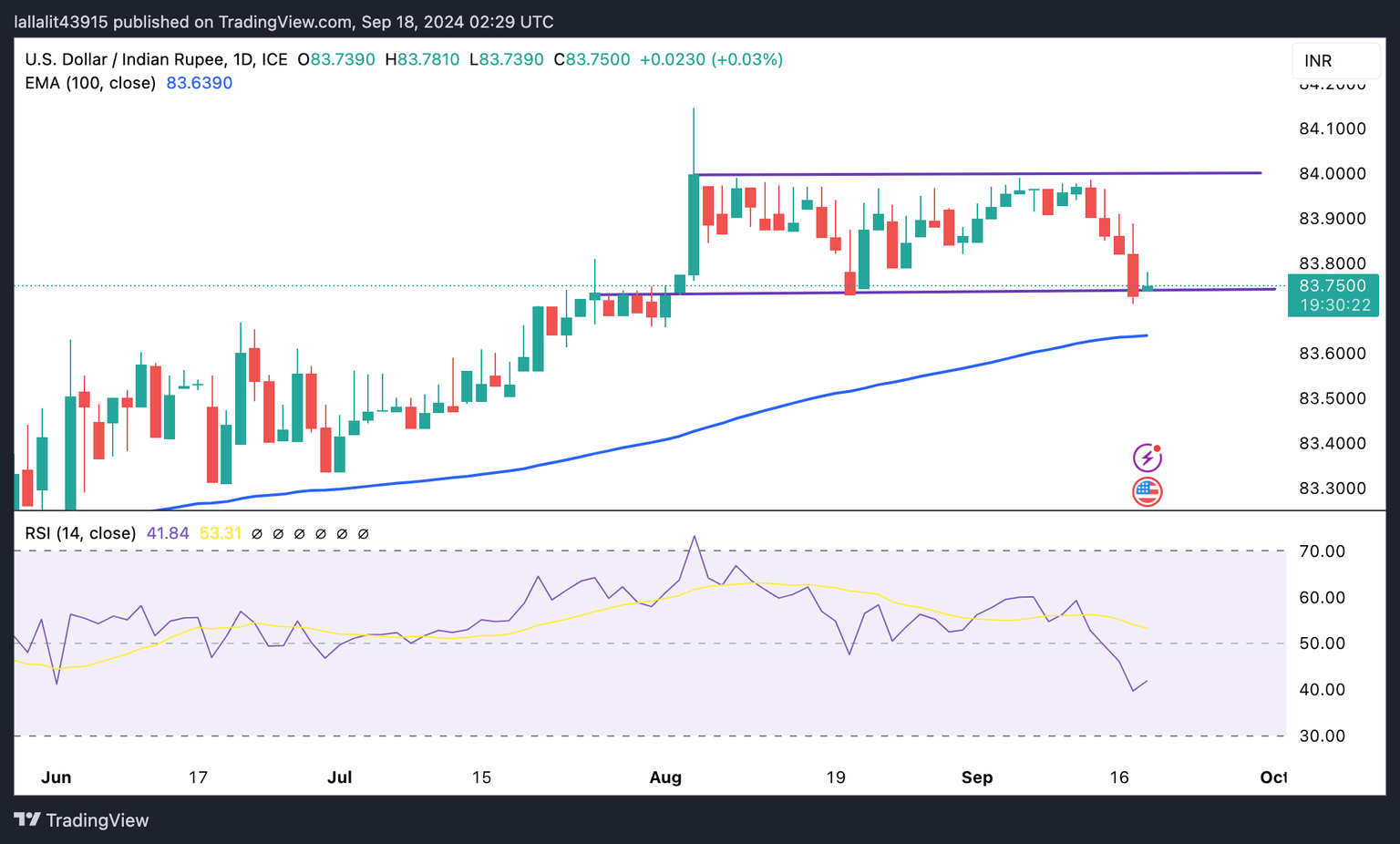

The Indian Rupee trades stronger on the day. The USD/INR pair oscillates within the rectangle on the daily chart. However, in the longer term, the pair keeps the bullish vibe as the price holds above the key 100-day Exponential Moving Average (EMA). Further downside cannot be ruled out as the 14-day Relative Strength Index (RSI) stands in the bearish zone below the midline, supporting the sellers for the time being.

The 83.90-84.00 zone appears to be a tough nut to crack for USD/INR buyers. This region portrays the upper boundary of the rectangle and psychological mark. A break above the mentioned level will see the next upside barrier at 84.50.

On the flip side, the initial support level is located at the low of September 17 at 83.70. A breach of this level will pave the way to the 100-day EMA at 83.64.

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.